GSFC (Gujarat State Fertilizers & Chemicals Ltd.) is a well-known company in India’s fertilizer and chemical sector. With a strong history and a focus on both traditional and modern agricultural solutions, GSFC plays a key role in helping farmers and industries grow. If you’re curious about where its share price is heading in the future, we’re here to guide you with simple and clear information. GSFC Share Price on 5 April 2025 is 179.10 INR. This article will provide more details on GSFC Share Price Target 2025, 2026 to 2030.

GSFC Company Info

- Founded: 1962

- Headquarters: India

- Number of employees: 2,855 (2024)

- Revenue: 11,445 crores INR (FY23, US$1.4 billion)

- Subsidiaries: Vadodara Jal Sanchay Private Limited, Gsfc Agrotech Limited, GSFC Investment & Leasing Co. Ltd.

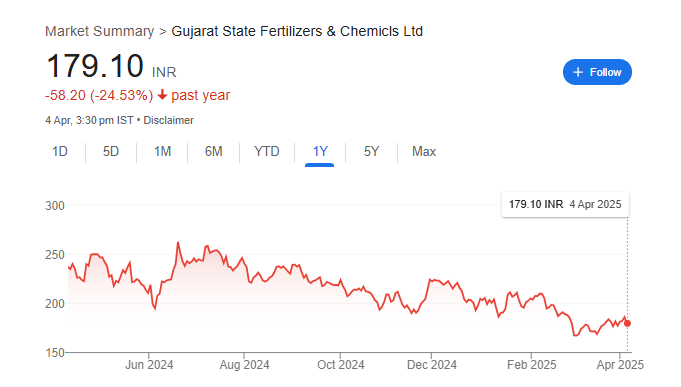

GSFC Share Price Chart

GSFC Share Price Details

- Today Open: 185.53

- Today High: 185.94

- Today Low: 177.84

- Mkt cap: 7.13KCr

- P/E ratio: 13.11

- Div yield: 2.23%

- 52-wk high: 274.70

- 52-wk low: 158.30

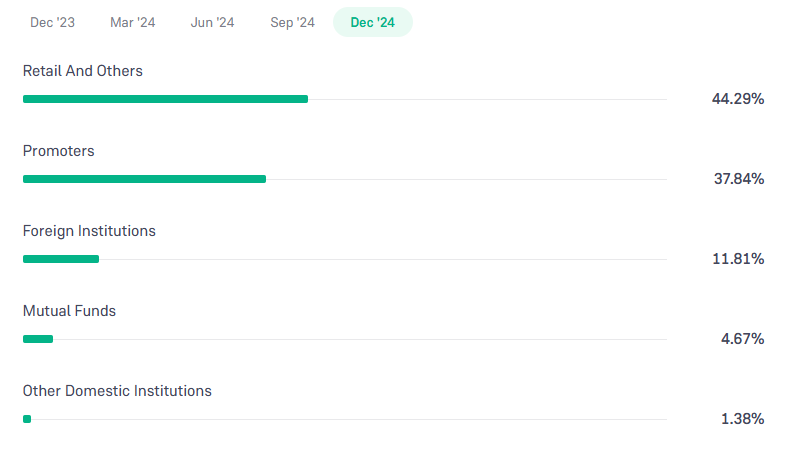

GSFC Shareholding Pattern

- Promoters: 37.84%

- Foreign Institutions: 11.81%

- Mutual Funds: 4.67%

- Retails and others: 44.29%

- Domestic Institutions: 1.38%

GSFC Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹280

- 2026 – ₹310

- 2027 – ₹340

- 2028 – ₹370

- 2029 – ₹400

- 2030 – ₹440

GSFC Share Price Target 2025

GSFC share price target 2025 Expected target could be ₹280. As of April 2025, Gujarat State Fertilizers & Chemicals Ltd. (GSFC) is a prominent player in India’s fertilizer and chemical industry. Several key factors are influencing its share price target for 2025:

-

Financial Performance: GSFC reported a significant recovery in Q1 FY2024/25, with profit before tax (PBT) increasing from INR 23 crore to INR 245 crore year-over-year.

-

Market Demand for Fertilizers: The chemical fertilizers market is projected to grow at a compound annual growth rate (CAGR) of 7.9%, reaching $284.96 billion by 2029.

-

Analyst Projections: Analysts forecast GSFC’s earnings to grow by 8.1% per annum, with revenue growth projected at 5.9% annually.

-

Return on Capital Employed (ROCE): GSFC’s ROCE stands at 3.1%, which is below the chemicals industry average of 13%.

-

Analyst Ratings and Price Targets: Prabhudas Lilladher expects more than a 20% upside for GSFC’s stock.

GSFC Share Price Target 2030

GSFC share price target 2030 Expected target could be ₹440. As of April 2025, Gujarat State Fertilizers & Chemicals Ltd. (GSFC) is a key player in India’s fertilizer and chemical industry. Several factors are projected to influence the company’s share price trajectory leading up to 2030:

-

Market Demand for Phosphatic Fertilizers

The Indian phosphatic fertilizer market is expected to grow, reaching a value of USD 2.14 billion by 2030. This growth is driven by increasing agricultural activities and government support for the agriculture sector, potentially boosting GSFC’s revenue from phosphatic fertilizer products. -

Expansion into Organic Fertilizers

The global organic fertilizers market is projected to grow at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2030. GSFC’s potential diversification into organic fertilizers could open new revenue streams and align with the rising demand for sustainable agricultural inputs. -

Operational Efficiency and Cost Management

GSFC’s focus on enhancing operational efficiency and managing input costs will be crucial for maintaining profitability. The company’s ability to optimize production processes and control expenses will directly impact its financial performance and investor confidence. -

Technological Advancements and Product Innovation

Investing in research and development to introduce innovative and efficient fertilizer products can provide GSFC with a competitive edge. Embracing technological advancements in production methods can also lead to cost reductions and improved product quality, attracting a broader customer base. -

Regulatory Environment and Sustainability Initiatives

Compliance with environmental regulations and adopting sustainable practices are becoming increasingly important in the chemical industry. GSFC’s commitment to sustainability and adherence to regulatory standards can enhance its reputation and mitigate risks associated with environmental compliance.

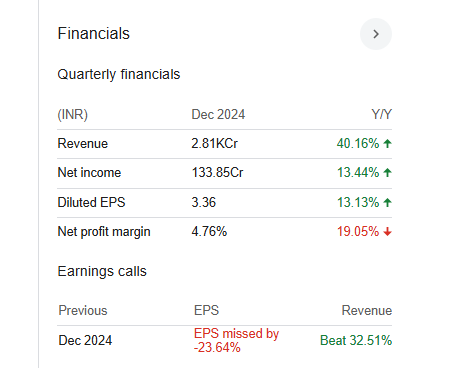

Financial Statement Of GSFC

| (INR) | 2024 | Y/Y change |

| Revenue | 91.55B | -19.47% |

| Operating expense | 17.41B | 5.29% |

| Net income | 5.64B | -55.44% |

| Net profit margin | 6.16 | -44.65% |

| Earnings per share | 14.16 | -55.43% |

| EBITDA | 5.76B | -64.27% |

| Effective tax rate | 19.89% | — |

Read Also:- DLF Share Price Target Tomorrow 2025, 2026 To 2030