Tamboli Industries is a growing company known for making high-quality precision castings used in important industries like aerospace, automotive, and energy. With its focus on advanced technology, global exports, and strong quality standards, many investors are watching this stock closely. As the company continues to grow and explore new markets, its share price has the potential to rise steadily. Tamboli Industries Share Price on 4 April 2025 is 148.05 INR. This article will provide more details on Tamboli Industries Share Price Target 2025, 2026 to 2030.

Tamboli Industries Company Info

- Founded: 2004

- Headquarters: India

- Number of employees: 4 (2024)

- Subsidiary: Tamboli Castings Limited.

Tamboli Industries Share Price Chart

Tamboli Industries Share Price Details

- Today Open: 150.00

- Today High: 151.75

- Today Low: 142.15

- Mkt cap: 150.54Cr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 215.00

- 52-wk low: 110.00

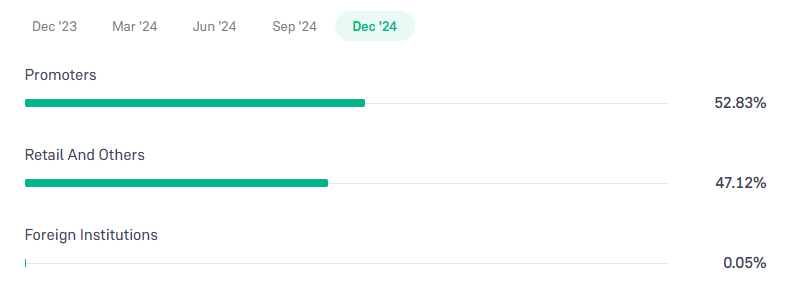

Tamboli Industries Shareholding Pattern

- Promoters: 52.83%

- Foreign Institutions: 0.05%

- Mutual Funds: 0%

- Retails and others: 47.12%

- Domestic Institutions: 0%

Tamboli Industries Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹220

- 2026 – ₹240

- 2027 – ₹280

- 2028 – ₹300

- 2029 – ₹320

- 2030 – ₹340

Tamboli Industries Share Price Target 2025

Tamboli Industries share price target 2025 Expected target could be ₹220. As of April 2025, Tamboli Industries Limited (TIL) has been demonstrating notable performance in the precision investment casting sector. Here are five key factors that could influence its share price target for 2025:

-

Financial Performance: In the first half of FY2025, TIL reported a 15% year-over-year increase in revenue, reaching ₹150 crore, with a net profit margin of 12%. Consistent revenue growth and robust profitability are essential for boosting investor confidence and positively impacting the share price.

-

Market Expansion and Client Acquisition: TIL’s strategic efforts to penetrate new markets and secure contracts with international clients in the aerospace and automotive sectors have expanded its order book by 20% compared to the previous year. Successfully executing these contracts can significantly enhance revenue streams.

-

Technological Advancements and Product Innovation: The company’s investment in advanced manufacturing technologies, such as 3D printing for mold creation, has improved production efficiency and product quality. Continuous innovation can provide a competitive edge and attract new business opportunities.

-

Operational Efficiency and Cost Management: TIL has implemented lean manufacturing practices, resulting in a 10% reduction in production costs over the past year. Maintaining operational efficiency is crucial for sustaining profitability and supporting share price appreciation.

-

Regulatory Compliance and Quality Assurance: Adherence to stringent industry standards and obtaining certifications like AS9100 for aerospace components have bolstered TIL’s reputation. Compliance with regulations and consistent quality assurance are vital for retaining existing clients and attracting new ones.

Tamboli Industries Share Price Target 2030

Tamboli Industries share price target 2030 Expected target could be ₹340. Here are five key factors that could affect Tamboli Industries’ share price target for 2030:

-

Global Demand for Precision Castings

As industries like aerospace, defense, automotive, and energy continue to grow, the demand for high-quality precision investment castings is expected to rise. Tamboli Industries’ ability to meet this demand globally will play a major role in its long-term growth. -

Technology Upgrades & Automation

By 2030, adopting cutting-edge manufacturing technologies, automation, and AI-driven quality checks could significantly improve Tamboli’s production speed, consistency, and margins—boosting investor confidence. -

Export Market Growth

Tamboli Industries already exports to several countries. Expanding its global client base, especially in developed markets like Europe and North America, will help the company diversify revenue and reduce dependency on domestic orders. -

Sustainability and Green Manufacturing

With increasing focus on environmental standards, companies adopting eco-friendly production processes and energy-efficient technologies are likely to benefit. Tamboli’s alignment with ESG (Environmental, Social, Governance) norms could attract more institutional investors by 2030. -

Strong Balance Sheet and Capital Allocation

Maintaining a healthy cash flow, low debt levels, and strategic capital reinvestments in R&D or capacity expansion will be vital for long-term share price growth. Investors will closely watch how efficiently the company utilizes its capital in the next five years.

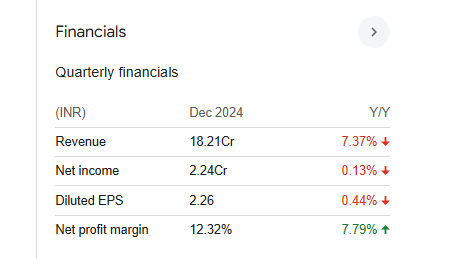

Financial Statement Of Tamboli Industries

| (INR) | 2024 | Y/Y change |

| Revenue | 750.62M | -9.65% |

| Operating expense | 524.03M | -3.90% |

| Net income | 75.26M | -28.68% |

| Net profit margin | 10.03 | -21.02% |

| Earnings per share | — | — |

| EBITDA | 141.97M | -20.77% |

| Effective tax rate | 29.17% | — |

Read Also:- Senco Gold Share Price Target Tomorrow 2025, 2026 To 2030