Swaraj Engines Ltd. is a trusted name in the Indian engine manufacturing sector, especially known for making powerful diesel engines used in tractors. The company has shown steady growth over the years, and many investors are now curious about its future share price. Swaraj Engines Share Price on 7 April 2025 is 3,740.00 INR. This article will provide more details on Swaraj Engines Share Price Target 2025, 2026 to 2030.

Swaraj Engines Company Info

- Founded: 1985

- Headquarters: India

- Number of employees: 297 (2024)

- Parent organization: Mahindra & Mahindra.

Swaraj Engines Share Price Chart

Swaraj Engines Share Price Details

- Today Open: 4,010.00

- Today High: 4,010.00

- Today Low: 3,713.35

- Mkt cap: 4.53KCr

- P/E ratio: 29.18

- Div yield: 2.54%

- 52-wk high: 4,200.05

- 52-wk low: 2,266.00

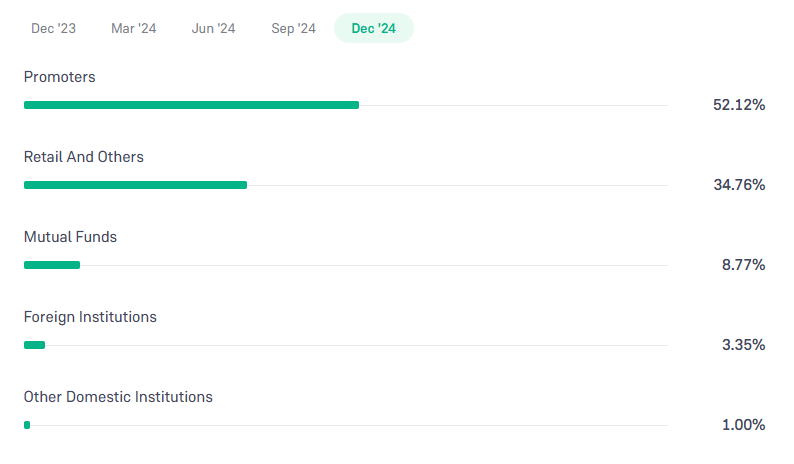

Swaraj Engines Shareholding Pattern

- Promoters: 52.12%

- Foreign Institutions: 3.35%

- Mutual Funds: 8.77%

- Retails and others: 34.76%

- Domestic Institutions: 1.00%

Swaraj Engines Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹4200

- 2026 – ₹5200

- 2027 – ₹6000

- 2028 – ₹7000

- 2029 – ₹8000

- 2030 – ₹9000

Swaraj Engines Share Price Target 2025

Swaraj Engines share price target 2025 Expected target could be ₹4200. As of April 2025, Swaraj Engines Ltd. has demonstrated notable performance in the diesel engine manufacturing sector. Several key factors are influencing the company’s share price target for 2025:

-

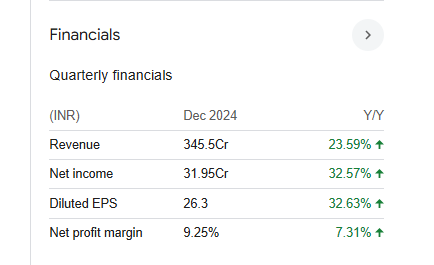

Robust Financial Performance: In Q3 FY2025, Swaraj Engines reported a net profit of ₹31.95 crore, a 32.57% increase from ₹24.10 crore in Q3 FY2024. Revenue from operations also rose by 23.59% to ₹345.50 crore during the same period.

-

High Return on Equity (ROE): The company maintains a strong ROE of approximately 38.9% over the past three years, indicating efficient utilization of shareholder equity to generate profits.

-

Minimal Debt Levels: Swaraj Engines is virtually debt-free, reflecting prudent financial management and a solid balance sheet.

-

Market Position in Agricultural Sector: With the Indian agricultural tractor market projected to reach USD 7.92 billion in 2025, growing at a CAGR of 6.70%, Swaraj Engines’ alignment with this sector positions it to capitalize on expanding market opportunities.

-

Consistent Dividend Payouts: The company has maintained a healthy dividend payout ratio of 85.4%, demonstrating a commitment to returning profits to shareholders.

Swaraj Engines Share Price Target 2030

Swaraj Engines share price target 2030 Expected target could be ₹9000. As of April 2025, Swaraj Engines Ltd. continues to be a significant player in India’s diesel engine manufacturing sector. Several key factors are projected to influence the company’s share price trajectory leading up to 2030:

-

Expansion of the Indian Tractor Market

The Indian tractor market is anticipated to grow from $7,540.8 million in 2020 to $12,700.8 million by 2030, reflecting a compound annual growth rate (CAGR) of 7.9%. This growth is driven by increasing mechanization in agriculture and supportive government policies. As a supplier of engines to the tractor industry, Swaraj Engines stands to benefit from this expanding market. -

Consistent Financial Performance and High Return on Equity (ROE)

Swaraj Engines has demonstrated strong financial health, with a notable ROE of approximately 38.9% over the past three years. This indicates efficient utilization of shareholder equity to generate profits, which could positively influence investor confidence and share price. -

Dividend Policy and Shareholder Value

The company has a history of maintaining a healthy dividend payout ratio, reflecting a commitment to returning profits to shareholders. This approach can enhance investor trust and potentially attract more investment, impacting the share price favorably. -

Technological Advancements and Product Innovation

Investing in research and development to introduce innovative and efficient engine models can provide Swaraj Engines with a competitive edge. Embracing technological advancements in manufacturing processes can also lead to cost reductions and improved product quality, attracting a broader customer base. -

Macroeconomic Factors and Government Policies

The company’s growth is influenced by external factors such as economic cycles, inflation rates, and changes in government policies related to the agricultural and manufacturing sectors. Favorable policies and a stable economic environment can support growth, while adverse changes may pose challenges.

Financial Statement Of Swaraj Engines

| (INR) | 2024 | Y/Y change |

| Revenue | 14.19B | -0.18% |

| Operating expense | 1.19B | 4.52% |

| Net income | 1.38B | 3.18% |

| Net profit margin | 9.71 | 3.30% |

| Earnings per share | 113.48 | 3.17% |

| EBITDA | 1.88B | 0.91% |

| Effective tax rate | 25.46% | — |

Read Also:- GSFC Share Price Target Tomorrow 2025, 2026 To 2030