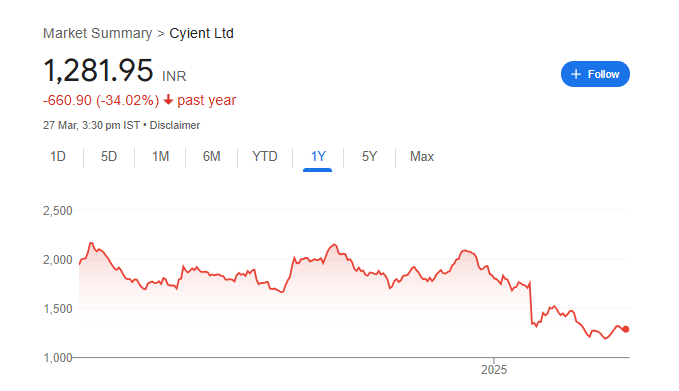

Cyient is a leading global engineering and digital technology company known for its innovative solutions in sectors such as aerospace, telecommunications, and healthcare. Investors are closely watching its share price target as the company continues to expand its market reach and adopt emerging technologies. Cyient Share Price on 27 March 2025 is 1,281.95 INR. This article will provide more details on Cyient Share Price Target 2025, 2026 to 2030.

Cyient Company Info

- Founded: 1991, Hyderabad

- Founder: B. V. R. Mohan Reddy

- Headquarters: Hyderabad

- Number of employees: 12,733 (2024)

- Revenue: 7,147 crores INR (FY24, US$900 million)

- Subsidiaries: Cyient DLM Ltd, Citec, Cyient Australia Pty. Ltd.

Cyient Share Price Chart

Cyient Share Price Details

- Today Open: 1,275.75

- Today High: 1,291.00

- Today Low: 1,260.30

- Mkt cap: 14.16KCr

- P/E ratio: 22.41

- Div yield: 2.34%

- 52-wk high: 2,190.00

- 52-wk low: 1,185.00

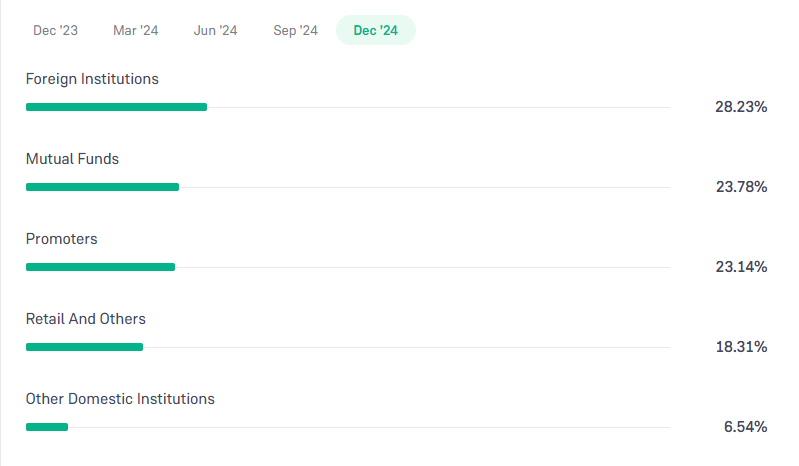

Cyient Shareholding Pattern

- Promoters: 23.14%

- Foreign Institutions: 28.23%

- Mutual Funds: 23.78%

- Retails and others: 18.31%

- Domestic Institutions: 6.54%

Cyient Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹2190

- 2026 – ₹2745

- 2027 – ₹3250

- 2028 – ₹3770

- 2029 – ₹4140

- 2030 – ₹4610

Cyient Share Price Target 2025

Cyient share price target 2025 Expected target could be ₹2190. Here are 5 Key Factors Affecting Growth for Cyient Share Price Target 2025:

-

Strong Demand for Engineering Services – With increasing global demand for digital and engineering solutions, Cyient’s revenue growth could drive its share price higher.

-

Expansion in Aerospace & Defense – The company’s focus on aerospace, defense, and automotive sectors can contribute to its long-term growth, benefiting from rising investments in these industries.

-

Adoption of AI & Digital Solutions – Cyient’s investments in AI, IoT, and digital transformation services can improve profitability and attract more clients, positively impacting share price.

-

Financial Performance & Earnings Growth – Consistent revenue growth, strong profit margins, and efficient cost management will be crucial for Cyient’s stock performance in 2025.

-

Global Economic Trends & IT Spending – Macroeconomic conditions, including IT sector growth and global tech spending, will influence investor confidence and stock valuation.

Cyient Share Price Target 2030

Cyient share price target 2030 Expected target could be ₹4610. Here are 5 Key Factors Affecting Growth for Cyient Share Price Target 2030:

-

Long-Term Digital Transformation Growth – As businesses worldwide continue to embrace AI, IoT, and cloud-based solutions, Cyient’s expertise in these areas could drive strong revenue growth.

-

Expansion into New Markets & Industries – Cyient’s ability to expand into emerging markets and industries like smart manufacturing, healthcare, and space technology will be crucial for its long-term success.

-

Strategic Acquisitions & Partnerships – Future mergers, acquisitions, and collaborations with global tech leaders can strengthen Cyient’s market position and enhance shareholder value.

-

Sustained Financial Performance – Consistent revenue growth, strong cash flow, and profitability will be key drivers influencing Cyient’s stock price over the decade.

-

Technological Advancements & Competitive Edge – The company’s ability to stay ahead in innovation and adapt to new technologies will play a major role in determining its stock performance by 2030.

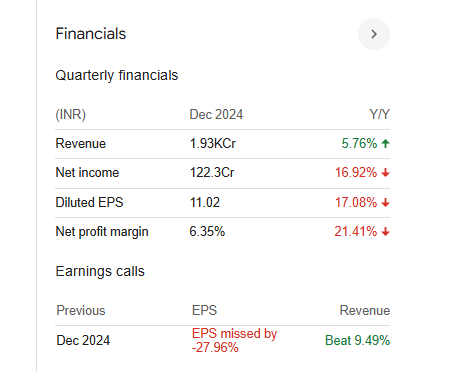

Financials Statement Of Cyient

| (INR) | 2024 | Y/Y change |

| Revenue | 71.47B | 18.81% |

| Operating expense | 13.88B | 3.75% |

| Net income | 6.83B | 32.74% |

| Net profit margin | 9.55 | 11.70% |

| Earnings per share | 66.48 | 33.20% |

| EBITDA | 11.83B | 33.63% |

| Effective tax rate | 23.48% | — |

Read Also:- Eplramco Cement Share Price Target Tomorrow 2025, 2026 To 2030