If you’re looking to invest in a trusted name in India’s energy sector, HPCL (Hindustan Petroleum Corporation Limited) is a company worth exploring. Known for its strong presence in fuel and oil products, HPCL is also taking big steps toward clean and renewable energy. Investors often keep an eye on HPCL shares because of its long-term growth plans and steady performance. HPCL Share Price on 10 April 2025 is 379.30 INR. This article will provide more details on HPCL Share Price Target 2025, 2026 to 2030.

HPCL Company Info

- Founded: 1974

- Headquarters: Mumbai

- Number of employees: 8,154 (2024)

- Parent organization: Oil and Natural Gas Corporation

- Revenue: 4.64 lakh crores INR (US$58 billion, 2024)

- Subsidiaries: Aavantika Gas, South Asia Lpg Company Pvt. Ltd.

HPCL Share Price Chart

HPCL Share Price Details

- Today Open: 372.00

- Today High: 383.05

- Today Low: 365.15

- Mkt cap: 80.73KCr

- P/E ratio: 13.39

- Div yield: 5.54%

- 52-wk high: 457.15

- 52-wk low: 287.55

HPCL Shareholding Pattern

- Promoters: 54.90%

- Foreign Institutions: 14.44%

- Mutual Funds: 16.97%

- Retails and others: 8.84%

- Domestic Institutions: 4.85%

HPCL Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹460

- 2026 – ₹540

- 2027 – ₹620

- 2028 – ₹700

- 2029 – ₹780

- 2030 – ₹860

HPCL Share Price Target 2025

HPCL share price target 2025 Expected target could be ₹460. Hindustan Petroleum Corporation Limited (HPCL) is influenced by several key factors that could impact its share price target for the year:

-

Rajasthan Refinery Commissioning

HPCL plans to commence operations of its new 180,000 barrels per day refinery in Barmer, Rajasthan, by the end of December 2024. This facility is expected to reach full capacity within a year, potentially enhancing HPCL’s refining capabilities and revenue streams.

-

Lubricant Business Demerger

The company is considering the demerger and potential listing of its lubricant business. This strategic move could unlock shareholder value and attract focused investments, thereby influencing the share price positively.

-

Financial Performance and Analyst Projections

Analyst projections place HPCL’s median target price at ₹411.84 over the next 12 months, with estimates ranging from ₹200 to ₹565. These projections are based on anticipated financial performance and market conditions.

-

Dividend Yield

As of March 10, 2025, HPCL reported a dividend yield of 6.5%. A consistent and attractive dividend yield can enhance investor confidence and potentially support the share price.

-

Regulatory and Market Dynamics

Changes in government policies, such as adjustments in excise duties and fuel pricing regulations, can directly impact HPCL’s profitability. Additionally, fluctuations in crude oil prices and competition within the oil marketing sector are critical factors affecting the company’s financial health and share price.

HPCL Share Price Target 2030

HPCL share price target 2030 Expected target could be ₹860. Hindustan Petroleum Corporation Limited (HPCL) is strategically positioned for growth leading up to 2030. Several key factors are anticipated to influence its share price trajectory:

-

Substantial Capital Expenditure Plans

HPCL has outlined an ambitious investment strategy, planning to allocate approximately ₹90,000 crore by 2030. Notably, 30-35% of this budget is earmarked for clean energy initiatives, reflecting the company’s commitment to diversifying its portfolio and embracing sustainable energy sources.

-

Expansion into Renewable Energy

The company aims to develop a renewable energy portfolio of 10 GW by 2030 through its subsidiary, Hindustan Power Renewable Gas & Energy (HPRGE). This initiative includes establishing solar power plants and expanding electric vehicle (EV) charging infrastructure, positioning HPCL to capitalize on the global shift towards green energy.

-

Enhancement of Refining and Petrochemical Capacities

HPCL is investing in upgrading its refineries and expanding petrochemical manufacturing. Plans include projects for producing linear low-density polyethylene (LLDPE), high-density polyethylene (HDPE), and polypropylene (PP), aiming to meet the growing demand for petrochemical products and enhance profit margins.

-

Development of LNG Infrastructure

The commissioning of a 5 million metric ton per year LNG import terminal at Chhara, Gujarat, is slated for completion by the end of 2024. This facility is expected to diversify HPCL’s energy offerings and strengthen its position in the natural gas market, contributing to long-term revenue growth.

-

Adaptation to Evolving Energy Trends

HPCL is proactively addressing the global shift towards reduced dependence on fossil fuels by investing in alternative energy sources and sustainable practices. This strategic adaptation is crucial for maintaining market relevance and ensuring long-term growth amidst changing energy consumption patterns.

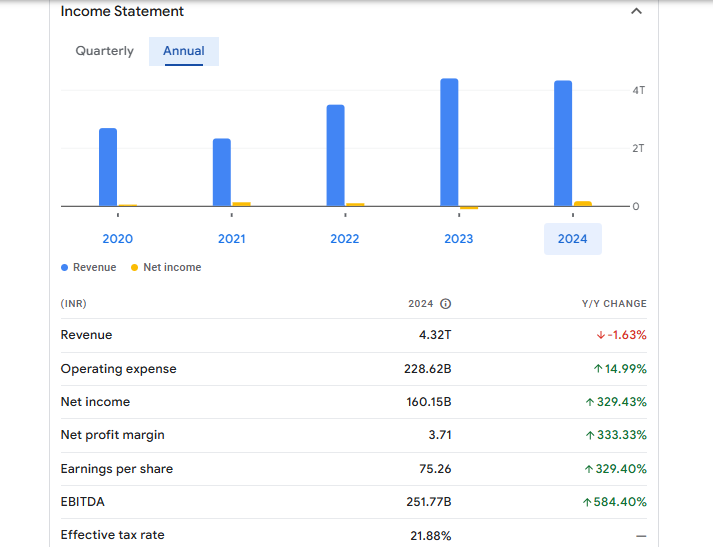

Financial Statement Of HPCL

| (INR) | 2024 | Y/Y change |

| Revenue | 4.32T | -1.63% |

| Operating expense | 228.62B | 14.99% |

| Net income | 160.15B | 329.43% |

| Net profit margin | 3.71 | 333.33% |

| Earnings per share | 75.26 | 329.40% |

| EBITDA | 251.77B | 584.40% |

| Effective tax rate | 21.88% | — |

Read Also:- IOB Share Price Target Tomorrow 2025, 2026 To 2030