Om Infra Ltd. is a well-known company in India’s infrastructure sector, especially active in water supply and hydro-mechanical projects. Over the years, it has built a strong reputation for delivering quality work and taking on big projects across the country. Many investors are now showing interest in the company’s future growth and share price outlook. Om Infra Share Price on 7 April 2025 is 107.41 INR. This article will provide more details on Om Infra Share Price Target 2025, 2026 to 2030.

Om Infra Company Info

- Headquarters: India

- Number of employees: 850 (2024)

- Subsidiaries: Gurha termal power company limited.

Om Infra Share Price Chart

Om Infra Share Price Details

- Today Open: 104.99

- Today High: 110.10

- Today Low: 100.30

- Mkt cap: 1.03KCr

- P/E ratio: 43.15

- Div yield: 0.47%

- 52-wk high: 227.90

- 52-wk low: 97.05

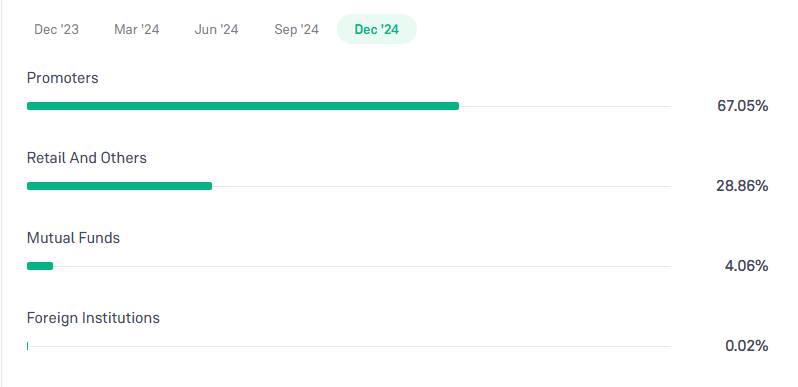

Om Infra Shareholding Pattern

- Promoters: 67.05%

- Foreign Institutions: 0.02%

- Mutual Funds: 4.06%

- Retails and others: 28.86%

- Domestic Institutions: 00%

Om Infra Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹230

- 2026 – ₹260

- 2027 – ₹290

- 2028 – ₹320

- 2029 – ₹350

- 2030 – ₹380

Om Infra Share Price Target 2025

Om Infra share price target 2025 Expected target could be ₹230. As of April 2025, Om Infra Ltd. is a notable player in India’s infrastructure sector, specializing in water supply and hydro-mechanical projects. Several key factors are influencing the company’s share price target for 2025:

-

Robust Order Book

As of September 2024, Om Infra reported an order book of ₹2,140 crore, with significant contributions from hydro power generation and water segments, including the Jal Jeevan Mission. This substantial order book provides strong revenue visibility for the near term. -

Recent Project Acquisitions

In March 2025, the company secured two significant water supply infrastructure projects worth ₹448 crore from Uttar Pradesh Jal Nigam (Rural). These projects are expected to enhance Om Infra’s market position and contribute positively to its financial performance. -

Financial Performance

Om Infra has demonstrated strong financial growth, with operating income increasing by 39.4% year-over-year and net profit growing by 262.2% in the fiscal year ending March 2024. This positive financial trajectory can boost investor confidence and influence share price targets. -

Government Initiatives and Budget Allocations

The company’s focus on water infrastructure aligns with major government initiatives like the Jal Jeevan Mission, which aims to provide tap water to all households. Significant funding and support from the government for such projects present opportunities for Om Infra’s growth. -

Market Valuation

As of April 4, 2025, Om Infra is trading at a premium of 47% over its estimated intrinsic value of ₹79.21, suggesting that the stock may be overvalued. Investors should consider this valuation in their investment decisions.

Om Infra Share Price Target 2030

Om Infra share price target 2030 Expected target could be ₹380. As of April 2025, Om Infra Ltd. is a notable player in India’s infrastructure sector, particularly in water resource management and hydroelectric projects. Several key factors are projected to influence the company’s share price trajectory leading up to 2030:

-

Robust Order Book and Project Pipeline

As of September 2024, Om Infra reported an order book of ₹2,140 crore, with significant contributions from hydro power generation and water segments, including the Jal Jeevan Mission. This substantial order book provides strong revenue visibility for the near term. -

Alignment with Government Initiatives

The company’s focus on water infrastructure aligns with major government initiatives like the Jal Jeevan Mission, which aims to provide tap water to all households. Significant funding and support from the government for such projects present opportunities for Om Infra’s growth. -

Financial Performance and Profitability

Om Infra has demonstrated strong financial growth, with operating income increasing by 39.4% year-over-year and net profit growing by 262.2% in the fiscal year ending March 2024. This positive financial trajectory can boost investor confidence and influence share price targets. -

Technological Expertise and Project Execution

With over five decades of experience and completion of more than 70 projects, Om Infra has established a strong technical and R&D edge. Efficient and timely project execution, often ahead of schedule, enhances the company’s reputation and can lead to increased business opportunities. -

Market Valuation and Investor Sentiment

As of April 4, 2025, Om Infra is trading at a premium of 47% over its estimated intrinsic value of ₹79.21, suggesting that the stock may be overvalued. Investors should consider this valuation in their investment decisions.

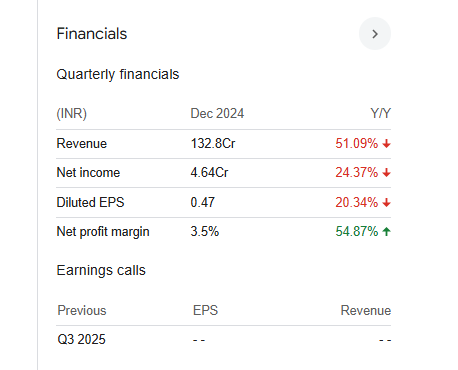

Financial Statement Of Om Infra

| (INR) | 2024 | Y/Y change |

| Revenue | 11.14B | 39.37% |

| Operating expense | 5.41B | 57.64% |

| Net income | 472.66M | 267.17% |

| Net profit margin | 4.24 | 163.35% |

| Earnings per share | — | — |

| EBITDA | 792.52M | 102.93% |

| Effective tax rate | 44.95% | — |

Read Also:- Swaraj Engines Share Price Target Tomorrow 2025, 2026 To 2030