Taylormade Renewables is a growing company in the renewable energy sector, focused on clean and sustainable solutions like solar thermal systems, water treatment, and waste-to-energy technology. With the world moving towards green energy, this company is gaining attention from both investors and environmental enthusiasts. If you’re curious about how its share price might grow in the coming years, you’re in the right place. Taylormade Renewables Share Price on 4 April 2025 is 207.15 INR. This article will provide more details on Taylormade Renewables Share Price Target 2025, 2026 to 2030.

Taylormade Renewables Company Info

- Founded: 2010

- Headquarters: India

- Subsidiary: Taylormade Enviro Private Limited.

Taylormade Renewables Share Price Chart

Taylormade Renewables Share Price Details

- Today Open: 207.15

- Today High: 207.15

- Today Low: 207.15

- Mkt cap: 255.83Cr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 658.70

- 52-wk low: 191.45

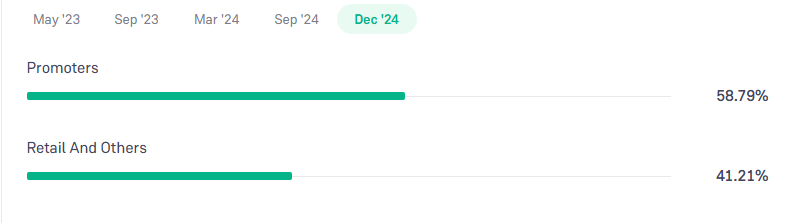

Taylormade Renewables Shareholding Pattern

- Promoters: 58.79%

- Foreign Institutions: 0%

- Mutual Funds: 0%

- Retails and others: 41.21%

- Domestic Institutions: 0%

Taylormade Renewables Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹660

- 2026 – ₹740

- 2027 – ₹800

- 2028 – ₹850

- 2029 – ₹900

- 2030 – ₹950

Taylormade Renewables Share Price Target 2025

Taylormade Renewables share price target 2025 Expected target could be ₹660. As of April 2025, Taylormade Renewables Limited (TRL) has been actively expanding its operations and pursuing strategic initiatives. Here are five key factors that could influence its share price target for 2025:

-

Operational Commencement of Tarapur BOO Plant: TRL’s Build-Own-Operate (BOO) plant in Tarapur is scheduled to begin operations in March 2025. This facility is expected to enhance the company’s revenue streams and strengthen its market position.

-

Strategic Partnerships and Client Acquisition: The company is in advanced discussions with major corporations, including SABIC and Coca-Cola, for potential contracts. Securing these partnerships could significantly boost TRL’s order book and revenue.

-

Acquisition of Taylormade Enviro Private Limited: In March 2025, TRL acquired a 51% stake in Taylormade Enviro Private Limited, expanding its footprint in the solar thermal sector. This acquisition is anticipated to contribute to the company’s growth and diversification.

-

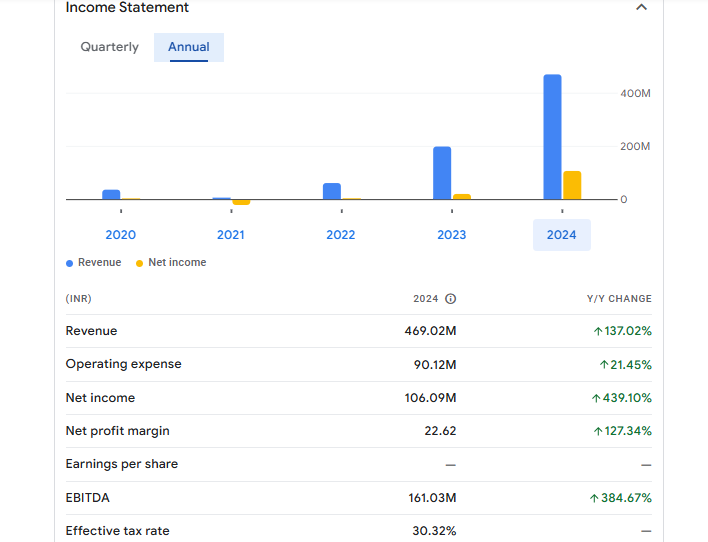

Financial Performance and Profitability: For the fiscal year ending March 2024, TRL reported a 137% year-over-year increase in operating income and a 439% rise in net profit. Sustaining this financial momentum is crucial for enhancing investor confidence and positively impacting the share price.

-

Fundraising Initiatives: The company’s Board of Directors is scheduled to meet on February 27, 2025, to consider potential fundraising activities. Successful capital raising could provide the necessary funds for further expansion and innovation.

Taylormade Renewables Share Price Target 2030

Taylormade Renewables share price target 2030 Expected target could be ₹950. Here are five key factors that could influence the Taylormade Renewables share price target for 2030:

-

Expansion in Renewable Energy Infrastructure

As demand for sustainable energy solutions grows globally, Taylormade Renewables’ ability to scale operations—especially in solar thermal, water treatment, and energy-efficient systems—will be vital for long-term growth and value creation. -

Global Collaborations and Export Potential

By 2030, forming international partnerships or exporting to energy-hungry regions like the Middle East, Africa, or Southeast Asia can significantly expand TRL’s customer base and revenue opportunities. -

Technological Innovation and R&D Investment

Continued investment in clean energy innovation, including hybrid solar systems, waste-to-energy, and zero liquid discharge (ZLD) technologies, will help the company stay competitive and tap into future green infrastructure projects. -

Favorable Government Policies & Climate Commitments

Government incentives, green energy mandates, and carbon reduction goals under global agreements (like India’s net-zero targets) will likely benefit companies like Taylormade Renewables working in clean tech sectors. -

Sustainable Financial Performance and Strategic Acquisitions

Maintaining strong revenue growth, profitability, and low debt, along with making smart acquisitions like Taylormade Enviro, will strengthen its market position and support investor confidence over the next 5–6 years.

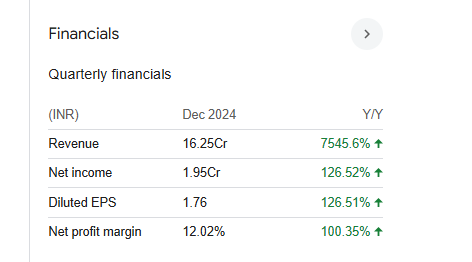

Financial Statement Of Taylormade Renewables

| (INR) | 2024 | Y/Y change |

| Revenue | 469.02M | 137.02% |

| Operating expense | 90.12M | 21.45% |

| Net income | 106.09M | 439.10% |

| Net profit margin | 22.62 | 127.34% |

| Earnings per share | — | — |

| EBITDA | 161.03M | 384.67% |

| Effective tax rate | 30.32% | — |

Read Also:- Tamboli Industries Share Price Target Tomorrow 2025, 2026 To 2030