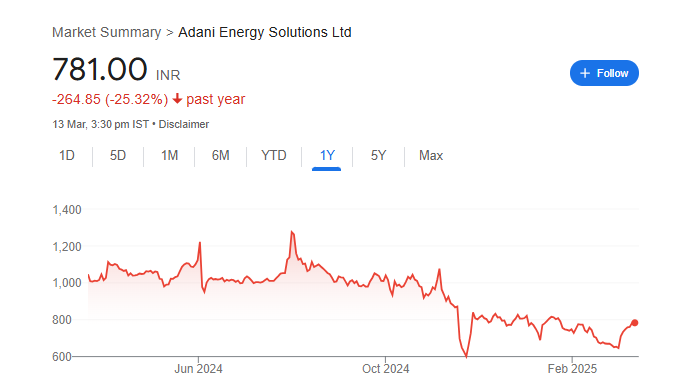

Adani Energy Solution is a well-known player in the power and energy sector, focusing on clean and sustainable energy solutions. Investors are keen to know its future potential, as the company continues to expand its projects and adopt new technologies. With strong government support and increasing demand for renewable energy, Adani Energy Solution’s share price target looks promising. Adani Energy Solution Share Price on 15 March 2025 is 781.00 INR. This article will provide more details on Adani Energy Solution Share Price Target 2025, 2026 to 2030.

Adani Energy Solution Company Info

- Founded: 9 December 2013

- Founder: Gautam Adani

- Headquarters: Ahmedabad

- Number of employees: 4,959 (2024)

- Parent organizations: Adani Group, S.B. Adani Family Trust

- Revenue: 17,218 crores INR (US$2.2 billion, 2024)

- Subsidiaries: Adani Electricity Mumbai Limited

Adani Energy Solution Share Price Chart

Adani Energy Solution Share Price Details

- Today Open: 783.80

- Today High: 795.95

- Today Low: 776.85

- Mkt cap: 94.08KCr

- P/E ratio: 110.26

- Div yield: N/A

- 52-wk high: 1,348.00

- 52-wk low: 588.00

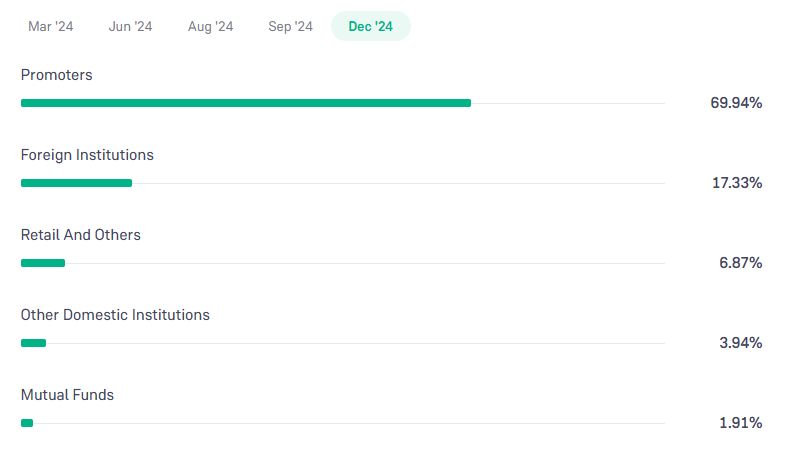

Adani Energy Solution Shareholding Pattern

- Promoters: 69.94%

- Foreign Institutions: 17.33%

- Mutual Funds: 1.91%

- Retails and others: 6.87%

- Domestic Institutions: 3.94%

Adani Energy Solution Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹1350

- 2026 – ₹1700

- 2027 – ₹2050

- 2028 – ₹2350

- 2029 – ₹2650

- 2030 – ₹2950

Adani Energy Solution Share Price Target 2025

Adani Energy Solution share price target 2025 Expected target could be ₹1350. Here are 5 Key Factors Affecting Growth for Adani Energy Solution Share Price Target 2025:

-

Expansion in Renewable Energy – Adani Energy Solution’s increasing investment in renewable energy projects, including solar and wind power, can drive growth and enhance investor confidence.

-

Government Policies & Regulations – Supportive government policies for clean energy, infrastructure development, and power distribution reforms can positively impact the company’s growth.

-

Rising Energy Demand – With India’s growing population and industrial expansion, the demand for electricity is expected to rise, benefiting Adani Energy Solution’s revenue and share price.

-

Technological Advancements – Adoption of smart grids, energy storage solutions, and modernized power transmission can improve operational efficiency and profitability.

-

Financial Performance & Debt Management – Strong revenue growth, controlled debt levels, and efficient project execution will play a crucial role in determining investor sentiment and stock price movement.

Adani Energy Solution Share Price Target 2030

Adani Energy Solution share price target 2030 Expected target could be ₹2950. Here are 5 Key Factors Affecting Growth for Adani Energy Solution Share Price Target 2030:

-

Expansion in Green Energy Projects – Adani Energy Solution’s long-term strategy to increase its renewable energy capacity will be a key driver of growth, aligning with global sustainability goals.

-

Government & Regulatory Support – Favorable policies, subsidies, and initiatives promoting clean energy and power infrastructure can positively impact the company’s future performance.

-

Technological Innovations – Adoption of advanced energy storage solutions, AI-driven power management, and smart grids will enhance operational efficiency and profitability.

-

Global Energy Demand & Market Expansion – Expansion into international markets and rising energy consumption in India will provide significant growth opportunities.

-

Financial Strength & Debt Management – Sustainable financial growth, efficient debt reduction, and stable cash flow will be crucial for maintaining investor confidence and driving share price growth.

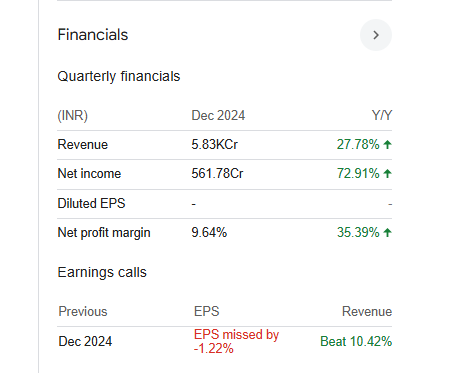

Financials Statement Of Adani Energy Solution

| (INR) | 2024 | Y/Y change |

| Revenue | 166.07B | 24.94% |

| Operating expense | 50.48B | 37.94% |

| Net income | 11.37B | -9.48% |

| Net profit margin | 6.85 | -27.51% |

| Earnings per share | 10.20 | -8.11% |

| EBITDA | 61.02B | 30.64% |

| Effective tax rate | 32.81% | — |

Read Also:- Capital Infra Trust Share Price Target Tomorrow 2025, 2026 To 2030