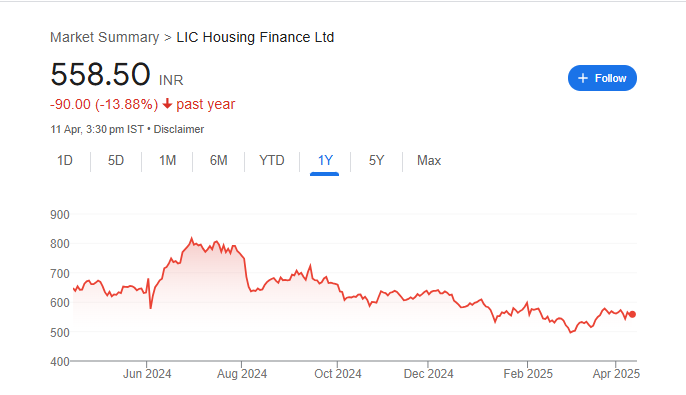

LIC Housing Finance Ltd. is one of India’s leading housing finance companies, established in 1989 and promoted by Life Insurance Corporation (LIC) of India. The company offers long-term loans to individuals for purchasing, constructing, or renovating homes, as well as providing finance to builders and developers. As of April 2025, LIC Housing Finance’s share price is approximately ₹559.65, with a market capitalization around ₹30,721 crore. LIC Housing Finance Share Price on 12 April 2025 is 558.50 INR. This article will provide more details on LIC Housing Finance Share Price Target 2025, 2026 to 2030.

LIC Housing Finance Company Info

- CEO: T Adhikari (3 Aug 2023–)

- Founded: 19 June 1989

- Headquarters: Mumbai

- Number of employees: 2,349 (2024)

- Revenue: 20,005 crores INR (US$2.5 billion, 2023)

- Subsidiaries: Lichfl Care Homes Limited, Lichfl Financial Services Ltd., LIC Housing Finance Ltd., Asset Management Arm.

LIC Housing Finance Share Price Chart

LIC Housing Finance Share Price Details

- Today Open: 568.90

- Today High: 571.10

- Today Low: 557.35

- Mkt cap: 30.72KCr

- P/E ratio: 5.96

- Div yield: 1.61%

- 52-wk high: 826.75

- 52-wk low: 483.70

LIC Housing Finance Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹830

- 2026 – ₹1000

- 2027 – ₹1200

- 2028 – ₹1400

- 2029 – ₹1600

- 2030 – ₹1800

LIC Housing Finance Share Price Target 2025

LIC Housing Finance share price target 2025 Expected target could be ₹830. Here are five key factors that could influence the growth of LIC Housing Finance Ltd.’s share price by 2025:

-

Strong Financial Performance

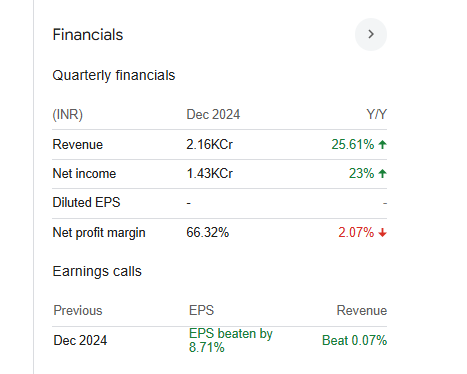

In Q3 FY25, LIC Housing Finance reported a 22.75% year-on-year increase in net consolidated profit, reaching ₹1,434.89 crore. This robust performance indicates the company’s resilience and potential for continued growth. -

Expansion into Affordable Housing

The company has launched specific products targeting the affordable housing segment, aiming for double-digit growth. This strategic move could open new revenue streams and enhance market presence. -

Analyst Recommendations and Price Targets

Analysts have set a 12-month price target of ₹690 for LIC Housing Finance, suggesting a potential upside from current levels. Such positive outlooks can boost investor confidence and drive share price appreciation. -

Improved Asset Quality

The company’s gross non-performing assets (NPAs) stood at 2.74%, with net NPAs at 1.46% as of December 31, 2024. Maintaining low NPA levels reflects effective risk management and financial stability. -

Cost of Funds and Interest Rate Environment

The cost of funds increased slightly to 7.78% in Q3 FY25 due to tighter liquidity and rising benchmark rates. Managing funding costs effectively will be crucial for sustaining margins and profitability.

