Deepak Nitrite is one of India’s most trusted chemical companies, known for its strong business performance and steady growth. With a growing presence in specialty and performance chemicals, the company has become a favorite among long-term investors. If you’re curious about where the share price of Deepak Nitrite might go in the coming years, this article will help you understand the key factors that may affect its future. Deepak Nitrite Share Price on 5 April 2025 is 1,930.00 INR. This article will provide more details on Deepak Nitrite Share Price Target 2025, 2026 to 2030.

Deepak Nitrite Company Info

- Headquarters: India

- Number of employees: 1,720 (2024)

- Subsidiaries: Deepak Chem Tech Limited, Nova Synthetic Ltd, Deepak Phenolics Ltd, Deepak Nitrite Corporation Inc.

Deepak Nitrite Share Price Chart

Deepak Nitrite Share Price Details

- Today Open: 1,985.10

- Today High: 2,001.50

- Today Low: 1,916.15

- Mkt cap: 26.32KCr

- P/E ratio: 35.16

- Div yield: 0.39%

- 52-wk high: 3,169.00

- 52-wk low: 1,790.80

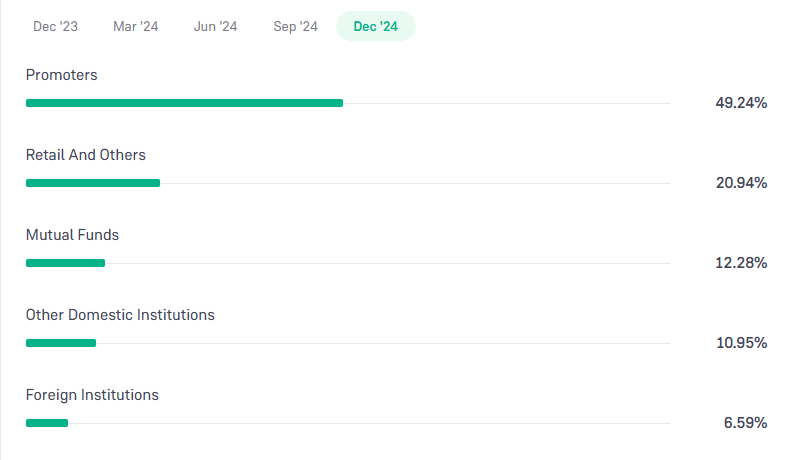

Deepak Nitrite Shareholding Pattern

- Promoters: 49.24%

- Foreign Institutions: 6.59%

- Mutual Funds: 12.28%

- Retails and others: 20.94%

- Domestic Institutions: 10.95%

Deepak Nitrite Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹3170

- 2026 – ₹3450

- 2027 – ₹3965

- 2028 – ₹4437

- 2029 – ₹4870

- 2030 – ₹5340

Deepak Nitrite Share Price Target 2025

Deepak Nitrite share price target 2025 Expected target could be ₹3170. As of April 2025, Deepak Nitrite Ltd. is a prominent player in India’s chemical industry. Several key factors are poised to influence the company’s share price target for 2025:

-

Financial Performance: In Q3 FY25, Deepak Nitrite reported a net profit of ₹98 crore, a 51.5% decline from the previous year’s ₹202 crore. Revenue also decreased by 5.3% year-over-year to ₹1,903.4 crore. Consistent financial results are crucial for investor confidence and share price stability.

-

Capacity Expansion Projects: The company is nearing completion of several projects, including nitric acid facilities and new nitration and hydrogenation blocks, expected to be operational within the next six months. These expansions could enhance production capabilities and revenue potential.

-

Market Demand and Pricing Pressures: The chemical sector has faced weak demand and pricing pressures, impacting sales volumes and profitability. The company’s ability to navigate these challenges will be pivotal for its financial health.

-

Strategic Initiatives: Deepak Nitrite’s backward integration plan, including the inauguration of a fluorination plant in Dahej with an investment of ₹200 crores, aims to reduce dependence on imports and strengthen supply chain resilience. Such initiatives can enhance operational efficiency and cost-effectiveness.

-

Analyst Projections: Analysts forecast earnings and revenue growth rates of 16.5% and 11.8% per annum, respectively, with an expected return on equity of 18.8% over the next three years. These projections can influence investor sentiment and share price expectations.

Deepak Nitrite Share Price Target 2030

Deepak Nitrite share price target 2030 Expected target could be ₹5340. As of April 2025, Deepak Nitrite Ltd. is a key player in India’s chemical industry. Several factors are expected to influence its share price target by 2030:

-

Expansion into Specialty Chemicals: Deepak Nitrite’s strategic focus on specialty chemicals positions it to benefit from the sector’s projected growth. The Indian chemical industry is expected to reach a market size of US$ 383 billion by 2030, growing at an 8% compound annual growth rate (CAGR).

-

Financial Performance and Debt Management: The company’s strong financials and low debt levels enable it to fund capital expenditure projects and invest in new initiatives, contributing to potential growth.

-

Demand for Phenolics and Performance Products: Deepak Phenolics, a subsidiary of Deepak Nitrite, benefits from increasing demand for phenol and acetone, significantly contributing to the company’s revenue.

-

Regulatory Environment and Environmental Compliance: As industries move towards sustainable practices in chemical manufacturing, Deepak Nitrite’s focus on green and environmentally friendly products provides a competitive edge for future growth.

-

Analyst Projections and Investor Sentiment: Analyst estimates and market forecasts will influence stock valuations. For instance, some projections suggest potential fluctuations in Deepak Nitrite’s stock price, emphasizing the importance of strategic planning and execution to achieve favorable outcomes by 2030.

Financial Statement Of Deepak Nitrite

| (INR) | 2024 | Y/Y change |

| Revenue | 76.82B | -3.64% |

| Operating expense | 9.20B | 5.57% |

| Net income | 8.11B | -4.82% |

| Net profit margin | 10.56 | -1.22% |

| Earnings per share | 63.76 | 2.06% |

| EBITDA | 11.49B | -12.00% |

| Effective tax rate | 26.40% | — |

Read Also:- Delta Corp Share Price Target Tomorrow 2025, 2026 To 2030