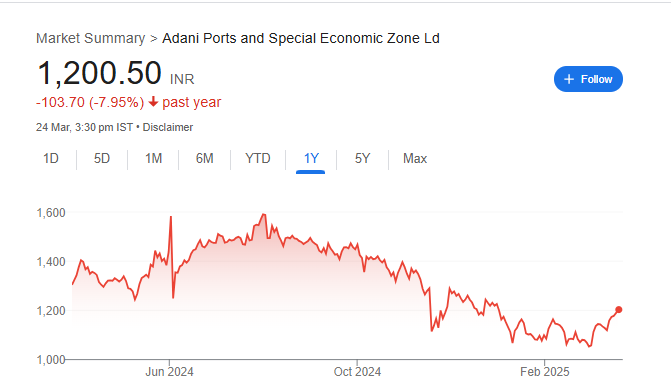

Adani Ports is one of India’s leading port operators, known for its strong infrastructure and global presence. Investors are keen to know its future growth potential and share price trends. With its continuous expansion, innovative strategies, and strong financial performance, Adani Ports remains a promising choice for long-term investment. Adani Port Share Price on 24 March 2025 is 1,200.50 INR. This article will provide more details on Adani Port Share Price Target 2025, 2026 to 2030.

Adani Port Company Info

- Founded: 26 May 1998

- Founder: Gautam Adani

- Headquarters: India

- Number of employees: 3,129 (2024)

- Parent organization: Adani Group

- Subsidiaries: Marine Infrastructure Developer Private Limited

Adani Port Share Price Chart

Adani Port Share Price Details

- Today Open: 1,196.00

- Today High: 1,210.85

- Today Low: 1,186.05

- Mkt cap: 2.59LCr

- P/E ratio: 25.63

- Div yield: 0.50%

- 52-wk high: 1,621.40

- 52-wk low: 995.65

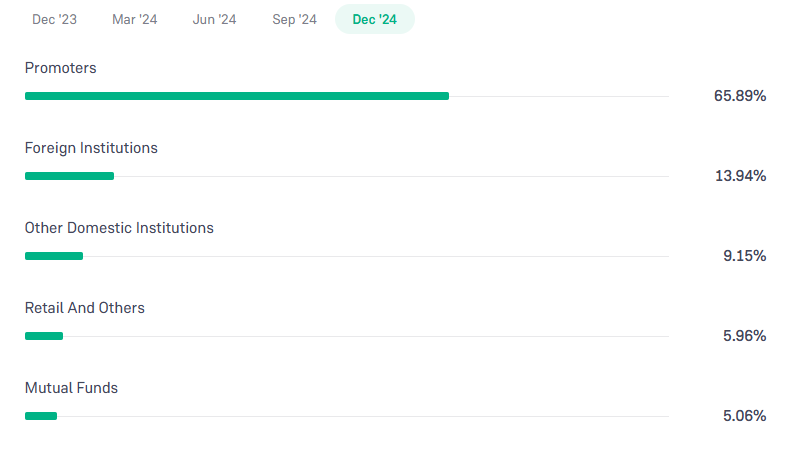

Adani Port Shareholding Pattern

- Promoters: 65.89%

- Foreign Institutions: 13.94%

- Mutual Funds: 5.06%

- Retails and others: 5.96%

- Domestic Institutions: 9.15%

Adani Port Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹1625

- 2026 – ₹1840

- 2027 – ₹2075

- 2028 – ₹2254

- 2029 – ₹2483

- 2030 – ₹2663

Adani Port Share Price Target 2025

Adani Port share price target 2025 Expected target could be ₹1625. Here are five key factors affecting the growth of Adani Ports Share Price Target 2025:

-

Expansion of Port Infrastructure – Adani Ports is continuously expanding its port facilities and logistics network, which can drive revenue growth and enhance its market share.

