Investors looking at Hazoor Multi Projects are keen to understand its future growth potential. As a company involved in infrastructure development, its share price depends on various factors like government policies, project execution, and market trends. Hazoor Multi Projects Share Price on 27 March 2025 is 43.65 INR. This article will provide more details on Hazoor Multi Projects Share Price Target 2025, 2026 to 2030.

Hazoor Multi Projects Company Info

- Founded: 1992

- Headquarters: India

- Number of employees: 9 (2024)

- Subsidiaries: Hazoor Multi Corp, Square Port Shipyard Private Limited

Hazoor Multi Projects Share Price Chart

Hazoor Multi Projects Share Price Details

- Today Open: 43.79

- Today High: 45.20

- Today Low: 43.19

- Mkt cap: 964.45Cr

- P/E ratio: 20.00

- Div yield: 0.46%

- 52-wk high: 63.90

- 52-wk low: 28.41

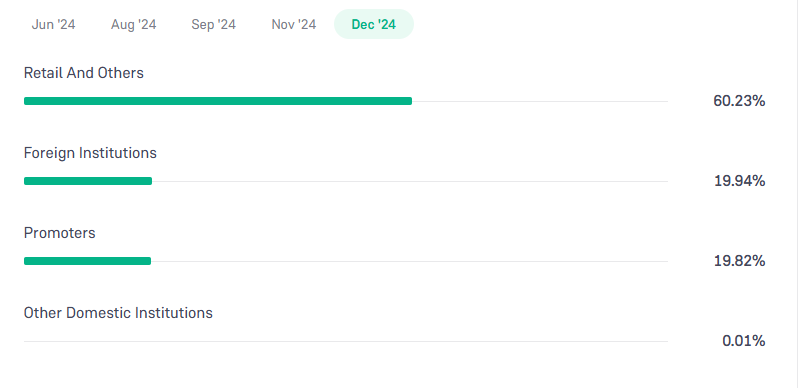

Hazoor Multi Projects Shareholding Pattern

- Promoters: 19.82%

- Foreign Institutions: 19.94%

- Mutual Funds: 0%

- Retails and others: 60.23%

- Domestic Institutions: 0,01%

Hazoor Multi Projects Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹65

- 2026 – ₹75

- 2027 – ₹85

- 2028 – ₹100

- 2029 – ₹110

- 2030 – ₹120

Hazoor Multi Projects Share Price Target 2025

Hazoor Multi Projects share price target 2025 Expected target could be ₹65. Here are 5 Key Factors Affecting Growth for Hazoor Multi Projects Share Price Target 2025:

-

Infrastructure and Real Estate Expansion – As Hazoor Multi Projects is involved in infrastructure and real estate development, its growth depends on upcoming government and private sector projects. Increased demand in these sectors can boost revenue and share prices.

-

Government Policies and Contracts – Favorable policies, approvals, and government contracts in infrastructure development will positively impact the company’s financial performance and stock value.

-

Financial Performance and Profitability – Investors will closely watch the company’s revenue growth, profit margins, and debt levels. Strong financials can drive confidence and push the share price higher.

-

Market Demand for Construction and Development – Rising urbanization and the need for better infrastructure can increase the demand for the company’s services, directly affecting its stock growth.

-

Macroeconomic Conditions – Factors such as inflation, interest rates, and overall economic stability will impact investment in infrastructure, influencing Hazoor Multi Projects’ future growth and stock price movement.

Hazoor Multi Projects Share Price Target 2030

Hazoor Multi Projects share price target 2030 Expected target could be ₹120. Here are 5 Key Factors Affecting Growth for Hazoor Multi Projects Share Price Target 2030:

-

Long-Term Infrastructure Development – With increasing government focus on infrastructure projects, roads, highways, and smart city initiatives, Hazoor Multi Projects could see consistent growth over the decade.

-

Technological Advancements in Construction – Adoption of advanced construction technologies, sustainable building practices, and automation could improve efficiency and profitability, boosting investor confidence.

-

Diversification and Business Expansion – Expanding into new infrastructure segments or regions can enhance revenue streams, reducing risks and making the company a more attractive investment.

-

Foreign Investments and Partnerships – Collaborations with global infrastructure firms, joint ventures, and foreign direct investments (FDI) could provide financial strength and technological expertise for long-term growth.

-

Economic and Policy Stability – A stable economic environment, favorable government policies, and infrastructure funding will play a key role in shaping the company’s future and share price trends.

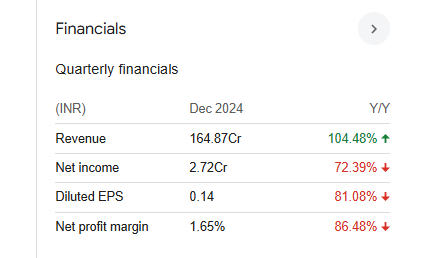

Financials Statement Of Hazoor Multi Projects

| (INR) | 2024 | Y/Y change |

| Revenue | 5.45B | -29.81% |

| Operating expense | 137.86M | 225.75% |

| Net income | 637.69M | 39.91% |

| Net profit margin | 11.71 | 99.15% |

| Earnings per share | — | — |

| EBITDA | 867.09M | 38.32% |

| Effective tax rate | 25.73% | — |

Read Also:- ABB India Share Price Target Tomorrow 2025, 2026 To 2030