Investors looking at ABB India are interested in its long-term potential in automation, robotics, and energy solutions. With strong government support, growing demand for smart technology, and a focus on clean energy, ABB India is well-positioned for steady growth. ABB India Share Price on 26 March 2025 is 5,519.00 INR. This article will provide more details on ABB India Share Price Target 2025, 2026 to 2030.

ABB India Company Info

- Headquarters: India

- Number of employees: 3,384 (2024)

- Parent organization: ABB Schweiz AG

- Subsidiaries: Turbocharging Industries And Services India Private Limited

ABB India Share Price Chart

ABB India Share Price Details

- Today Open: 5,454.20

- Today High: 5,622.85

- Today Low: 5,407.55

- Mkt cap: 1.17LCr

- P/E ratio: 62.39

- Div yield: 0.43%

- 52-wk high: 9,149.95

- 52-wk low: 4,890.00

ABB India Shareholding Pattern

- Promoters: 75%

- Foreign Institutions: 11.85%

- Mutual Funds: 3.62%

- Retails and others: 7.46%

- Domestic Institutions: 2.07%

ABB India Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹9,150

- 2026 – ₹10,000

- 2027 – ₹11,000

- 2028 – ₹12,000

- 2029 – ₹13,000

- 2030 – ₹14,000

ABB India Share Price Target 2025

ABB India share price target 2025 Expected target could be ₹9,150. Here are 5 Key Factors Affecting Growth for ABB India Share Price Target 2025:

-

Industrial Automation & Electrification Demand – ABB India’s growth is driven by the increasing demand for automation, robotics, and electrification solutions across industries like manufacturing, energy, and infrastructure. Rising industrial adoption of smart technologies will boost revenue.

-

Government Policies & Infrastructure Push – Policies supporting renewable energy, smart cities, and electrification initiatives create strong opportunities for ABB India. Government spending on power distribution and industrial growth can positively impact the company’s performance.

-

Renewable Energy Expansion – ABB India plays a crucial role in the green energy transition, providing solutions for solar, wind, and electric mobility. The shift towards sustainable energy sources can drive long-term growth.

-

Global & Domestic Economic Conditions – Economic stability, interest rates, and inflation impact the industrial sector and capital expenditure. Favorable conditions will encourage higher investments in automation and power solutions, benefiting ABB India.

-

Financial Performance & Order Book Strength – A strong order pipeline, revenue growth, and consistent profitability will influence investor confidence. Robust financials and timely project execution will support positive share price momentum.

ABB India Share Price Target 2030

ABB India share price target 2030 Expected target could be ₹14,000. Here are 5 Key Factors Affecting Growth for ABB India Share Price Target 2030:

-

Technological Advancements in Automation & AI – ABB India’s long-term growth depends on its ability to integrate AI, robotics, and smart automation into industrial processes. The increasing shift toward Industry 4.0 will drive demand for advanced solutions.

-

Renewable Energy & Electric Mobility Boom – With India focusing on sustainability, ABB India’s involvement in solar, wind, and electric vehicle (EV) charging infrastructure will be a key growth driver. The demand for energy-efficient solutions will likely expand significantly by 2030.

-

Government Policies & Infrastructure Development – Large-scale infrastructure projects, smart city initiatives, and industrial expansion plans backed by government policies will create opportunities for ABB India in sectors like power distribution, automation, and electrification.

-

Global Market Expansion & Export Growth – ABB India’s ability to leverage global partnerships and export capabilities will play a vital role in its revenue growth. Expansion into emerging markets and strengthening its global footprint will support long-term profitability.

-

Financial Stability & Consistent Performance – A strong balance sheet, growing revenue streams, and a solid order book will enhance investor confidence. ABB India’s ability to sustain profitability and manage operational costs efficiently will be a key factor in its stock price movement by 2030.

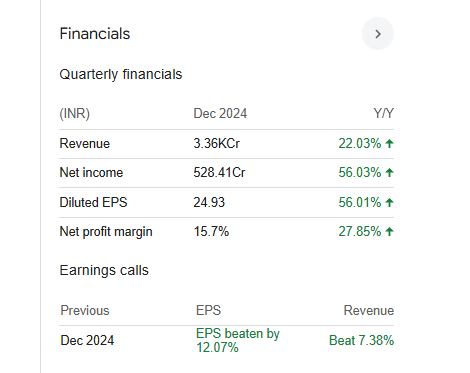

Financials Statement Of ABB India

| (INR) | 2024 | Y/Y change |

| Revenue | 121.88B | 16.67% |

| Operating expense | 29.22B | 22.40% |

| Net income | 18.72B | 50.69% |

| Net profit margin | 15.36 | 29.18% |

| Earnings per share | 88.46 | 50.19% |

| EBITDA | 23.05B | 52.90% |

| Effective tax rate | 25.41% | — |

Read Also:- ITDCEM Share Price Target Tomorrow 2025, 2026 To 2030