Angel One is one of India’s top stockbroking firms, known for its strong digital presence and customer-friendly services. With the growing interest in stock markets and online trading, the company has seen rapid expansion. Investors are keen to track Angel One’s share price target as it continues to innovate and attract new customers. Angel One Share Price on 5 March 2025 is 2,111.00 INR. This article will provide more details on Angel One Share Price Target 2025, 2026 to 2030.

Angel One Company Info

- Founded: 8 August 1996

- Headquarters: India

- Number of employees: 3,650 (2024)

- Revenue: 742.78 crores INR (US$93 million, 2019–2020)

- Subsidiaries: Angel One Asset Management Company Limited

Angel One Share Price Chart

Angel One Share Price Details

- Today Open: 2,014.00

- Today High: 2,128.20

- Today Low: 1,995.50

- Mkt cap: 18.99KCr

- P/E ratio: 14.21

- Div yield: 1.04%

- 52-wk high: 3,503.15

- 52-wk low: 1,944.00

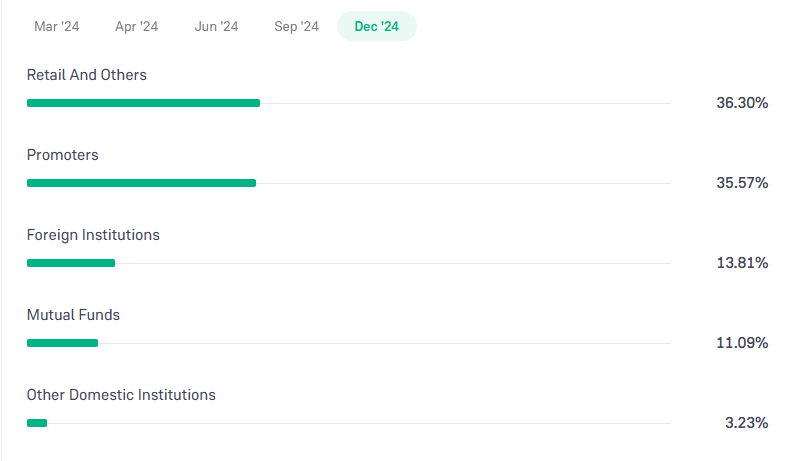

Angel One Shareholding Pattern

- Promoters: 35.57%

- Foreign Institutions: 13.81%

- Mutual Funds: 11.09%

- Retails and others: 36.30%

- Domestic Institutions: 3.23%

Angel One Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹3,505

- 2026 – ₹4,030

- 2027 – ₹4.560

- 2028 – ₹5,145

- 2029 – ₹5,783

- 2030 – ₹6,267

Angel One Share Price Target 2025

Angel One share price target 2025 Expected target could be ₹3,505. Angel One, a leading stockbroking and financial services company, has shown impressive growth in recent years. Several key factors could influence its share price target by 2025:

1. Growing Retail Participation in Stock Market

With more individuals investing in stocks, mutual funds, and derivatives, Angel One benefits from a rising client base. Increased trading volumes can drive revenue growth and positively impact share prices.

2. Strong Digital and Tech-Driven Platform

Angel One has a strong focus on digital trading solutions, AI-driven analytics, and a user-friendly mobile app. Continuous tech upgrades and innovation can attract more customers and enhance profitability.

3. Expanding Customer Base and Market Share

The company’s ability to acquire and retain clients through competitive brokerage fees and personalized services can contribute to long-term growth, improving its valuation in the stock market.

4. Regulatory Environment and SEBI Policies

Favorable regulatory changes and compliance with SEBI guidelines can enhance investor trust in the company. However, strict regulations or unexpected policy shifts could impact operations.

5. Growth in Investment and Wealth Management Services

Angel One is expanding beyond stockbroking into financial advisory, wealth management, and investment services. Diversification of offerings can provide additional revenue streams and support sustainable growth.

Angel One Share Price Target 2030

Angel One share price target 2030 Expected target could be ₹6,26. While Angel One has strong growth potential, several risks and challenges could impact its share price by 2030. Here are five key concerns:

1. Increasing Competition in the Brokerage Industry

The rise of discount brokers and fintech platforms offering zero brokerage and advanced trading features can challenge Angel One’s market position. Staying competitive will require continuous innovation.

2. Regulatory and Compliance Risks

Changes in SEBI regulations, taxation policies, and compliance requirements can impact brokerage firms. Any unfavorable policy shift could restrict business operations and affect profitability.

3. Market Volatility and Economic Downturns

Stock markets are influenced by global and domestic economic conditions. A prolonged downturn or market crash could reduce trading activity, impacting Angel One’s revenue from brokerage and investment services.

4. Dependence on Technology and Cybersecurity Risks

As a tech-driven company, Angel One relies heavily on digital platforms. Cyber threats, technical failures, or data breaches could disrupt services and affect customer trust and business growth.

5. Changing Investor Behavior and Preferences

With evolving investment trends, investors may shift to alternative asset classes like cryptocurrencies, real estate, or international markets. This could reduce trading volumes and impact Angel One’s long-term revenue.

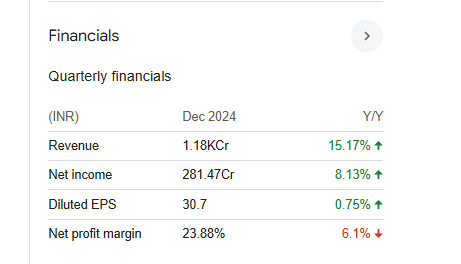

Financials Statement Of Angel One

| (INR) | 2024 | Y/Y change |

| Revenue | 41.67B | 41.79% |

| Operating expense | 18.45B | 65.26% |

| Net income | 11.26B | 26.47% |

| Net profit margin | 27.01 | -10.80% |

| Earnings per share | 131.82 | 25.40% |

| EBITDA | — | — |

| Effective tax rate | 25.64% | — |

Read Also:- Salasar Techno Share Price Target Tomorrow 2025, 2026 To 2030