-

Rising Trade Volume – An increase in imports and exports, supported by India’s growing economy, boosts cargo handling at Adani Ports, positively impacting its stock performance.

-

Strategic Acquisitions – The company’s acquisition of new ports and terminals strengthens its position as a market leader, contributing to long-term growth.

-

Government Policies & Initiatives – Supportive government initiatives for infrastructure and port development, such as Sagarmala and logistics reforms, provide growth opportunities.

-

Global Economic Conditions – International trade, currency exchange rates, and global shipping trends can influence Adani Ports’ revenue and share price movements.

Adani Port Share Price Target 2030

Adani Port share price target 2030 Expected target could be ₹2663. Here are five key factors affecting the growth of Adani Ports Share Price Target 2030:

-

Expansion into Global Markets – Adani Ports’ increasing presence in international shipping and logistics can boost long-term revenue and enhance its global competitiveness.

-

Diversification into Logistics & Warehousing – Investments in multimodal logistics parks, inland waterways, and warehousing can create additional revenue streams and improve operational efficiency.

-

Sustainability & Green Initiatives – Adoption of eco-friendly port operations, renewable energy usage, and carbon reduction policies can attract ESG-focused investors and drive sustainable growth.

-

Technological Advancements – Integration of automation, artificial intelligence, and smart port technologies can improve efficiency, reduce costs, and enhance cargo handling capacity.

-

Geopolitical & Trade Policies – Changes in global trade regulations, international relations, and foreign investments will play a crucial role in the company’s long-term expansion and profitability.

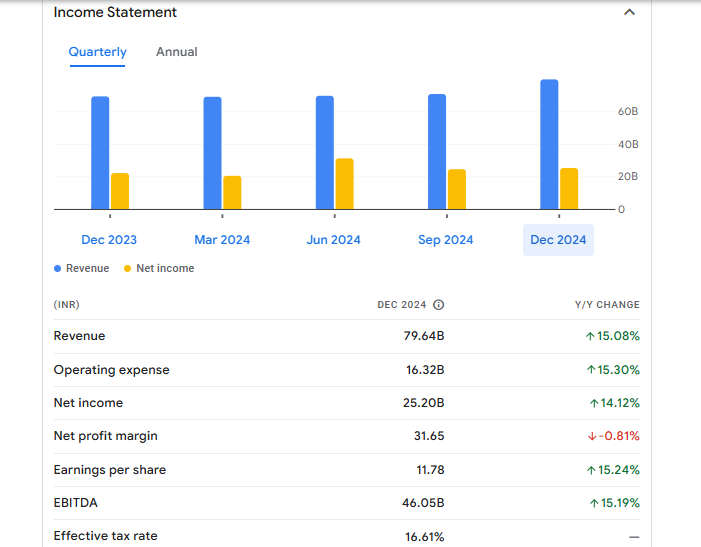

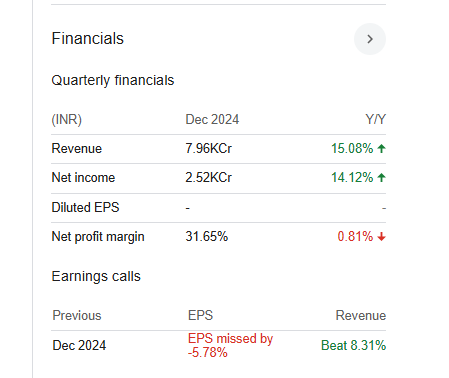

Financials Statement Of Adani Port

| (INR) | 2024 | Y/Y change |

| Revenue | 79.64B | 15.08% |

| Operating expense | 16.32B | 15.30% |

| Net income | 25.20B | 14.12% |

| Net profit margin | 31.65 | -0.81% |

| Earnings per share | 11.78 | 15.24% |

| EBITDA | 46.05B | 15.19% |

| Effective tax rate | 16.61% | — |

Read Also:- Adani Green Share Price Target Tomorrow 2025, 2026 To 2030