Indian Overseas Bank (IOB) is one of the trusted public sector banks in India with a long history of serving customers across the country. Known for its wide network and focus on customer service, IOB is slowly but steadily making its mark in the banking sector. For investors looking for stability and long-term value, IOB shares can be an interesting choice. IOB Share Price on 10 April 2025 is 35.15 INR. This article will provide more details on IOB Share Price Target 2025, 2026 to 2030.

IOB Company Info

- CEO: Ajay Kumar Srivastava (1 Jan 2023–)

- Founded: 10 February 1937, Chennai

- Founder: M. Ct. M. Chidambaram Chettiar

- Headquarters: Chennai

- Number of employees: 21,148 (2024)

- Revenue: 22,422.91 crores INR (US$2.8 billion, 2021)

- Subsidiaries: Indian Overseas Bank, Singapore Branch.

IOB Share Price Chart

IOB Share Price Details

- Today Open: 35.75

- Today High: 35.90

- Today Low: 35.00

- Mkt cap: 67.77KCr

- P/E ratio: 21.34

- Div yield: N/A

- 52-wk high: 75.55

- 52-wk low: 33.50

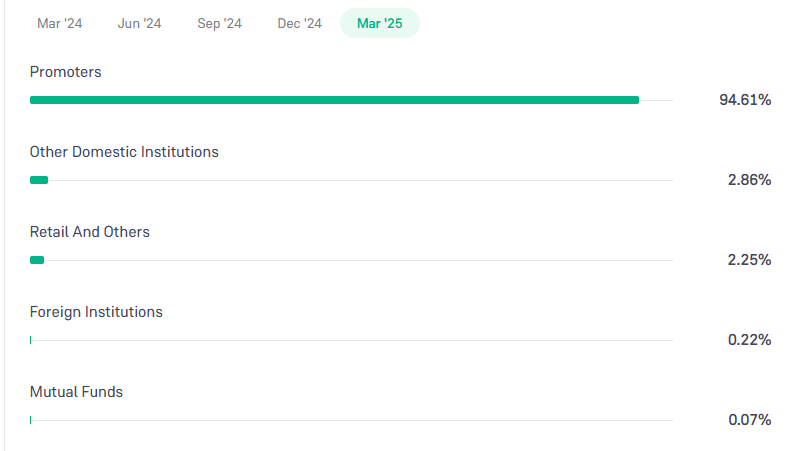

IOB Shareholding Pattern

- Promoters: 94.61%

- Foreign Institutions: 0.22%

- Mutual Funds: 0.07%

- Retails and others: 2.25%

- Domestic Institutions: 2.86%

IOB Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹80

- 2026 – ₹100

- 2027 – ₹120

- 2028 – ₹140

- 2029 – ₹160

- 2030 – ₹180

IOB Share Price Target 2025

IOB share price target 2025 Expected target could be ₹80. Indian Overseas Bank (IOB) is navigating several factors that could influence its share price target for 2025:

-

Financial Performance

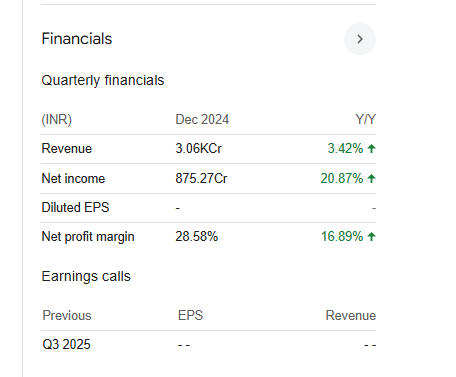

In Q3 FY2025, IOB reported a 20.89% increase in net profit, indicating improved operational efficiency. However, the bank has experienced declines in corporate credit and is addressing ongoing tax disputes, which could impact future profitability.

-

Asset Quality and Non-Performing Assets (NPAs)

The bank’s focus on enhancing asset quality and reducing NPAs is crucial. Effective management of these assets can lead to better financial health and positively influence investor confidence.

