PCBL Ltd (formerly Phillips Carbon Black Ltd) is one of India’s top carbon black manufacturers, serving industries like tyres, plastics, inks, and coatings. Over the years, the company has grown steadily with its strong focus on innovation, quality, and expansion. PCBL Share Price on 9 April 2025 is 400.00 INR. This article will provide more details on PCBL Share Price Target 2025, 2026 to 2030.

PCBL Company Info

- Founded: 1960

- Headquarters: India

- Number of employees: 1,275 (2024)

- Subsidiaries: Aquapharm Chemical Pvt. Ltd.

PCBL Share Price Chart

PCBL Share Price Details

- Today Open: 405.85

- Today High: 410.90

- Today Low: 396.20

- Mkt cap: 15.11KCr

- P/E ratio: 33.91

- Div yield: 2.06%

- 52-wk high: 584.40

- 52-wk low: 209.00

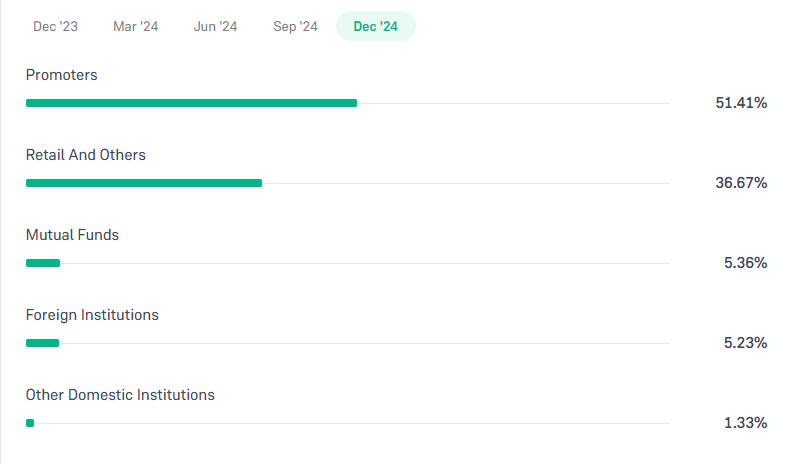

PCBL Shareholding Pattern

- Promoters: 51.41%

- Foreign Institutions: 5.23%

- Mutual Funds: 5.36%

- Retails and others: 36.67%

- Domestic Institutions: 1.33%

PCBL Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹590

- 2026 – ₹600

- 2027 – ₹700

- 2028 – ₹800

- 2029 – ₹900

- 2030 – ₹1000

PCBL Share Price Target 2025

PCBL share price target 2025 Expected target could be ₹590. PCBL Chemical Ltd. (formerly Phillips Carbon Black Limited) is a leading manufacturer of carbon black in India. Several key factors are influencing the company’s growth and share price target for 2025:

-

Expansion of Production Capacity

PCBL is actively increasing its manufacturing capabilities. The company plans to commission a specialty-grade carbon black facility with a capacity of 20,000 MTPA in Mundra and a 30,000 MTPA brownfield expansion in Tamil Nadu by the end of the third fiscal quarter. These initiatives are part of a broader strategy to achieve a total capacity of 1 million MTPA by FY2027-28, positioning the company to meet growing global demand.

-

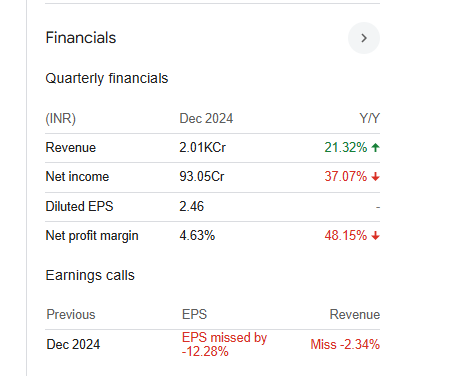

Financial Performance and Profitability

In the December 2024 quarter, PCBL reported consolidated net sales of ₹2,010 crore, marking a 21.32% year-over-year increase. However, the company also experienced a 23% decline in standalone profit after tax, amounting to ₹110.99 crore. This decline was attributed to factors such as fluctuating raw material prices and increased operational costs.

-

Analyst Recommendations and Target Prices

Analysts have maintained a positive outlook on PCBL’s stock. For instance, HDFC Securities has issued a ‘Buy’ recommendation with a target price of ₹524, citing the company’s strategic expansion plans and potential for increased market share in both domestic and export markets.

-

Diversification into Specialty Chemicals

PCBL is diversifying its product portfolio by focusing on specialty carbon black and performance chemicals. The company aims to double its specialty-grade output by FY2028, targeting high-margin segments and applications in industries such as electric vehicle battery components.

-

Strategic Partnerships and Joint Ventures

The company has entered into a joint venture with Kindia Pty Ltd. to form Nanovace Technologies Ltd., focusing on developing nano-silicon products for use in lithium-ion battery anodes. This initiative aligns with PCBL’s strategy to tap into emerging technologies and markets, potentially enhancing its growth trajectory.

PCBL Share Price Target 2030

PCBL share price target 2030 Expected target could be ₹1000. PCBL Chemical Ltd. (formerly Phillips Carbon Black Limited) is a leading manufacturer of carbon black in India. Looking ahead to 2030, several key factors are anticipated to influence the company’s growth and share price:

-

Expansion of Production Capacity

PCBL is actively expanding its manufacturing capabilities. The company plans to commission a specialty-grade carbon black facility with a capacity of 20,000 MTPA in Mundra and a 30,000 MTPA brownfield expansion in Tamil Nadu by the end of the third fiscal quarter. These initiatives are part of a broader strategy to achieve a total capacity of 1 million MTPA by FY2027-28, positioning the company to meet growing global demand.

-

Diversification into Specialty Chemicals

PCBL is diversifying its product portfolio by focusing on specialty carbon black and performance chemicals. The company aims to double its specialty-grade output by FY2028, targeting high-margin segments and applications in industries such as electric vehicle battery components.

-

Strategic Partnerships and Technological Advancements

The company has entered into a technology transfer agreement with Ningxia Jinhua Chemical Co. to produce acetylene black in India. Acetylene black is a high-end conductive grade chemical with applications in high voltage power cables, lithium-ion batteries, and semiconductor packaging. This initiative aligns with PCBL’s strategy to tap into emerging technologies and markets, potentially enhancing its growth trajectory.

-

Global Market Demand and Export Potential

The global carbon black market is projected to grow at a compound annual growth rate (CAGR) of 4.01% until 2035, driven by increased demand in sectors such as tires, mechanical rubber goods, and plastics. PCBL’s capacity expansions and focus on specialty products position it to capitalize on this growing demand, particularly in export markets.

-

Financial Performance and Investor Confidence

PCBL has demonstrated strong financial performance, with consolidated revenue from operations increasing by 52% year-over-year to ₹4,307 crores in H1 FY2025. Maintaining robust financial health and delivering consistent returns will be crucial for sustaining investor confidence and supporting share price appreciation leading up to 2030.

Financial Statement Of PCBL

| (INR) | 2024 | Y/Y change |

| Revenue | 64.20B | 11.18% |

| Operating expense | 11.39B | 40.66% |

| Net income | 4.91B | 11.12% |

| Net profit margin | 7.65 | 0.00% |

| Earnings per share | 13.00 | 10.54% |

| EBITDA | 9.56B | 37.75% |

| Effective tax rate | 27.39% | — |

Read Also:- Zen Technologies Share Price Target Tomorrow 2025, 2026 To 2030