Bajaj Auto is one of the most trusted and well-known names in the Indian automobile industry. From two-wheelers to three-wheelers, the company has built a strong brand with innovation, performance, and value for money. Whether you’re an investor, a market follower, or someone just exploring stocks, Bajaj Auto’s steady growth and future plans make it an interesting company to watch. Bajaj Auto Share Price on 8 April 2025 is 7,519.95 INR. This article will provide more details on Bajaj Auto Share Price Target 2025, 2026 to 2030.

Bajaj Auto Company Info

- CEO: Rajiv Bajaj (1 Apr 2005–)

- Founded: 29 November 1945

- Headquarters: Pune

- Number of employees: 6,192 (2024)

- Parent organization: Bajaj Group

- Revenue: 46,306 crores INR (US$5.8 billion, 2024)

- Subsidiaries: Chetak Technology Limited.

Bajaj Auto Share Price Chart

Bajaj Auto Share Price Details

- Today Open: 7,384.50

- Today High: 7,529.85

- Today Low: 7,345.75

- Mkt cap: 2.09LCr

- P/E ratio: 27.95

- Div yield: 1.06%

- 52-wk high: 12,774.00

- 52-wk low: 7,089.35

Bajaj Auto Shareholding Pattern

- Promoters: 55.04%

- Foreign Institutions: 12.45%

- Mutual Funds: 6.19%

- Retails and others: 22.45%

- Domestic Institutions: 3.87%

Bajaj Auto Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹12,780

- 2026 – ₹13,357

- 2027 – ₹13,830

- 2028 – ₹14,520

- 2029 – ₹15150

- 2030 – ₹15,780

Bajaj Auto Share Price Target 2025

Bajaj Auto share price target 2025 Expected target could be ₹12,780. As of April 2025, Bajaj Auto Ltd. is a leading player in India’s two-wheeler and three-wheeler automotive sectors. Several key factors are influencing the company’s growth and share price target for 2025:

-

Analyst Recommendations and Target Prices

Financial analysts have maintained a ‘Buy’ rating for Bajaj Auto, with target prices indicating potential upsides. For instance, Nuvama has set a target price of ₹10,700, suggesting a 27% increase from the last traded price of ₹8,392.

-

Export Performance and Market Expansion

Bajaj Auto’s export segment has shown resilience, with a 21% year-over-year growth in the export two-wheeler segment, driven by recovery in African market demand and sustained momentum in Latin America. This international performance helps offset domestic market fluctuations.

-

Product Portfolio Diversification

The company’s focus on expanding its product range, including electric vehicles (EVs) and premium motorcycles, positions it to capture emerging market segments and cater to evolving consumer preferences.

-

Financial Performance and Profitability

In the third quarter of FY2025, Bajaj Auto reported a 3% year-over-year increase in profit after tax (PAT), reaching ₹17.2 billion. This growth reflects the company’s ability to maintain profitability amidst market challenges.

-

Industry Trends and Domestic Demand

The two-wheeler industry in India is projected to grow by 6-8% in FY2025, with increasing signs of recovery in export markets. Bajaj Auto’s performance is influenced by these industry trends and the overall demand in the domestic market.

Bajaj Auto Share Price Target 2030

Bajaj Auto share price target 2030 Expected target could be ₹15,780. As of April 2025, Bajaj Auto Ltd. stands as a significant entity in India’s automotive industry. Several key factors are projected to influence the company’s share price trajectory leading up to 2030:

-

Electric Vehicle (EV) Adoption and Product Innovation

Bajaj Auto’s proactive approach in electrifying its vehicle lineup positions it favorably in the evolving EV market. With India’s EV adoption rate reaching 7.8% in FY2025 and a government target of 30% by 2030, the company’s innovations in electric two and three-wheelers are critical for capturing market share and driving growth.

-

Expansion in Global Markets

The company’s focus on expanding its presence in international markets, particularly in Latin America and Southeast Asia, is expected to bolster revenue streams. Bajaj Auto forecasts a 20% growth in exports in the coming months, reflecting its strategic efforts to strengthen its global footprint.

-

Growth in Three-Wheeler Segment

The global three-wheeler market is projected to grow significantly, with an expected compound annual growth rate (CAGR) of 10.4%, reaching $29.12 billion by 2030. Bajaj Auto’s strong position in this segment could contribute positively to its overall growth.

-

Financial Performance and Investor Confidence

Analysts have maintained a positive outlook on Bajaj Auto, with some setting target prices that suggest potential upsides. For instance, Nuvama has set a target price of ₹10,700, indicating a 27% increase from the last traded price of ₹8,392. Such projections can enhance investor confidence and influence share price performance.

-

Adaptation to Industry Trends and Consumer Preferences

Bajaj Auto’s emphasis on cleaner fuels and advanced technologies aligns with the global shift towards sustainable transportation. By adapting to these industry trends and evolving consumer preferences, the company is well-positioned to maintain its competitive edge and drive future growth.

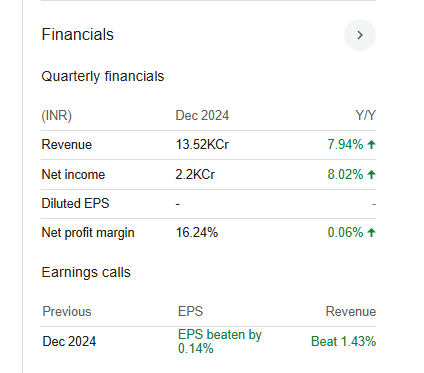

Financial Statement Of Bajaj Auto

| (INR) | 2024 | Y/Y change |

| Revenue | 461.62B | 23.68% |

| Operating expense | 43.03B | 10.44% |

| Net income | 77.08B | 27.19% |

| Net profit margin | 16.70 | 2.83% |

| Earnings per share | 272.70 | 38.22% |

| EBITDA | 101.85B | 36.87% |

| Effective tax rate | 23.23% | — |

Read Also:- Radico Khaitan Share Price Target Tomorrow 2025, 2026 To 2030