Radico Khaitan is one of India’s leading alcohol beverage companies, known for popular brands like Magic Moments, 8 PM, and Rampur Indian Single Malt. Over the years, it has gained trust with its wide range of quality products and strong market presence both in India and abroad. Radico Khaitan Share Price on 7 April 2025 is 2,241.40 INR. This article will provide more details on Radico Khaitan Share Price Target 2025, 2026 to 2030.

Radico Khaitan Company Info

- Headquarters: India

- Number of employees: 1,469 (2024)

- Subsidiaries: Rampur Distillery, Radico Spiritzs India Private Limited, Diageo Radico Distilleries Private Limited.

Radico Khaitan Share Price Chart

Radico Khaitan Share Price Details

- Today Open: 2,200.00

- Today High: 2,271.70

- Today Low: 2,200.00

- Mkt cap: 30.03KCr

- P/E ratio: 97.75

- Div yield: 0.13%

- 52-wk high: 2,637.70

- 52-wk low: 1,429.85

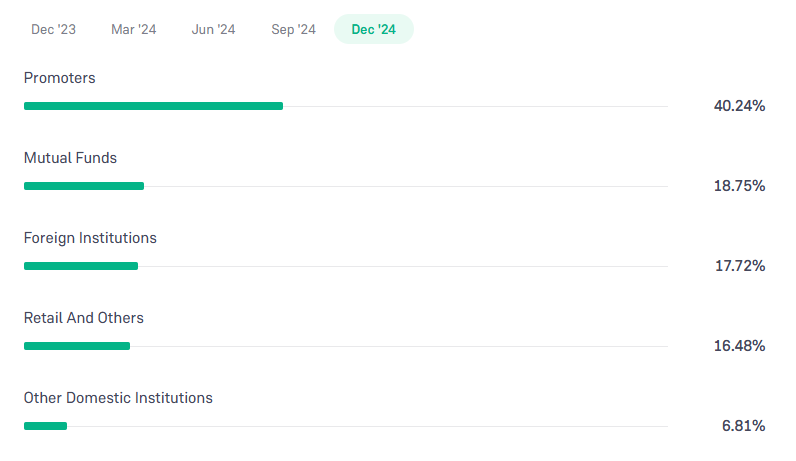

Radico Khaitan Shareholding Pattern

- Promoters: 40.24%

- Foreign Institutions: 17.72%

- Mutual Funds: 18.75%

- Retails and others: 16.48%

- Domestic Institutions: 6.81%

Radico Khaitan Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹2640

- 2026 – ₹3357

- 2027 – ₹4130

- 2028 – ₹4920

- 2029 – ₹5750

- 2030 – ₹6380

Radico Khaitan Share Price Target 2025

Radico Khaitan share price target 2025 Expected target could be ₹2640. As of April 2025, Radico Khaitan Ltd. continues to be a prominent player in India’s alcoholic beverage industry. Several key factors are influencing the company’s growth and share price target for 2025:

-

Strong Financial Performance

In the first half of the 2025 financial year, Radico Khaitan reported a 27.4% increase in pre-tax profits, reaching ₹213.2 crore (approximately US$25 million). Net revenues also saw a significant rise of nearly 20%, totaling ₹2,252.8 crore (about US$265 million).

-

Expansion into Premium and Luxury Segments

The company is focusing on the premium and luxury spirits market, with plans to launch three new luxury products in India. This strategy aims to enhance its portfolio in the country’s booming premium alcohol sector.

-

Global Market Penetration

Radico Khaitan is expanding its global footprint by introducing products like the Ankahi Zaffran Spiced Liqueur. Shipments are set to begin in April 2025 across key markets, including the USA, Europe, Asia Pacific, and the Middle East.

-

Analyst Confidence and Positive Outlook

Financial analysts have maintained a ‘Buy’ rating for Radico Khaitan, with target prices ranging up to ₹2,700. This reflects confidence in the company’s growth prospects, driven by favorable policies, price hikes in key states, and cost optimization initiatives.

-

Operational Efficiency and Cost Management

Despite challenges such as increased interest expenses and a decline in the debtors turnover ratio, Radico Khaitan has achieved record net sales and operating profit. Effective cost management and operational efficiency have been pivotal in sustaining profitability.

Radico Khaitan Share Price Target 2030

Radico Khaitan share price target 2030 Expected target could be ₹6380. As of April 2025, Radico Khaitan Ltd. continues to be a significant entity in India’s alcoholic beverage industry. Several key factors are projected to influence the company’s share price trajectory leading up to 2030:

-

Earnings and Revenue Growth Projections

Analysts forecast that Radico Khaitan’s earnings will grow by approximately 35.2% annually, with revenue expected to increase by 16.9% per annum. Such robust growth projections can positively impact investor sentiment and the company’s share price. -

Global Expansion Initiatives

Radico Khaitan is actively expanding its global footprint by introducing products like the Ankahi Zaffran Spiced Liqueur. Shipments are set to begin in April 2025 across key markets, including the USA, Europe, Asia Pacific, and the Middle East. This strategic move aims to tap into international markets, potentially boosting revenue and enhancing brand recognition. -

Premiumization and Product Diversification

The company’s focus on premium and luxury segments, with plans to launch new high-end products, aligns with the growing consumer preference for premium alcoholic beverages. This strategy is expected to enhance profit margins and attract a more affluent customer base. -

Market Trends in Alcoholic Beverages

The global vodka market, for instance, is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2030, reaching USD 40.25 billion by 2030. Radico Khaitan’s involvement in such segments positions it to benefit from these favorable market trends. -

Operational Efficiency and Cost Management

Despite challenges such as increased interest expenses and a decline in the debtors turnover ratio, Radico Khaitan has achieved record net sales and operating profit. Effective cost management and operational efficiency have been pivotal in sustaining profitability.

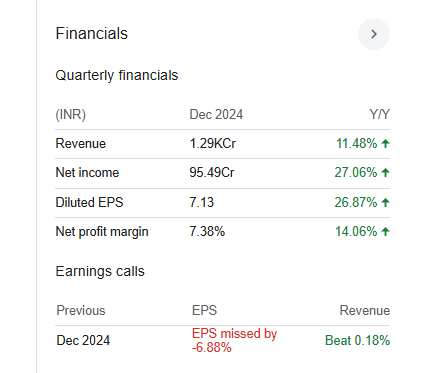

Financial Statement Of Radico Khaitan

| (INR) | 2024 | Y/Y change |

| Revenue | 41.19B | 31.05% |

| Operating expense | 13.19B | 32.15% |

| Net income | 2.62B | 18.98% |

| Net profit margin | 6.37 | -9.13% |

| Earnings per share | 19.13 | 25.11% |

| EBITDA | 4.93B | 42.18% |

| Effective tax rate | 24.76% | — |

Read Also:- Om Infra Share Price Target Tomorrow 2025, 2026 To 2030