-

Capital Adequacy and Regulatory Compliance

Maintaining a strong capital adequacy ratio and adhering to regulatory requirements are vital for IOB’s stability. Adequate capitalization ensures the bank can absorb potential losses and supports expansion plans.

-

Market Position and Competition

IOB’s ability to strengthen its market position amidst competition from other public and private sector banks will affect its growth. Innovative product offerings and customer service enhancements can help retain and attract customers.

-

Macroeconomic Factors

Economic indicators such as GDP growth, inflation rates, and interest rate movements influence the banking sector’s performance. Favorable economic conditions can lead to increased lending and profitability for IOB.

IOB Share Price Target 2030

IOB share price target 2030 Expected target could be ₹180. Indian Overseas Bank (IOB) is poised for potential growth leading up to 2030. Several key factors are anticipated to influence its share price trajectory:

-

Advancements in Digital Transformation

IOB’s commitment to accelerating digital transformation aims to enhance operational efficiency and customer experience. Implementing advanced technologies and expanding digital banking services can attract a tech-savvy customer base and improve service delivery, contributing to revenue growth.

-

Government Policy and Stake Reduction

The planned reduction of government stake in IOB to below 75% aligns with SEBI’s minimum public shareholding norms. This move could increase market liquidity and attract private investors, potentially boosting the bank’s market valuation and share price.

-

Economic Growth and Credit Demand

India’s projected economic expansion is expected to drive increased demand for banking services. IOB’s ability to capitalize on this growth by expanding its loan portfolio and customer base will be crucial for its financial performance and share price appreciation.

-

Competitive Landscape and Market Position

IOB faces competition from both public and private sector banks. Enhancing its market position through innovative products, superior customer service, and strategic partnerships will be vital to attract and retain customers, thereby influencing its growth and share price.

-

Regulatory Environment and Compliance

Adherence to regulatory requirements and proactive compliance measures are essential for IOB’s stability and reputation. Navigating the evolving regulatory landscape effectively can prevent legal challenges and foster investor confidence, positively impacting the share price.

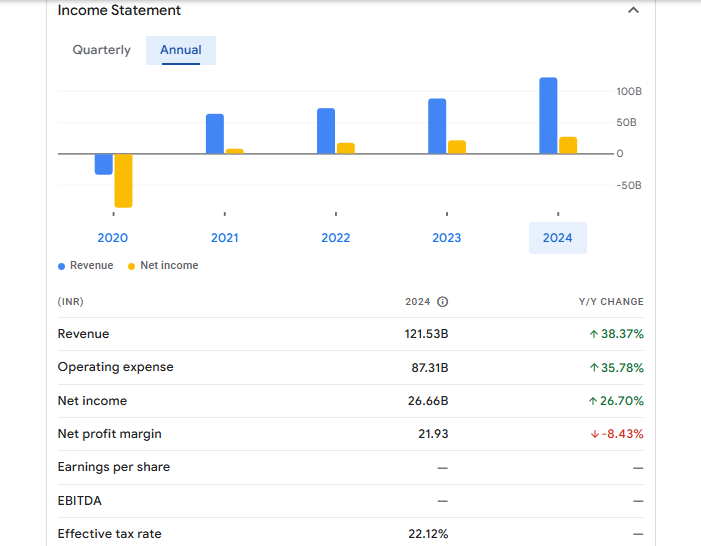

Financial Statement Of IOB

| (INR) | 2024 | Y/Y change |

| Revenue | 121.53B | 38.37% |

| Operating expense | 87.31B | 35.78% |

| Net income | 26.66B | 26.70% |

| Net profit margin | 21.93 | -8.43% |

| Earnings per share | — | — |

| EBITDA | — | — |

| Effective tax rate | 22.12% | — |

Read Also:- KEC International Share Price Target Tomorrow 2025, 2026 To 2030