Delta Corp is one of India’s leading companies in the gaming and hospitality sector. Known for its popular casinos and online gaming platforms, the company has created a strong presence in a fast-growing industry. As more people show interest in entertainment and gaming, many investors are curious about where Delta Corp’s share price might go in the future. Delta Corp Share Price on 5 April 2025 is 82.49 INR. This article will provide more details on Delta Corp Share Price Target 2025, 2026 to 2030.

Delta Corp Company Info

- Founded: 1990

- Headquarters: Mumbai

- Number of employees: 2,484 (2024)

- Revenue: 454.33 crores INR

- Subsidiaries: Delta Penland Private Limited.

Delta Corp Share Price Chart

Delta Corp Share Price Details

- Today Open: 85.80

- Today High: 86.44

- Today Low: 81.65

- Mkt cap: 2.21KCr

- P/E ratio: 14.10

- Div yield: 1.52%

- 52-wk high: 154.90

- 52-wk low: 81.65

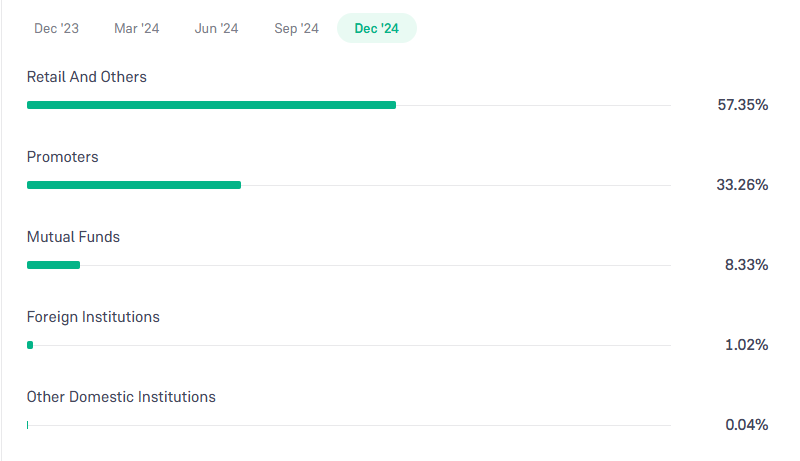

Delta Corp Shareholding Pattern

- Promoters: 33.26%

- Foreign Institutions: 1.02%

- Mutual Funds: 8.33%

- Retails and others: 57.35%

- Domestic Institutions: 0.04%

Delta Corp Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹160

- 2026 – ₹190

- 2027 – ₹220

- 2028 – ₹250

- 2029 – ₹280

- 2030 – ₹310

Delta Corp Share Price Target 2025

Delta Corp share price target 2025 Expected target could be ₹160. Here are five key factors that could influence Delta Corp’s share price target for 2025:

-

Regulatory Environment

Delta Corp operates in India’s gaming and casino industry, which is subject to stringent regulations. Any changes in government policies or taxation laws can significantly impact operations and profitability. For instance, recent developments regarding the Goods and Services Tax (GST) have affected the company, with the Supreme Court agreeing to hear pleas from the online gaming industry against GST notices. -

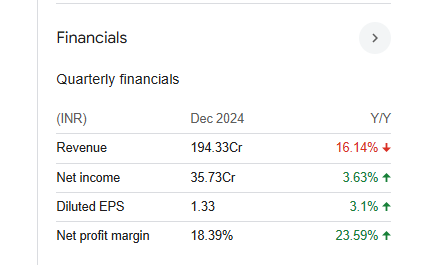

Financial Performance

The company’s financial health plays a crucial role in determining its stock performance. In the quarter ending December 2024, Delta Corp reported net sales of ₹150.17 crore, a modest increase of 2.02% year-over-year. Consistent revenue growth and profitability are essential for positive investor sentiment. -

Market Expansion and Diversification

Expanding into new markets and diversifying service offerings can drive growth. Delta Corp’s efforts to broaden its footprint in the gaming industry, including potential ventures into online gaming platforms, could open new revenue streams and enhance its market position. -

Tourism and Consumer Spending Trends

As a casino and hospitality operator, Delta Corp’s revenue is closely tied to tourism and consumer spending. An uptick in domestic and international tourism, along with increased discretionary spending, can positively impact the company’s earnings. -

Competitive Landscape

The gaming industry in India is becoming increasingly competitive. Delta Corp’s ability to maintain a competitive edge through unique offerings, superior customer experience, and strategic partnerships will be vital for sustaining growth and achieving favorable share price targets.

Delta Corp Share Price Target 2030

Delta Corp share price target 2030 Expected target could be ₹310. As of April 2025, Delta Corp operates as a prominent player in India’s gaming and hospitality industry. Looking ahead to 2030, several key factors are poised to influence the company’s share price trajectory:

-

Expansion into Online Gaming: The Indian online gaming market is projected to experience substantial growth, with estimates indicating a compound annual growth rate (CAGR) of 16.9% from 2023 to 2030, reaching a valuation of US$ 346 billion by 2030. Delta Corp’s strategic initiatives to enhance its online gaming portfolio could position the company to capitalize on this burgeoning market, potentially boosting revenue streams and positively impacting share prices.

-

Regulatory Environment: The legal landscape for gaming in India is evolving. Recent developments, such as the Supreme Court’s decision to stay Goods and Services Tax (GST) notices to online gaming firms, have provided temporary relief to companies like Delta Corp. However, long-term regulatory clarity and favorable policies will be crucial in determining the company’s operational stability and investor confidence leading up to 2030.

-

Market Position and Competitive Landscape: As the only listed company in India engaged in casino gaming across live, electronic, and online platforms, Delta Corp holds a unique position. Sustaining and enhancing this market position amid increasing competition will be vital. The company’s ability to innovate and offer differentiated experiences will influence its market share and, consequently, its stock performance.

-

Tourism and Economic Growth: The performance of Delta Corp’s physical casinos is closely tied to tourism trends and the broader economy. Factors such as increased domestic and international travel, rising disposable incomes, and a growing middle class can drive footfall to casinos, thereby boosting revenues. Monitoring these macroeconomic indicators will provide insights into potential growth trajectories.

-

Financial Performance and Investor Sentiment: Consistent financial growth, marked by increasing revenues and profitability, will play a pivotal role in shaping investor sentiment. Analyst estimates and market forecasts will further influence stock valuations. For instance, some projections suggest potential fluctuations in Delta Corp’s stock price, emphasizing the importance of strategic planning and execution to achieve favorable outcomes by 2030.

Financial Statement Of Delta Corp

| (INR) | 2024 | Y/Y change |

| Revenue | 9.25B | -4.06% |

| Operating expense | 3.09B | 1.88% |

| Net income | 2.44B | -6.56% |

| Net profit margin | 26.39 | -2.62% |

| Earnings per share | — | — |

| EBITDA | 2.79B | -16.24% |

| Effective tax rate | 25.00% | — |

Read Also:- Indian Infotech Share Price Target Tomorrow 2025, 2026 To 2030