UTI AMC is one of the leading asset management companies in India, offering a wide range of mutual funds and investment solutions. Investors are always keen to know the future share price trends of UTI AMC, as it plays a key role in India’s financial market. UTI AMC Share Price on 26 March 2025 is 1,040.00 INR. This article will provide more details on UTI AMC Share Price Target 2025, 2026 to 2030.

UTI AMC Company Info

- CEO: Imtaiyazur Rahman (13 Jun 2020–)

- Founded: 14 January 2003

- Headquarters: India

- Number of employees: 1,402 (2024)

- Subsidiaries: UTI Capital, UTI Ventures

UTI AMC Share Price Chart

UTI AMC Share Price Details

- Today Open: 1,062.00

- Today High: 1,067.80

- Today Low: 1,029.40

- Mkt cap: 13.31KCr

- P/E ratio: 15.75

- Div yield: 2.31%

- 52-wk high: 1,403.65

- 52-wk low: 807.00

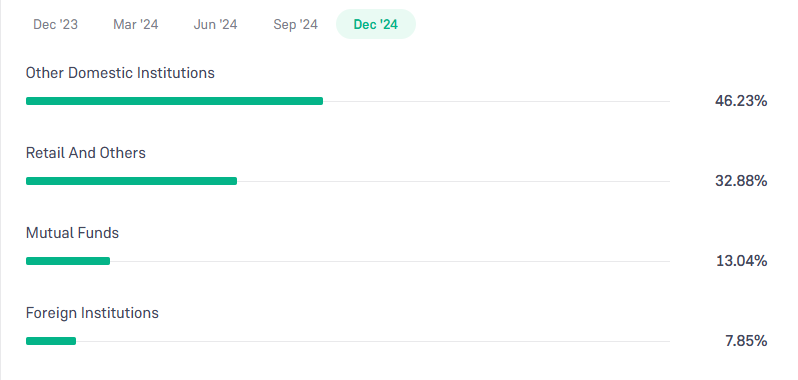

UTI AMC Shareholding Pattern

- Promoters: 0%

- Foreign Institutions: 7.85%

- Mutual Funds: 13.04%

- Retails and others: 32.88%

- Domestic Institutions: 46.23%

UTI AMC Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹1405

- 2026 – ₹1600

- 2027 – ₹1800

- 2028 – ₹2000

- 2029 – ₹2200

- 2030 – ₹2400

UTI AMC Share Price Target 2025

UTI AMC share price target 2025 Expected target could be ₹1405. Here are 5 Key Factors Affecting Growth for UTI AMC Share Price Target 2025:

-

Growth in Mutual Fund Industry – The increasing adoption of mutual funds in India, driven by rising financial awareness and SIP inflows, can positively impact UTI AMC’s revenue and stock price.

-

Assets Under Management (AUM) – A higher AUM indicates strong investor trust and better earnings potential. Consistent growth in AUM will be a key factor for stock performance.

-

Regulatory Changes – SEBI’s regulations on fund management fees, compliance norms, and operational guidelines can impact profitability and investor sentiment.

-

Competitive Positioning – UTI AMC competes with other leading asset management companies like HDFC AMC and Nippon AMC. Its ability to attract investors and launch innovative products will influence its market share and stock price.

-

Market Performance – The overall stock market performance and macroeconomic factors such as interest rates, inflation, and GDP growth will play a crucial role in shaping investor confidence and stock valuation.

UTI AMC Share Price Target 2030

UTI AMC share price target 2030 Expected target could be ₹2400. Here are 5 Key Factors Affecting Growth for UTI AMC Share Price Target 2030:

-

Long-Term AUM Growth – The expansion of UTI AMC’s Assets Under Management (AUM) over the years will be a crucial factor in determining its stock performance by 2030. Higher AUM leads to increased revenue from management fees.

-

Technology & Digital Adoption – The adoption of AI-driven investment strategies, robo-advisory services, and digital platforms for mutual fund investments will enhance efficiency and attract more investors.

-

Expansion into New Markets – UTI AMC’s ability to expand into global markets, introduce innovative financial products, and attract institutional investors will significantly impact its long-term growth.

-

Regulatory & Compliance Framework – Changes in SEBI regulations, taxation policies, and compliance requirements will influence the profitability and operational efficiency of the company.

-

Macroeconomic Factors & Investor Sentiment – Global and domestic economic trends, inflation rates, interest rate policies, and overall stock market conditions will shape investor confidence in mutual funds, thereby impacting UTI AMC’s stock price trajectory.

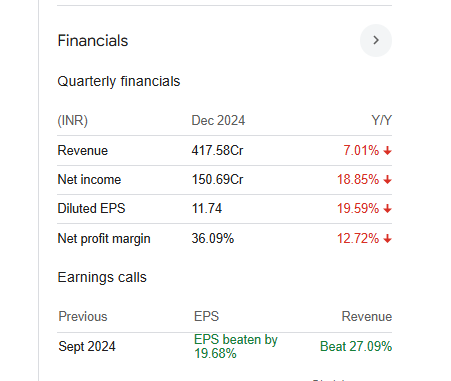

Financials Statement Of UTI AMC

| (INR) | 2024 | Y/Y change |

| Revenue | 17.37B | 37.11% |

| Operating expense | 2.83B | 8.96% |

| Net income | 7.66B | 75.07% |

| Net profit margin | 44.08 | 27.69% |

| Earnings per share | 60.22 | 74.85% |

| EBITDA | 10.13B | 72.09% |

| Effective tax rate | 18.73% | — |

Read Also:- Oriana Power Share Price Target Tomorrow 2025, 2026 To 2030