KEC International is one of India’s top infrastructure companies, known for building power transmission lines, railways, and civil projects. Over the years, the company has earned trust by completing big projects both in India and abroad. If you are an investor looking for a reliable company with long-term potential, KEC International is definitely worth watching. KEC International Share Price on 10 April 2025 is 660.00 INR. This article will provide more details on KEC International Share Price Target 2025, 2026 to 2030.

KEC International Company Info

- CEO: Vimal Kejriwal (Apr 2015–)

- Founded: 7 May 1945

- Founder: Ramji H. Kamani

- Headquarters: Maharashtra

- Number of employees: 6,450 (2024)

- Parent organization: RPG Group

- Revenue: 17,282 crores INR (FY23, US$2.2 billion).

KEC International Share Price Chart

KEC International Share Price Details

- Today Open: 661.00

- Today High: 674.25

- Today Low: 653.00

- Mkt cap: 17.57KCr

- P/E ratio: 37.73

- Div yield: 0.61%

- 52-wk high: 1,313.25

- 52-wk low: 627.45

KEC International Shareholding Pattern

- Promoters: 50.10%

- Foreign Institutions: 15.20%

- Mutual Funds: 22.84%

- Retails and others: 9.79%

- Domestic Institutions: 2.06%

KEC International Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹1315

- 2026 – ₹1500

- 2027 – ₹1700

- 2028 – ₹1900

- 2029 – ₹2100

- 2030 – ₹2300

KEC International Share Price Target 2025

KEC International share price target 2025 Expected target could be ₹1315. Several key factors are influencing the company’s growth and could impact its share price target for 2025:

-

Robust Order Book

KEC International has secured a substantial order intake, surpassing ₹22,000 crore year-to-date, marking a 70% year-over-year growth. This includes significant projects in the Transmission & Distribution (T&D) sector, such as a 765 kV transmission line order from a private developer in India and multiple international orders in Saudi Arabia, Oman, and the UAE.

-

Financial Performance

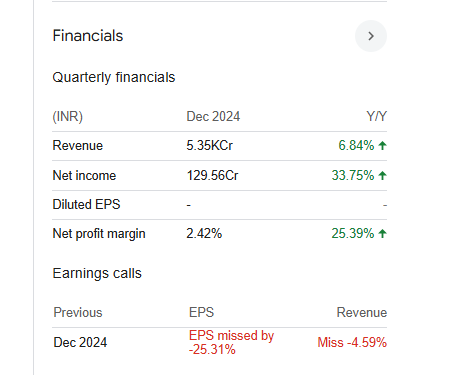

In Q3 FY25, the company reported a revenue of ₹5,349 crore, a 7% increase compared to the same period in the previous fiscal year. The Profit After Tax (PAT) rose to ₹130 crore, up from ₹97 crore in Q3 FY24, reflecting a 34% growth. This improvement is attributed to enhanced operational efficiencies and a diversified business portfolio.

-

Diversification into Civil Projects

KEC International has expanded its footprint in the civil construction segment, securing its largest order to date in the residential building sector. This includes contracts for residential projects across Northern and Southern India, contributing to a more diversified revenue stream.

-

Margin Improvement Initiatives

The company is targeting an EBITDA margin of 9% by FY26, supported by a strong order book and operational improvements. In Q3 FY25, the EBITDA margin improved to 7.0%, up from 6.2% in the previous year, indicating progress towards this goal.

-

Debt Management

KEC International has reduced its net debt, including acceptances, to ₹5,574 crore as of December 31, 2024, a reduction of ₹471 crore compared to the same period in the previous year. This demonstrates effective financial management and a focus on strengthening the balance sheet.

KEC International Share Price Target 2030

KEC International share price target 2030 Expected target could be ₹2300. Several key factors are expected to influence the company’s share price trajectory over this period:

-

Expanding Order Book

KEC International has achieved a robust order book, reaching ₹37,440 crore as of February 2025, reflecting a 24% year-over-year growth. This substantial backlog indicates strong future revenue streams and underpins the company’s growth prospects.

-

Diversification into Emerging Sectors

The company is actively diversifying its portfolio by venturing into sectors such as civil construction, oil and gas pipelines, and urban infrastructure. Notably, KEC has secured significant orders in these areas, including a recent ₹1,136 crore contract encompassing Transmission & Distribution, transportation, and oil and gas pipeline segments. This strategic diversification is expected to mitigate risks associated with sector-specific downturns and contribute to long-term growth.

-

Focus on Renewable Energy and Sustainability

Aligning with global trends towards sustainability, KEC International is enhancing its capabilities in renewable energy projects. The company’s emphasis on building sustainable infrastructure positions it favorably to capitalize on the increasing demand for green energy solutions. This focus is anticipated to open new revenue streams and bolster the company’s market position.

-

Innovation in Product Offerings

KEC has developed new products in the cables segment, including electric vehicle (EV) charging cables and green cables. These innovations cater to emerging markets and demonstrate the company’s commitment to staying ahead in a rapidly evolving industry landscape. Such advancements are likely to enhance KEC’s competitive edge and contribute to revenue growth.

-

Global Infrastructure Market Growth

The global construction market is projected to increase from $10.7 trillion in 2020 to $15.2 trillion by 2030. As a key player in the engineering, procurement, and construction (EPC) sector, KEC International is well-positioned to benefit from this expansion. The company’s established presence and expertise in executing large-scale projects globally are expected to drive growth in alignment with the broader market trends.

Financial Statement Of KEC International

| (INR) | 2024 | Y/Y change |

| Revenue | 199.14B | 15.23% |

| Operating expense | 35.80B | 8.87% |

| Net income | 3.47B | 97.00% |

| Net profit margin | 1.74 | 70.59% |

| Earnings per share | 13.49 | 96.93% |

| EBITDA | 11.86B | 52.67% |

| Effective tax rate | 18.69% | — |

Read Also:- RIL Share Price Target Tomorrow 2025, 2026 To 2030