LIC Housing Finance Share Price Target 2030

LIC Housing Finance share price target 2030 Expected target could be ₹1800. Here are five key factors that could influence the growth of LIC Housing Finance Ltd.’s share price by 2030:

-

Projected Share Price Appreciation

Analysts anticipate a significant increase in LIC Housing Finance’s share price, with projections suggesting a rise to approximately ₹922.50 by April 2025 and further growth to around ₹4,285.54 by 2030, reflecting a positive long-term outlook. -

Strategic Bond Issuances

The company plans to raise substantial funds through bond reissuances, aiming to enhance liquidity and support expansion initiatives. For instance, LIC Housing Finance is set to raise ₹20 billion through the reissue of 7.6450% bonds maturing in February 2030, which could strengthen its financial position and fund growth projects. -

Analyst Recommendations and Price Targets

Positive analyst sentiments can bolster investor confidence. Nomura, for example, adjusted LIC Housing Finance’s price target to ₹735 from ₹700, maintaining a ‘Buy’ rating, indicating optimism about the company’s future performance. -

Government Initiatives in Housing Sector

Government policies promoting affordable housing and infrastructure development can increase demand for housing finance. LIC Housing Finance, with its extensive reach and product offerings, is well-positioned to capitalize on such initiatives, potentially driving growth. -

Economic Factors and Interest Rate Trends

Macroeconomic conditions, including GDP growth, employment rates, and interest rate movements, significantly impact the housing finance sector. Favorable economic indicators and stable interest rates can lead to increased borrowing and loan disbursements, positively influencing LIC Housing Finance’s performance and share price.

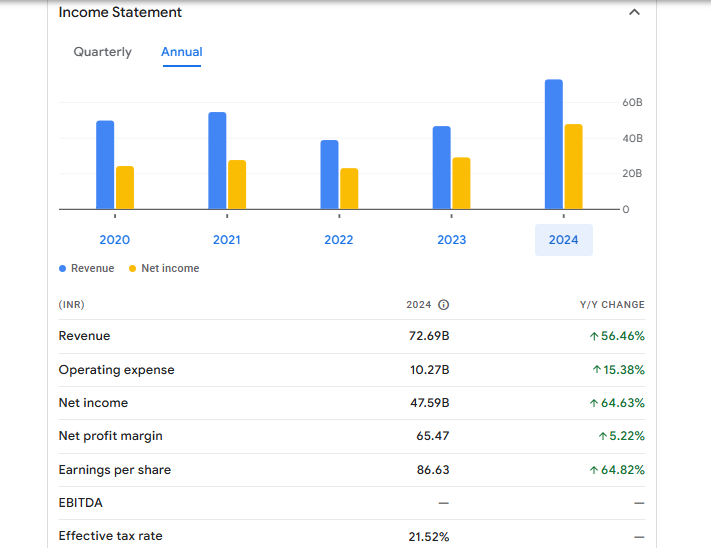

Financial Statement Of LIC Housing Finance

| (INR) | 2024 | Y/Y change |

| Revenue | 72.69B | 56.46% |

| Operating expense | 10.27B | 15.38% |

| Net income | 47.59B | 64.63% |

| Net profit margin | 65.47 | 5.22% |

| Earnings per share | 86.63 | 64.82% |

| EBITDA | — | — |

| Effective tax rate | 21.52% | — |

Read Also:- Taneja Aerospace Share Price Target 2025, 2026 To 2030