Indian Hotels Company Limited (IHCL), part of the Tata Group, is one of the most trusted and well-known names in the hospitality industry. From luxury stays to smart budget options, the company has something for every kind of traveler. Over the years, it has built a strong presence both in India and overseas. Indian Hotels Share Price on 12 April 2025 is 788.80 INR. This article will provide more details on Indian Hotels Share Price Target 2025, 2026 to 2030.

Indian Hotels Company Info

- CEO: Puneet Chhatwal (6 Nov 2017–)

- Founded: 1902

- Founder: Jamshedji Tata

- Headquarters: Mumbai

- Number of employees: 18,359 (2024)

- Parent organization: Tata Group

- Revenue: 6,951 crores INR (US$870 million, FY24).

Indian Hotels Share Price Chart

Indian Hotels Share Price Details

- Today Open: 793.75

- Today High: 799.95

- Today Low: 778.35

- Mkt cap: 1.12LCr

- P/E ratio: 62.27

- Div yield: 0.22%

- 52-wk high: 894.90

- 52-wk low: 506.45

Indian Hotels Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹900

- 2026 – ₹1000

- 2027 – ₹1100

- 2028 – ₹1200

- 2029 – ₹1300

- 2030 – ₹1400

Indian Hotels Share Price Target 2025

Indian Hotels share price target 2025 Expected target could be ₹900. Here are five key factors influencing Indian Hotels’ share price target for 2025:

-

Robust Industry Growth

The Indian hospitality sector is experiencing strong growth, driven by increased demand from MICE (Meetings, Incentives, Conferences, and Exhibitions), cultural festivals, and the wedding season. RevPAR (Revenue Per Available Room) is expected to rise 12-14%, with metro cities seeing surges in business and event-driven tourism. Government initiatives, infrastructure improvements, and rising foreign tourist arrivals further support long-term growth, positioning India as a competitive global tourism hub.

-

Strategic Expansion Plans

IHCL aims to double its portfolio to over 700 hotels by 2030, with its operational hotels increasing from 230 to 500 in the next five years. This expansion strategy focuses on both domestic growth in Tier 2 and 3 cities and international markets with a strong Indian diaspora.

-

Capital-Light Business Model

The company’s capital-light approach involves strategic leases and management contracts, minimizing financial risk while expanding its footprint. This model allows IHCL to grow its presence without significant capital expenditure, enhancing profitability.

-

Positive Analyst Outlook

Motilal Oswal has maintained a ‘Buy’ rating on Indian Hotels with a target price of ₹950, implying a 20% upside from the current trading price. This positive outlook reflects confidence in the company’s growth prospects and operational efficiency.

-

Favorable Market Dynamics

The Indian hospitality sector is anticipating strong growth in Q4FY25, driven by high demand from MICE activities, weddings, and cultural events. Major cities like Mumbai and Delhi NCR are expected to perform well, while spiritual tourism is significantly boosting revenue. Government initiatives and favorable economic factors are set to further enhance the industry’s prospects.

Indian Hotels Share Price Target 2030

Indian Hotels share price target 2030 Expected target could be ₹1400.

Here are several key factors are expected to influence IHCL’s growth trajectory:

-

Ambitious Expansion Plans

Under its ‘Accelerate 2030’ strategy, IHCL aims to double its hotel portfolio to over 700 properties and achieve consolidated revenue of ₹15,000 crore by 2030. This expansion includes both domestic growth in Tier 2 and 3 cities and international markets with a strong Indian diaspora.

-

Diversification into New Business Segments

IHCL is focusing on diversifying its revenue streams by expanding into new business segments. The company plans to generate 25% or more of its revenue from new and re-imagined businesses, such as food and beverage retail through Qmin and experiential stays via ama Stays & Trails.

-

Capital-Light Business Model

The company’s capital-light approach involves strategic leases and management contracts, minimizing financial risk while expanding its footprint. This model allows IHCL to grow its presence without significant capital expenditure, enhancing profitability.

-

Projected Increase in Management Fees

IHCL has set a target of ₹10 billion in management fees by 2030. However, projections indicate that the company may surpass this milestone earlier, reaching ₹11 billion by FY27 at a CAGR of 33% over the next three years.

-

Favorable Industry Dynamics

The Indian hospitality sector is experiencing strong growth, driven by increased demand from MICE (Meetings, Incentives, Conferences, and Exhibitions), cultural festivals, and the wedding season. Government initiatives, infrastructure improvements, and rising foreign tourist arrivals further support long-term growth, positioning India as a competitive global tourism hub.

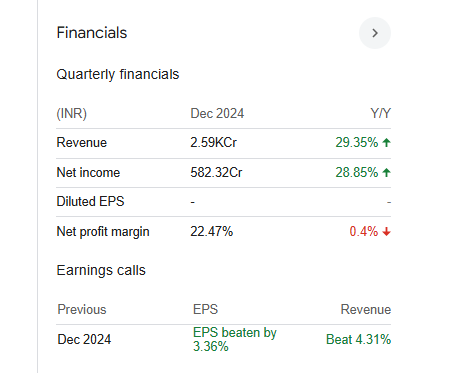

Financial Statement Of Indian Hotels

| (INR) | 2024 | Y/Y change |

| Revenue | 69.16B | 17.08% |

| Operating expense | 25.19B | 16.60% |

| Net income | 12.59B | 25.58% |

| Net profit margin | 18.21 | 7.31% |

| Earnings per share | 8.86 | 25.81% |

| EBITDA | 22.17B | 21.41% |

| Effective tax rate | 25.86% | — |

Read Also:- MMTC Share Price Target 2025, 2026 To 2030