Abbott Laboratories is a trusted name in the healthcare and medical technology industry, known for its strong focus on innovation and improving lives. Whether it’s diagnostic tools, nutrition products, or advanced devices like the FreeStyle Libre for diabetes care, Abbott is always working to make healthcare more accessible and effective. Abbott Laboratories Share Price on 10 April 2025 is 127.04 USD. This article will provide more details on Abbott Laboratories Share Price Target 2025, 2026 to 2030.

Abbott Laboratories Company Info

- CEO: Robert B. Ford (31 Mar 2020–)

- Founded: 1888, Chicago, Illinois, United States

- Founder: Wallace Calvin Abbott

- Headquarters: Chicago, Illinois, United States

- Number of employees: 1,14,000 (2024)

- Revenue: 4,010 crores USD (2023)

- Subsidiaries: Alere Inc., Similac, CardioMEMS.

Abbott Laboratories Share Price Chart

Abbott Laboratories Share Price Details

- Today Open: 121.62

- Today High: 127.76

- Today Low: 120.85

- Mkt cap: 22.03KCr

- P/E ratio: 16.57

- Div yield: 1.86%

- 52-wk high: 141.23

- 52-wk low: 99.71

Abbott Laboratories Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – $145

- 2026 – $160

- 2027 – $175

- 2028 – $180

- 2029 – $195

- 2030 – $200

Abbott Laboratories Share Price Target 2025

Abbott Laboratories share price target 2025 Expected target could be $145. Several key factors are poised to influence Abbott’s share price target for 2025:

-

Robust Financial Performance

In 2024, Abbott reported sales of $42.0 billion, marking a 4.6% increase from the previous year. Net income rose significantly to $13.4 billion, up 134% year-over-year, resulting in a profit margin of 32%, an improvement from 14% in 2023.

-

Strong Medical Devices Segment

The medical devices unit, particularly the diabetes care division, has been a significant growth driver. Sales of continuous glucose monitors, including the FreeStyle Libre system, grew nearly 21% from the previous year, contributing to the company’s optimistic outlook.

-

Innovative Product Pipeline

Abbott’s focus on innovation has led to the development of new products, such as the recently approved TriClip device for tricuspid valve repair, which is projected to be a billion-dollar opportunity.

-

Positive Analyst Outlook

Analysts have given Abbott a “Buy” rating, reflecting confidence in the company’s growth prospects and financial health.

-

Raised Earnings Guidance

Abbott has increased its full-year adjusted earnings per share forecast to a range of $4.64 to $4.70, up from the previous midpoint of $4.66, indicating strong expected performance.

Abbott Laboratories Share Price Target 2030

Abbott Laboratories share price target 2030 Expected target could be $200. Several key factors are poised to influence Abbott’s share price target for 2030:

-

Sustainability Initiatives

Abbott’s 2030 Sustainability Plan focuses on designing life-changing technologies for broader access and affordability, aiming to transform care for chronic diseases, malnutrition, and infectious diseases.

-

Product Innovation and Market Expansion

The company is expanding its continuous glucose monitor (CGM) offerings, such as the FreeStyle Libre system, targeting both diabetic and non-diabetic markets. This expansion is expected to drive significant revenue growth by 2030.

-

Financial Projections and Analyst Forecasts

Analyst projections for Abbott’s stock price in 2030 vary, with estimates ranging from $138.64 to $201.33, indicating potential growth and investor optimism.

-

Market Position and Competitive Landscape

Abbott’s ability to maintain and enhance its market position amidst competition, particularly in the CGM sector, will influence its growth trajectory. The company’s focus on innovation and accessibility is key to attracting and retaining customers.

-

Macroeconomic and Regulatory Factors

Economic conditions, healthcare policies, and regulatory changes will impact Abbott’s operations and profitability. Adapting to these factors is crucial for sustained growth and achieving share price targets by 2030.

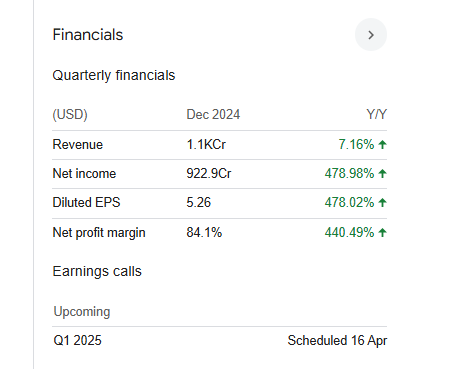

Financial Statement Of Abbott Laboratories

| (INR) | 2024 | Y/Y change |

| Revenue | 41.95B | 4.59% |

| Operating expense | 15.81B | 5.61% |

| Net income | 13.40B | 134.18% |

| Net profit margin | 31.95 | 123.90% |

| Earnings per share | 4.67 | 5.18% |

| EBITDA | 10.71B | 2.40% |

| Effective tax rate | -91.10% | — |

Read Also:- HPCL Share Price Target Tomorrow 2025, 2026 To 2030