Zen Technologies is a fast-growing Indian company known for its smart defense solutions like simulation training and anti-drone systems. With the government focusing more on defense and “Make in India” initiatives, Zen has become a trusted name in this space. Many investors are now looking at Zen Technologies as a strong long-term player in the market. Zen Technologies Share Price on 8 April 2025 is 1,422.00 INR. This article will provide more details on Zen Technologies Share Price Target 2025, 2026 to 2030.

Zen Technologies Company Info

- Founded: 1993

- Headquarters: Hyderabad

- Number of employees: 363 (2024)

- Subsidiaries: Vector Technics.

Zen Technologies Share Price Chart

Zen Technologies Share Price Details

- Today Open: 1,389.95

- Today High: 1,435.35

- Today Low: 1,375.00

- Mkt cap: 12.85KCr

- P/E ratio: 56.97

- Div yield: 0.070%

- 52-wk high: 2,627.00

- 52-wk low: 886.45

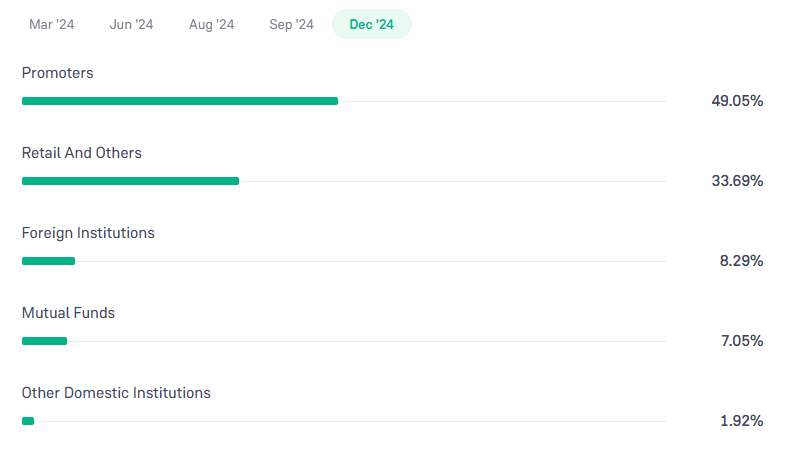

Zen Technologies Shareholding Pattern

- Promoters: 49.05%

- Foreign Institutions: 8.29%

- Mutual Funds: 7.05%

- Retails and others: 33.69%

- Domestic Institutions: 1.92%

Zen Technologies Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹2630

- 2026 – ₹2900

- 2027 – ₹3200

- 2028 – ₹3500

- 2029 – ₹2800

- 2030 – ₹3100

Zen Technologies Share Price Target 2025

Zen Technologies share price target 2025 Expected target could be ₹2630. As of April 2025, Zen Technologies Ltd. is a key player in India’s defense simulation and training solutions sector. Several factors are influencing the company’s growth and share price target for 2025:

-

Financial Performance

In Q3 FY2025, Zen Technologies reported a 44% year-over-year increase in sales, reaching ₹1.4 billion, up from ₹980.8 million in Q3 FY2024.

-

Order Inflows and Revenue Guidance

The company has a domestic order pipeline of approximately ₹8 billion and has shifted its order inflow expectations to the first half of FY2026. Zen Technologies maintains a revenue guidance of ₹9 billion with a 35% EBITDA margin for FY2025.

-

Analyst Recommendations and Target Prices

ICICI Securities has assigned a ‘Buy’ rating to Zen Technologies, setting a target price of ₹1,970. This reflects confidence in the company’s growth prospects despite recent market corrections.

-

Strategic Acquisitions

Zen Technologies has acquired 100% stakes in Applied Research International Private Limited and ARI Labs Private Limited, aiming to enhance its technological capabilities and expand its product offerings.

-

Market Position and Industry Demand

As a leading supplier of simulation training equipment and anti-drone systems in India, Zen Technologies is well-positioned to benefit from increasing defense expenditures and the growing emphasis on indigenous defense solutions.

Zen Technologies Share Price Target 2030

Zen Technologies share price target 2030 Expected target could be ₹3100. As of April 2025, Zen Technologies Ltd. is a prominent player in defense training solutions and anti-drone systems. Looking ahead to 2030, several key factors are anticipated to influence the company’s growth and share price:

-

Expansion of Product Portfolio

Zen Technologies is diversifying its offerings by developing advanced simulation systems and anti-drone technologies. This strategic expansion positions the company to meet evolving defense needs and access new markets.

-

Robust Order Pipeline and Revenue Growth

The company has projected significant growth, aiming for revenues of ₹450 crore in FY2024 and ₹900 crore in FY2025. Achieving these targets will require securing substantial orders and effectively fulfilling them.

-

Financial Performance and Profitability

Zen Technologies has demonstrated strong financial performance, with a 56.9% compound annual growth rate (CAGR) in profits over the past five years. Maintaining this trajectory is crucial for sustaining investor confidence and supporting share price appreciation.

-

Talent Acquisition and Retention

Attracting and retaining skilled professionals is vital for the company’s innovation and operational efficiency. Zen Technologies offers competitive compensation and fosters a positive work culture to secure top talent.

-

Market Dynamics and Competitive Landscape

The defense sector is subject to rapid technological advancements and shifting geopolitical factors. Zen Technologies’ ability to adapt to these changes and maintain a competitive edge will significantly impact its growth prospects leading up to 2030.

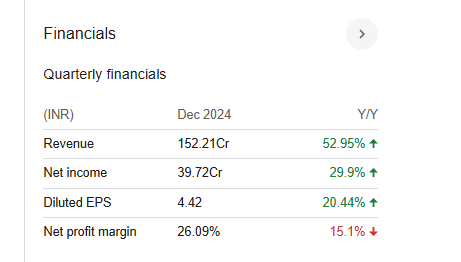

Financial Statement Of Zen Technologies

| (INR) | 2024 | Y/Y change |

| Revenue | 1.52B | 52.95% |

| Operating expense | 451.98M | 38.62% |

| Net income | 397.19M | 29.90% |

| Net profit margin | 26.09 | -15.10% |

| Earnings per share | — | — |

| EBITDA | 442.29M | 7.26% |

| Effective tax rate | 28.25% | — |

Read Also:- Zydus Share Price Target Tomorrow 2025, 2026 To 2030