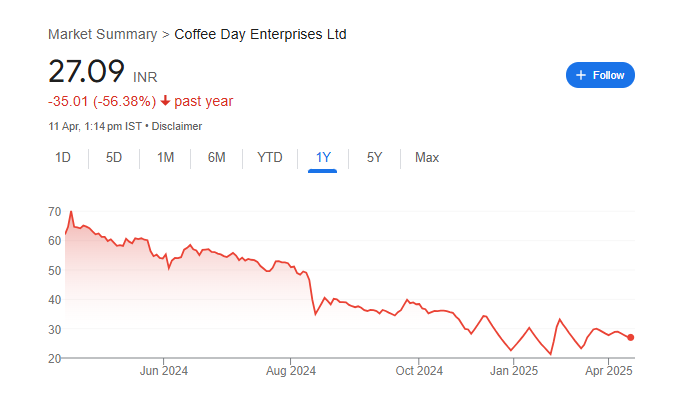

Coffee Day, known best for its Café Coffee Day outlets, has long been a familiar name among coffee lovers in India. Whether it’s a friendly catch-up or a peaceful solo moment, many people have found comfort in its cozy cafes and quality coffee. Over the years, Coffee Day Enterprises has seen its fair share of ups and downs, especially on the business and stock market front. Coffee Day Share Price on 11 April 2025 is 27.09 INR. This article will provide more details on Coffee Day Share Price Target 2025, 2026 to 2030.

Coffee Day Company Info

- Headquarters: India

- Number of employees: 144 (2024)

- Subsidiaries: Café Coffee Day, Tanglin Developments Limited, Coffee Day Trading Ltd, Coffee Day Hotels & Resorts Pvt.Ltd.

Coffee Day Share Price Chart

Coffee Day Share Price Details

- Today Open: 27.29

- Today High: 27.29

- Today Low: 27.09

- Mkt cap: 581.85Cr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 74.65

- 52-wk low: 21.28

Coffee Day Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹75

- 2026 – ₹100

- 2027 – ₹125

- 2028 – ₹150

- 2029 – ₹175

- 2030 – ₹200

Coffee Day Share Price Target 2025

Coffee Day share price target 2025 Expected target could be ₹75. Here are five key factors influencing CDEL’s share price target for 2025:

-

Debt Restructuring and Reduction

CDEL has made strides in addressing its debt burden, notably settling an outstanding debt of ₹205 crore in March 2025. This settlement, involving payments in tranches and asset sales, signals the company’s commitment to financial restructuring and has positively impacted investor sentiment.

-

Operational Challenges and Legal Proceedings

Despite debt reduction efforts, CDEL faces ongoing operational challenges, including insolvency proceedings initiated due to a ₹228 crore default. These legal issues contribute to market uncertainty and can affect the company’s share price trajectory.

-

Brand Strength and Market Presence

CDEL’s flagship brand, Café Coffee Day, remains a recognized name in India’s coffee retail sector. The brand’s strong market presence provides a foundation for potential recovery, assuming effective management and strategic initiatives are implemented.

-

Financial Performance Metrics

The company’s financial indicators reflect ongoing challenges, with a net loss of ₹354.49 crore and a high debt-to-equity ratio of 43.55. These metrics highlight the need for continued financial discipline and operational efficiency to improve investor confidence.

-

Analyst Projections and Market Sentiment

Analyst projections for CDEL’s share price in 2025 vary, with some estimates ranging from ₹45.51 to ₹53.06, suggesting cautious optimism. These projections are contingent on the company’s ability to execute its turnaround strategy effectively.

Coffee Day Share Price Target 2030

Coffee Day share price target 2030 Expected target could be ₹200. Here are several key factors are expected to influence CDEL’s growth trajectory:

-

Global Coffee Market Expansion

The global coffee market is projected to grow significantly, with estimates suggesting it could reach USD 323.72 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030. This overall market growth presents opportunities for CDEL to expand its market share and revenue streams.

-

Rising Demand for Specialty Coffee

Consumer preferences are increasingly shifting towards specialty and premium coffee products. The specialty coffee market is expected to grow at a CAGR of 10.4% from 2025 to 2030, reaching USD 183.0 billion by 2030. CDEL’s ability to cater to this demand through product innovation and quality enhancement could drive growth.

-

Expansion of Coffee Shop Culture

The global coffee shop market is anticipated to grow, with projections indicating it could reach USD 133.98 billion by 2030, at a CAGR of 6.83% from 2023 to 2030. Strengthening and expanding CDEL’s Café Coffee Day outlets, especially in emerging markets, could capitalize on this trend.

-

Adaptation to Consumer Convenience Trends

The increasing demand for convenience, such as ready-to-drink coffee and efficient delivery services, is reshaping the coffee industry. Embracing these trends through strategic partnerships and service diversification could enhance CDEL’s competitive edge.

-

Financial Restructuring and Operational Efficiency

Addressing existing financial challenges through effective debt management and improving operational efficiencies will be crucial. Demonstrating fiscal responsibility and profitability can bolster investor confidence and positively impact share price.

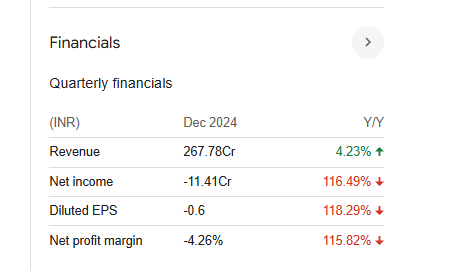

Financial Statement Of Coffee Day

| (INR) | 2024 | Y/Y change |

| Revenue | 10.23B | 10.52% |

| Operating expense | 5.39B | -43.41% |

| Net income | -3.23B | 15.09% |

| Net profit margin | -31.52 | 23.18% |

| Earnings per share | — | — |

| EBITDA | 1.33B | 146.28% |

| Effective tax rate | 16.67% | — |

Read Also:- Sona BLW Precision Forgings Share Price Target 2025, 2026 To 2030