Tech Mahindra is one of the leading IT companies in India, known for its strong presence in digital transformation, AI, and 5G services. Investors are keen to know its future growth potential and share price targets. Various factors like technology advancements, global demand, and financial performance influence its stock movement. Tech Mahindra Share Price on 26 March 2025 is 1,412.00 INR. This article will provide more details on Tech Mahindra Share Price Target 2025, 2026 to 2030.

Tech Mahindra Company Info

- Founded: 1986

- Founder: Anand Mahindra

- Headquarters: Pune

- Number of employees: 1,54,273 (2024)

- Parent organization: Mahindra Group

- Revenue: 52,912 crores INR (FY24, US$6.6 billion)

- Subsidiaries: Comviva, Pininfarina

Tech Mahindra Share Price Chart

Tech Mahindra Share Price Details

- Today Open: 1,464.00

- Today High: 1,464.00

- Today Low: 1,409.50

- Mkt cap: 1.38LCr

- P/E ratio: 33.44

- Div yield: 3.05%

- 52-wk high: 1,807.70

- 52-wk low: 1,162.95

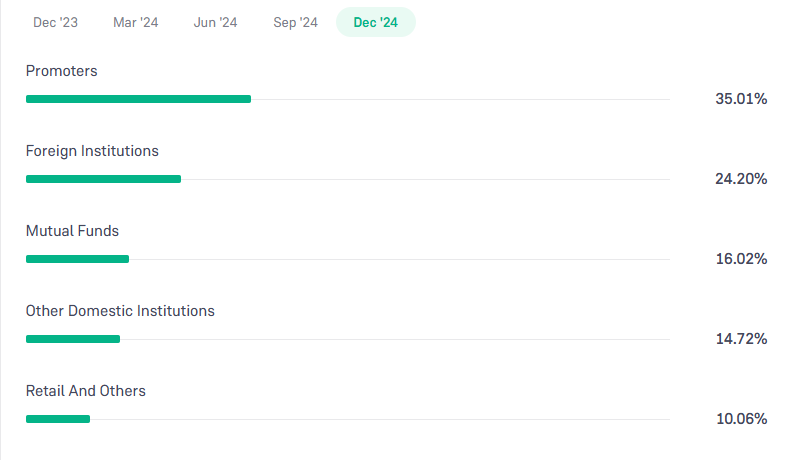

Tech Mahindra Shareholding Pattern

- Promoters: 35.01%

- Foreign Institutions: 24.20%

- Mutual Funds: 16.02%

- Retails and others: 10.06%

- Domestic Institutions: 14.72%

Tech Mahindra Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹1810

- 2026 – ₹1950

- 2027 – ₹2100

- 2028 – ₹2250

- 2029 – ₹2400

- 2030 – ₹2600

Tech Mahindra Share Price Target 2025

Tech Mahindra share price target 2025 Expected target could be ₹1810. Here are 5 Key Factors Affecting Growth for Tech Mahindra Share Price Target 2025:

-

Demand for IT and Digital Transformation:- Increasing global demand for digital transformation, cloud computing, AI, and 5G solutions will drive Tech Mahindra’s growth.

-

Telecom and 5G Expansion:- As a leader in telecom IT services, the rollout of 5G and increased investments in network modernization will boost revenue.

-

Strong Order Pipeline & Client Growth:- Tech Mahindra’s expanding client base, large deal wins, and strategic partnerships will contribute to steady revenue growth.

-

Global Economic Trends & Currency Fluctuations:- Economic slowdowns or currency fluctuations, especially in the US and Europe, can impact earnings and stock performance.

-

Operational Efficiency & Cost Management:- Effective cost optimization, automation, and improved profit margins will influence investor confidence and stock price movement.

Tech Mahindra Share Price Target 2030

Tech Mahindra share price target 2030 Expected target could be ₹2600. Here are 5 Key Factors Affecting Growth for Tech Mahindra Share Price Target 2030:

-

Long-Term Digital Transformation Trends:- Increasing reliance on AI, blockchain, and cloud computing will drive demand for Tech Mahindra’s IT services and solutions.

-

5G and Emerging Technologies Expansion:- With the global rollout of 5G and advancements in IoT, cybersecurity, and automation, Tech Mahindra is well-positioned for sustained growth.

-

Geopolitical & Economic Factors:- Trade policies, inflation, and economic stability in key markets like the US and Europe will impact revenue growth and investor sentiment.

-

Market Competition & Innovation:- Staying ahead of competitors by investing in R&D and acquiring innovative tech firms will determine Tech Mahindra’s market leadership.

-

Sustainability & ESG Compliance:- Growing focus on ESG (Environmental, Social, and Governance) compliance and sustainable business practices may enhance investor trust and long-term profitability.

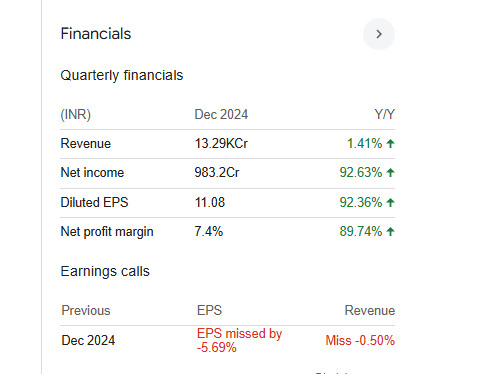

Financials Statement Of Tech Mahindra

| (INR) | 2024 | Y/Y change |

| Revenue | 519.96B | -2.43% |

| Operating expense | 122.57B | 12.71% |

| Net income | 23.58B | -51.20% |

| Net profit margin | 4.53 | -51.27% |

| Earnings per share | 26.58 | -51.27% |

| EBITDA | 44.75B | -40.38% |

| Effective tax rate | 25.67% | — |

Read Also:- Crisil Share Price Target Tomorrow 2025, 2026 To 2030