Indegene is a fast-growing company in the healthcare and life sciences sector, helping global pharmaceutical companies with digital solutions and medical services. It combines the power of technology and healthcare expertise to support better patient outcomes and efficient drug development. Indegne Share Price on 9 April 2025 is 550.00 INR. This article will provide more details on Indegne Share Price Target 2025, 2026 to 2030.

Indegne Company Info

- Founders: Manish Gupta, Rajesh Nair

- Headquarters: India

- Number of employees: 4,367 (2024)

- Revenue: 2,306 crores INR (FY23, US$290 million)

- Subsidiary: Indegene Ireland Limited.

Indegne Share Price Chart

Indegne Share Price Details

- Today Open: 548.95

- Today High: 551.95

- Today Low: 537.05

- Mkt cap: 13.16KCr

- P/E ratio: 31.13

- Div yield: N/A

- 52-wk high: 736.30

- 52-wk low: 470.10

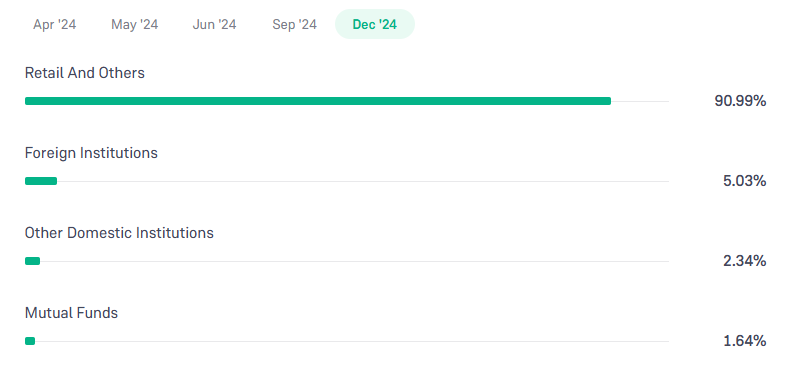

Indegne Shareholding Pattern

- Promoters: 0%

- Foreign Institutions: 5.03%

- Mutual Funds: 1.64%

- Retails and others: 90.99%

- Domestic Institutions: 2.34%

Indegne Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹740

- 2026 – ₹790

- 2027 – ₹850

- 2028 – ₹900

- 2029 – ₹950

- 2030 – ₹1000

Indegne Share Price Target 2025

Indegne share price target 2025 Expected target could be ₹740. Several key factors are influencing the company’s share price target for 2025:

-

Robust Financial Performance

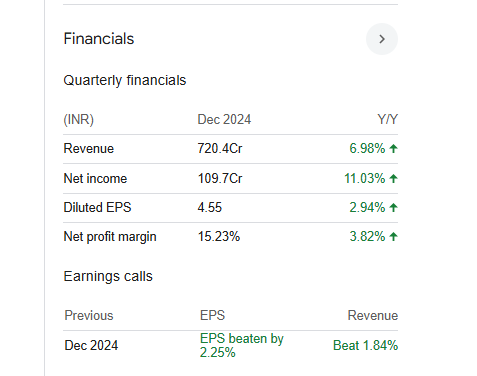

In the third quarter of FY2024-2025, Indegene reported a revenue of ₹7,204 million, marking a 7.0% year-over-year increase. The Profit After Tax (PAT) stood at ₹1,097 million, reflecting an 11.1% growth compared to the same period in the previous year.

-

Strategic Global Expansion

Indegene has been actively expanding its global footprint, notably launching a new entity in Spain to serve as a key delivery hub for European clients. This expansion aims to enhance the company’s service capabilities and client engagement in the European market.

-

Analyst Outlook and Market Sentiment

Analysts have shown a neutral stance on Indegene’s stock, with JPMorgan initiating coverage with a target price of ₹570. This suggests a cautious optimism, indicating potential for growth while awaiting more favorable entry points.

-

Strategic Partnerships and Acquisitions

The company is focusing on strategic acquisitions to bolster its technological capabilities and global presence. With a cash reserve exceeding ₹1,500 crore, Indegene is well-positioned to pursue opportunities that enhance its service offerings and market reach.

-

Industry Recognition and Market Position

Indegene’s inclusion in the Financial Times High-Growth Companies in Asia-Pacific 2025 underscores its strong market position and growth trajectory. Such recognition enhances the company’s credibility and visibility in the industry.

Indegne Share Price Target 2030

Indegne share price target 2030 Expected target could be ₹1000. Several key factors are anticipated to influence Indegene’s growth trajectory and share price:

-

Expansion of Global Capability Centers (GCCs)

India hosts 36 life sciences Global Capability Centers, with projections indicating market expansion to $110 billion by 2030—a 144% increase. Indegene’s strategic involvement in scaling commercial and medical services within these GCCs positions it to capitalize on this substantial growth.

-

Investment in Digital and Analytics Programs

The life sciences industry is expected to increase spending on digital and analytics programs by 27% annually, reaching $1.2 billion by 2030. Indegene’s focus on digital-first solutions aligns with this trend, potentially enhancing its service offerings and market competitiveness.

-

Growth in Medical Affairs Outsourcing Market

The global medical affairs outsourcing market is projected to grow at a compound annual growth rate (CAGR) of 12.5%, surpassing $3.51 billion by 2030. Indegene’s expertise in this domain positions it to benefit from the increasing demand for outsourced medical affairs services.

-

Financial Performance and Market Recognition

Indegene reported a 12.3% growth in annual revenue to ₹25,896 million, with EBITDA growth of 28.6%. Additionally, its inclusion in the Financial Times High-Growth Companies in Asia-Pacific 2025 reflects strong market recognition, which could positively influence investor confidence and share price.

-

Strategic Acquisitions and Service Diversification

Indegene’s track record of strategic acquisitions has enhanced its service offerings and market reach. Continued focus on integrating complementary businesses and technologies may drive growth and innovation within the life sciences sector, contributing to long-term share price appreciation.

Financial Statement Of Indegne

| (INR) | 2024 | Y/Y change |

| Revenue | 25.90B | 12.29% |

| Operating expense | 20.96B | 8.69% |

| Net income | 3.37B | 26.53% |

| Net profit margin | 13.00 | 12.65% |

| Earnings per share | — | — |

| EBITDA | 4.85B | 29.93% |

| Effective tax rate | 26.58% | — |

Read Also:- Hudco Share Price Target Tomorrow 2025, 2026 To 2030