Cochin Shipyard is a well-established name in the shipbuilding and repair industry, known for its strong order book and expertise in both commercial and defense projects. Investors closely watch its share price as the company continues to expand its operations and secure new contracts. Cochin Shipyard Share Price on 6 March 2025 is 1,284.00 INR. This article will provide more details on Cochin Shipyard Share Price Target 2025, 2026 to 2030.

Cochin Shipyard Company Info

- Founded: 29 April 1972

- Headquarters: India

- Number of employees: 2,133 (2024)

- Revenue: 2,536.94 crores INR (US$320 million, 2023)

- Subsidiaries: Hooghly Cochin Shipyard Limited, Tebma Shipyard Limited

Cochin Shipyard Share Price Chart

Cochin Shipyard Share Price Details

- Today Open: 1,270.00

- Today High: 1,301.75

- Today Low: 1,260.00

- Mkt cap: 33.88KCr

- P/E ratio: 42.29

- Div yield: 0.76%

- 52-wk high: 2,979.45

- 52-wk low: 713.35

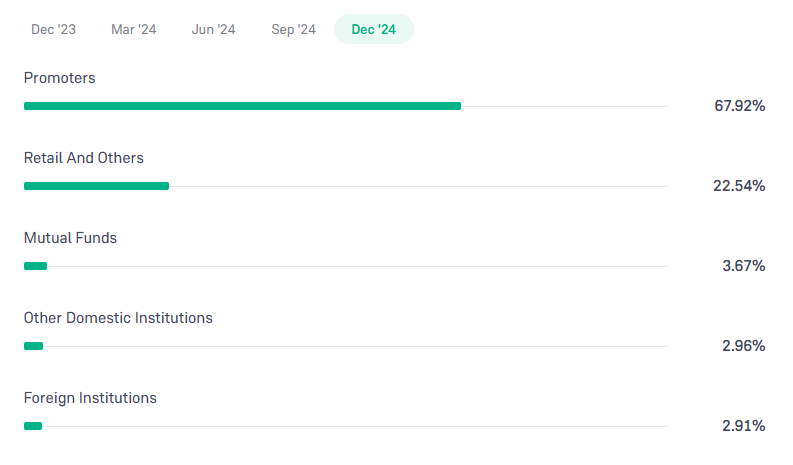

Cochin Shipyard Shareholding Pattern

- Promoters: 67.92%

- Foreign Institutions: 2.91%

- Mutual Funds: 3.67%

- Retails and others: 22.54%

- Domestic Institutions: 2.96%

Cochin Shipyard Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹2980

- 2026 – ₹3400

- 2027 – ₹3800

- 2028 – ₹4200

- 2029 – ₹4600

- 2030 – ₹5000

Cochin Shipyard Share Price Target 2025

Cochin Shipyard share price target 2025 Expected target could be ₹2980. Here are 5 Key Factors Affecting Growth for Cochin Shipyard Share Price Target 2025:

-

Strong Order Book – Cochin Shipyard consistently secures contracts for shipbuilding and repairs from both domestic and international clients. A healthy order book ensures steady revenue and profitability, boosting investor confidence.

-

Government Defense Projects – The company plays a crucial role in India’s defense sector, building warships and submarines. Increased defense spending by the government can significantly impact its growth and share price.

-

Expansion Plans – Cochin Shipyard is investing in infrastructure and technology upgrades to enhance its capacity and efficiency. Expansion into new projects, such as green energy-powered ships, can drive future growth.

-

Global Demand for Shipbuilding – The worldwide shipping industry is growing, and an increase in demand for commercial and defense vessels presents opportunities for Cochin Shipyard to secure more international contracts.

-

Policy Support & Government Backing – As a key player in India’s maritime sector, Cochin Shipyard benefits from favorable policies and government incentives. Supportive regulations and financial aid can contribute to its long-term success.

Cochin Shipyard Share Price Target 2030

Cochin Shipyard share price target 2030 Expected target could be ₹5000. Here are 5 Risks and Challenges for Cochin Shipyard Share Price Target 2030:

-

Market Competition – The shipbuilding industry is highly competitive, with strong players from China, South Korea, and Europe. Increased global competition can impact Cochin Shipyard’s ability to secure new contracts and maintain profitability.

-

Fluctuations in Raw Material Costs – The prices of steel, fuel, and other essential materials for shipbuilding can vary significantly. Rising costs without proportional contract price adjustments could affect profit margins.

-

Dependence on Government Orders – A significant portion of Cochin Shipyard’s revenue comes from government defense and commercial contracts. Any slowdown in government spending or policy changes can impact future order flow.

-

Economic and Geopolitical Risks – Global economic slowdowns, trade restrictions, or geopolitical tensions can affect the shipping and defense sectors, leading to potential delays or cancellations of projects.

-

Regulatory and Environmental Challenges – Stricter environmental regulations on shipbuilding and maritime emissions may require heavy investments in cleaner technologies. Compliance costs could impact profitability if not managed efficiently.

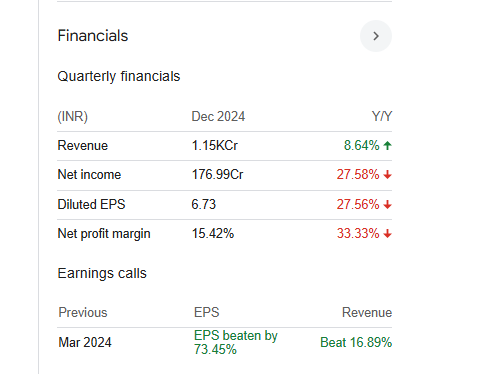

Financials Statement Of Cochin Shipyard

| (INR) | 2024 | Y/Y change |

| Revenue | 38.31B | 61.99% |

| Operating expense | 6.79B | 34.48% |

| Net income | 7.83B | 157.06% |

| Net profit margin | 20.45 | 58.65% |

| Earnings per share | 30.91 | 113.65% |

| EBITDA | 8.99B | 164.88% |

| Effective tax rate | 26.86% | — |

Read Also:- Sun Pharma Share Price Target Tomorrow 2025, 2026 To 2030