Crisil is a well-known credit rating agency and financial research company that plays a crucial role in India’s financial sector. Investors closely follow its share price as it reflects the company’s growth, market trends, and financial stability. Crisil Share Price on 25 March 2025 is 4,160.00 INR. This article will provide more details on Crisil Share Price Target 2025, 2026 to 2030.

Crisil Company Info

- CEO: Amish Mehta (1 Oct 2021–)

- Headquarters: Mumbai

- Number of employees: 4,673 (2024)

- Parent organizations: S&P Global, Standard & Poor’s International, LLC

- Revenue: 2,076.3 crores INR (December 2020, US$260 million)

- Subsidiaries: CRISIL Ratings Limited

Crisil Share Price Chart

Crisil Share Price Details

- Today Open: 4,225.00

- Today High: 4,225.00

- Today Low: 4,131.20

- Mkt cap: 30.42KCr

- P/E ratio: 44.47

- Div yield: 1.35%

- 52-wk high: 6,950.00

- 52-wk low: 3,880.00

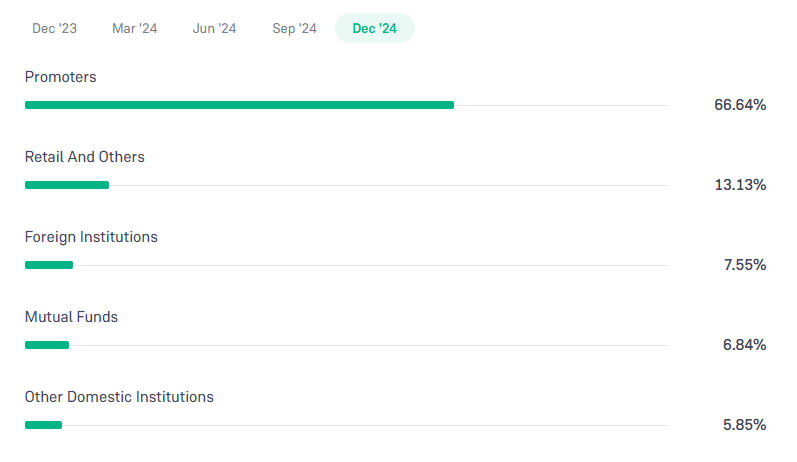

Crisil Shareholding Pattern

- Promoters: 66.64%

- Foreign Institutions: 7.55%

- Mutual Funds: 6.84%

- Retails and others: 13.13%

- Domestic Institutions: 5.85%

Crisil Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹6950

- 2026 – ₹7600

- 2027 – ₹8250

- 2028 – ₹8900

- 2029 – ₹9750

- 2030 – ₹10,300

Crisil Share Price Target 2025

Crisil share price target 2025 Expected target could be ₹6950. Here are 5 Key Factors Affecting Growth for Crisil Share Price Target 2025:

-

Economic Growth & Credit Market Expansion – As India’s economy expands, demand for credit ratings and financial analysis increases, boosting Crisil’s business.

-

Regulatory Changes – Government policies and SEBI regulations affecting credit rating agencies can influence Crisil’s revenue and market share.

-

Global Market Demand – Crisil’s international presence and partnerships with S&P Global can drive revenue growth through global rating and research services.

-

Technological Advancements – Investment in AI-driven analytics and financial modeling can enhance efficiency and attract more clients.

-

Competition in the Industry – Rising competition from domestic and global rating agencies could impact Crisil’s pricing power and growth potential.

Crisil Share Price Target 2030

Crisil share price target 2030 Expected target could be ₹10,300. Here are 5 Key Factors Affecting Growth for Crisil Share Price Target 2030:

-

Long-Term Economic Growth – A strong Indian and global economy will drive demand for credit ratings, risk assessments, and financial research, benefiting Crisil’s business.

-

Regulatory and Compliance Developments – Future changes in financial regulations and compliance requirements could create new opportunities or challenges for Crisil’s rating and advisory services.

-

Adoption of AI & Big Data Analytics – Advanced technology in financial modeling, risk assessment, and AI-driven analytics will enhance Crisil’s services and efficiency, attracting more clients.

-

Global Expansion & Partnerships – Strengthening international collaborations, especially with S&P Global, could increase Crisil’s global market reach and revenue streams.

-

Industry Competition & Market Position – The rise of new players in financial analytics and rating services could influence Crisil’s pricing power and market dominance, requiring strategic expansion and innovation.

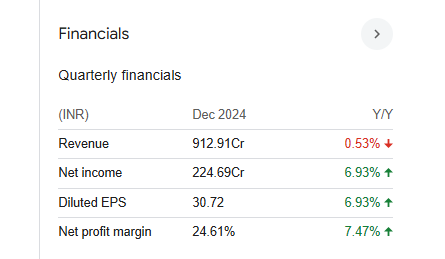

Financials Statement Of Crisil

| (INR) | 2024 | Y/Y change |

| Revenue | 9.13B | -0.53% |

| Operating expense | 1.82B | -0.82% |

| Net income | 2.25B | 6.93% |

| Net profit margin | 24.61 | 7.47% |

| Earnings per share | 30.72 | — |

| EBITDA | 2.84B | 9.48% |

| Effective tax rate | 23.70% | — |

Read Also:- Oriana Power Share Price Target Tomorrow 2025, 2026 To 2030