Ramco Cement is one of India’s leading cement companies, known for its high-quality products and strong market presence. Investors often look at its share price target to understand future growth potential. With India’s booming infrastructure and real estate sectors, Ramco Cement has a bright future ahead. Eplramco Cement Share Price on 27 March 2025 is 881.00 INR. This article will provide more details on Eplramco Cement Share Price Target 2025, 2026 to 2030.

Eplramco Cement Company Info

- Founded: 1957

- Headquarters: Chennai

- Number of employees: 3,647 (2024)

- Subsidiary: Ramco Windfarms Ltd.

Eplramco Cement Share Price Chart

Eplramco Cement Share Price Details

- Today Open: 850.00

- Today High: 888.45

- Today Low: 844.75

- Mkt cap: 20.82KCr

- P/E ratio: 54.98

- Div yield: 0.28%

- 52-wk high: 1,060.00

- 52-wk low: 700.00

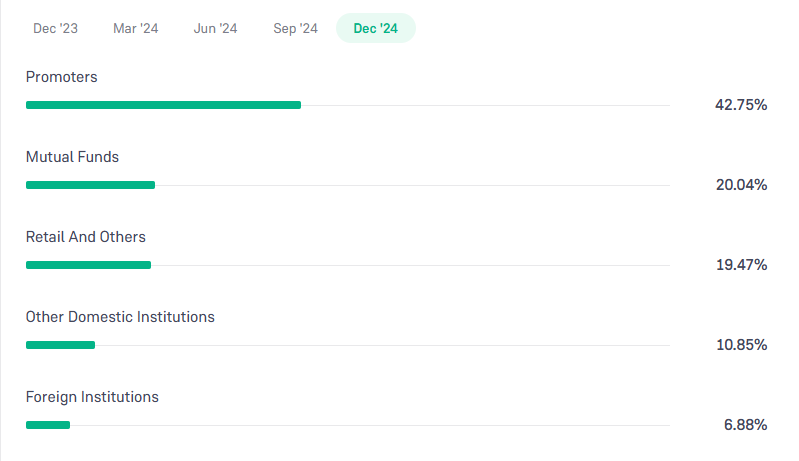

Eplramco Cement Shareholding Pattern

- Promoters: 42.75%

- Foreign Institutions: 6.88%

- Mutual Funds: 20.04%

- Retails and others: 19.47%

- Domestic Institutions: 10.85%

Eplramco Cement Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹1060

- 2026 – ₹1130

- 2027 – ₹1200

- 2028 – ₹1270

- 2029 – ₹1340

- 2030 – ₹1410

Eplramco Cement Share Price Target 2025

Eplramco Cement share price target 2025 Expected target could be ₹1060. Here are 5 Key Factors Affecting Growth for Ramco Cement Share Price Target 2025:

-

Infrastructure and Construction Demand – Growth in real estate and infrastructure projects will directly impact the demand for cement, influencing Ramco Cement’s revenue and stock performance.

-

Raw Material and Energy Costs – The prices of coal, pet coke, and limestone play a crucial role in production costs. Any fluctuations can impact profitability and, in turn, share prices.

-

Government Policies and Investments – Policies related to housing, smart cities, and rural development can drive demand for cement, boosting Ramco’s market position.

-

Expansion Plans and Capacity Utilization – Any new plant setups, production capacity expansion, or technology upgrades can improve efficiency and contribute to future growth.

-

Market Competition and Pricing Strategy – The performance of competitors like UltraTech Cement and ACC Cement can impact Ramco’s pricing power and overall market share, affecting investor sentiment.

Eplramco Cement Share Price Target 2030

Eplramco Cement share price target 2030 Expected target could be ₹1410. Here are 5 Key Factors Affecting Growth for Ramco Cement Share Price Target 2030:

-

Long-Term Infrastructure Growth – The increasing demand for cement due to large-scale infrastructure projects, highways, smart cities, and real estate expansion will be a major growth driver.

-

Sustainability and Green Initiatives – Adoption of eco-friendly cement production methods, alternative fuels, and carbon reduction strategies could attract ESG-focused investors and enhance Ramco’s market value.

-

Technological Advancements in Cement Production – Investments in automation, AI-driven quality control, and efficiency improvements can reduce costs and boost profitability over the decade.

-

Global Expansion and Export Market – If Ramco Cement expands its presence in international markets, it can open new revenue streams and reduce dependency on domestic demand.

-

Economic and Policy Stability – Supportive government policies, steady economic growth, and favorable interest rates will play a vital role in shaping the company’s long-term share price trajectory.

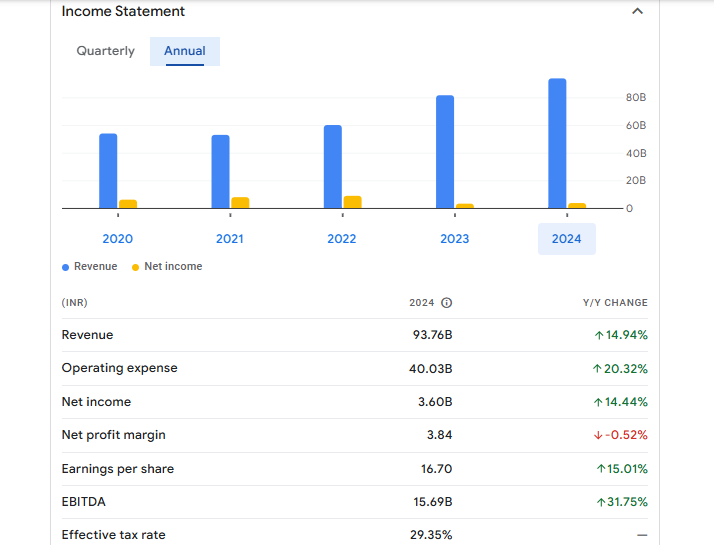

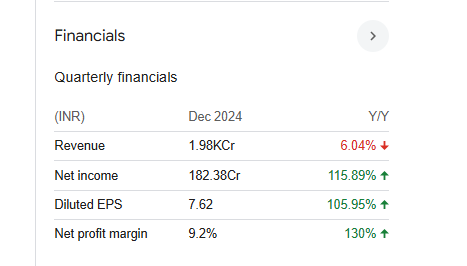

Financials Statement Of Eplramco Cement

| (INR) | 2024 | Y/Y change |

| Revenue | 93.76B | 14.94% |

| Operating expense | 40.03B | 20.32% |

| Net income | 3.60B | 14.44% |

| Net profit margin | 3.84 | -0.52% |

| Earnings per share | 16.70 | 15.01% |

| EBITDA | 15.69B | 31.75% |

| Effective tax rate | 29.35% | — |

Read Also:- SBFC Share Price Target Tomorrow 2025, 2026 To 2030