If you’re curious about TARC and its share price future, you’re in the right place! TARC Limited is a growing real estate company known for its premium residential and commercial projects, especially in Delhi. Investors and market watchers often keep an eye on this stock because of its potential in the fast-moving real estate sector. Tarc Share Price on 11 April 2025 is 147.00 INR. This article will provide more details on Tarc Share Price Target 2025, 2026 to 2030.

Tarc Company Info

- Founded: 2016

- Headquarters: India

- Number of employees: 187 (2024)

- Subsidiaries: TARC Green Retreat Limited, Monarch Buildtech Pvt. Ltd., Travel Mate (India) Pvt. Ltd.

Tarc Share Price Chart

Tarc Share Price Details

- Today Open: 153.90

- Today High: 153.90

- Today Low: 145.55

- Mkt cap: 4.34KCr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 269.95

- 52-wk low: 103.22

Tarc Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹270

- 2026 – ₹290

- 2027 – ₹310

- 2028 – ₹330

- 2029 – ₹350

- 2030 – ₹370

Tarc Share Price Target 2025

Tarc share price target 2025 Expected target could be ₹270. Here are five key factors influencing TARC Ltd.’s share price target for 2025:

-

Record Sales and Project Pipeline

TARC Ltd. has reported record annual sales in FY25, driven by the launch of new projects like TARC Ishva and Phase II of TARC Kailasa in New Delhi. As of March 31, 2025, the total Gross Development Value (GDV) of projects under development has surpassed ₹7,700 crore, highlighting the company’s robust pipeline in the luxury real estate segment.

-

Analyst Price Targets

Analysts have set a share price target of ₹325.00 for TARC Ltd., suggesting a potential upside of approximately 125% from the current trading price. This optimistic outlook reflects confidence in the company’s growth prospects.

-

Market Capitalization and Trading Activity

With a market capitalization of ₹4,258.24 crore as of April 9, 2025, TARC Ltd. maintains a significant presence in the real estate sector. The stock’s trading activity and investor interest are influenced by its market position and performance.

-

Financial Metrics

TARC Ltd. is trading at 3.70 times its book value. However, the company has a low interest coverage ratio and a low return on equity of -7.08% over the last three years. These financial metrics indicate areas where the company may need to improve to enhance investor confidence.

-

Real Estate Market Trends

The overall performance of the real estate sector, especially in the luxury segment, can significantly impact TARC Ltd.’s growth. Demand for premium residential developments in limited supply markets, like New Delhi, supports the company’s strategic focus and potential for increased revenues.

Tarc Share Price Target 2030

Tarc share price target 2030 Expected target could be ₹370.

Here are several key factors are expected to influence TARC Ltd.’s growth trajectory:

-

Long-Term Share Price Forecast

According to WalletInvestor, TARC Ltd.’s share price is projected to reach ₹466.12 by April 2030, suggesting a potential upside of approximately 225% over five years.

-

Insider Ownership and Confidence

Insiders hold a significant stake in TARC Ltd., with two investors owning a majority of 65%. Recent insider purchases indicate strong confidence in the company’s future prospects.

-

Strategic Real Estate Development

TARC Ltd. focuses on luxury residential projects in New Delhi, a market with high demand and limited supply. This strategic positioning is expected to drive growth in the coming years.

-

Financial Performance and Metrics

While TARC Ltd. has shown growth, certain financial metrics such as a low interest coverage ratio and a return on equity of -7.08% over the last three years highlight areas for improvement.

-

Market Trends and Economic Factors

The overall performance of the real estate sector, especially in the luxury segment, can significantly impact TARC Ltd.’s growth. Demand for premium residential developments in limited supply markets, like New Delhi, supports the company’s strategic focus and potential for increased revenues.

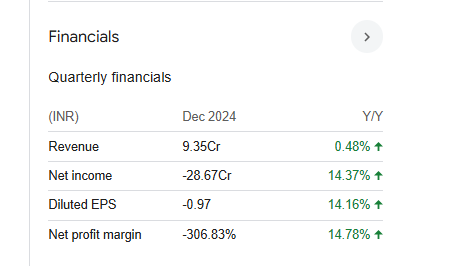

Financial Statement Of Tarc

| (INR) | 2024 | Y/Y change |

| Revenue | 1.12B | -69.57% |

| Operating expense | 1.06B | -35.42% |

| Net income | -770.46M | -478.80% |

| Net profit margin | -68.68 | -1,344.20% |

| Earnings per share | — | — |

| EBITDA | 536.64M | -66.41% |

| Effective tax rate | 10.43% | — |

Read Also:- Coffee Day Share Price Target 2025, 2026 To 2030