DLF is one of the most trusted names in the Indian real estate market. Known for its premium housing projects and strong presence in commercial spaces, DLF has built a solid reputation over the years. If you’re an investor or someone curious about where DLF’s share price might go in the coming years, you’re in the right place. DLF Share Price on 5 April 2025 is 654.00 INR. This article will provide more details on DLF Share Price Target 2025, 2026 to 2030.

DLF Company Info

- Founded: 4 July 1946

- Founder: Chaudhary Raghvendra Singh

- Headquarters: Haryana

- Number of employees: 2,507 (2024)

- Parent organization: Rajdhani Investments & Agencies Private Limited

- Revenue: 6,958 crores INR (US$870 million, 2024)

- Subsidiaries: DLF Cyber City Developers Limited.

DLF Share Price Chart

DLF Share Price Details

- Today Open: 678.00

- Today High: 679.70

- Today Low: 648.75

- Mkt cap: 1.62LCr

- P/E ratio: 40.41

- Div yield: 0.76%

- 52-wk high: 930.65

- 52-wk low: 622.00

DLF Shareholding Pattern

- Promoters: 74.08%

- Foreign Institutions: 16.37%

- Mutual Funds: 3,48%

- Retails and others: 4.69%

- Domestic Institutions: 1.39%

DLF Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹940

- 2026 – ₹1120

- 2027 – ₹1368

- 2028 – ₹1574

- 2029 – ₹1749

- 2030 – ₹2060

DLF Share Price Target 2025

DLF share price target 2025 Expected target could be ₹940. As of April 2025, DLF Ltd. remains a significant player in India’s real estate sector. Several key factors are poised to influence the company’s share price target by the end of 2025:

-

Robust Pre-Sales and Project Launches

DLF has demonstrated strong pre-sales momentum, particularly in its luxury residential projects. Notably, the company achieved record bookings for its “The Dahlias” project in Gurugram, selling 173 units for approximately $1.4 billion over nine weeks. Such successes underscore DLF’s ability to attract high-end buyers and generate substantial revenue. -

Strategic Investment Plans

The company’s announcement to invest ₹20,000 crore in expanding its commercial portfolio reflects a commitment to long-term growth. This investment aims to enhance DLF’s presence in the office and retail property segments, potentially boosting future rental income and overall financial performance. -

Analyst Ratings and Price Targets

Leading brokerage firms have expressed optimism about DLF’s growth prospects. For instance, JM Financial has issued a “Buy” rating with a target price of ₹1,000, indicating a potential upside of approximately 44% from the current market price. Such endorsements can positively influence investor sentiment and share price. -

Market Demand for Luxury Housing

The increasing demand for luxury housing in India, driven by affluent buyers seeking premium properties, aligns with DLF’s focus on high-end residential projects. This trend is expected to continue, providing a favorable market environment for the company’s offerings. -

Financial Performance and Earnings Growth

Analysts forecast DLF’s earnings to grow by 28.9% per annum, with revenue growth projected at 24.2% annually. These projections suggest a strong financial trajectory, which could positively impact the company’s share price by the end of 2025.

DLF Share Price Target 2030

DLF share price target 2030 Expected target could be ₹2060. As of April 2025, DLF Ltd. continues to be a dominant force in India’s real estate sector. Several key factors are expected to influence the company’s share price trajectory leading up to 2030:

-

Vision 2030 Strategy: DLF aims to double its profit after tax (PAT) and cash flow by FY30 as part of its Vision 2030 strategy. This ambitious plan reflects the company’s commitment to substantial growth and operational efficiency.

-

Expansion into Luxury Residential Market: The company has launched high-end projects, such as “The Camellias” in Gurugram, targeting affluent buyers. This focus aligns with the projected growth of India’s luxury residential real estate market, expected to reach USD 105 billion by 2030.

-

Commercial Real Estate Development: DLF’s plan to invest ₹20,000 crore in expanding its commercial portfolio indicates a strategic move to capitalize on the anticipated growth in India’s commercial real estate market, projected to reach USD 128.40 billion by 2030.

-

Market Demand and Urbanization: India’s rapid urbanization and economic growth are driving increased demand for both residential and commercial properties. DLF’s strategic positioning in key urban centers positions it to benefit from this trend.

-

Financial Performance and Investor Confidence: Analyst forecasts predict DLF’s earnings to grow by 28.58% per annum. Consistent financial performance and positive investor sentiment are crucial for achieving favorable share price targets by 2030.

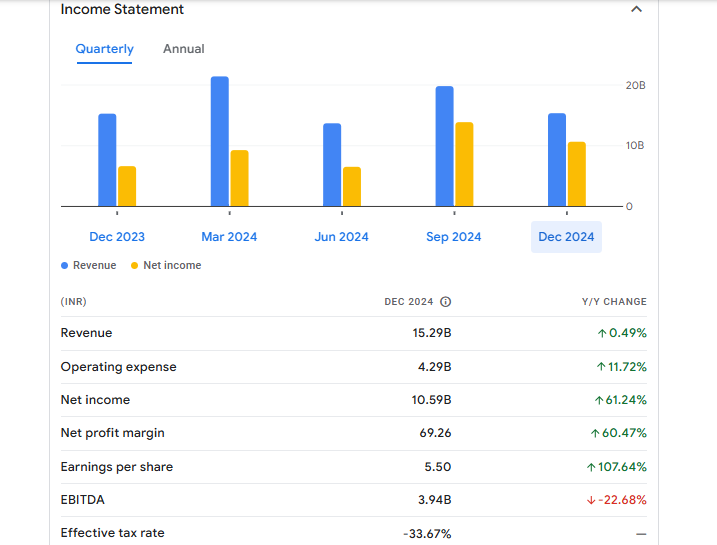

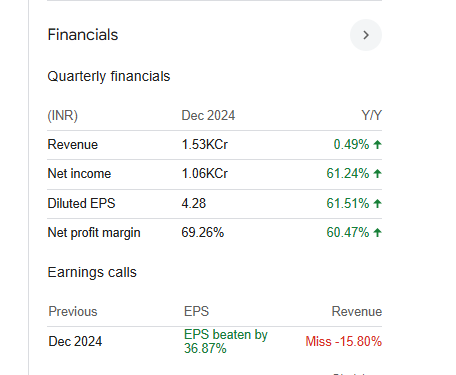

Financial Statement Of DLF

| (INR) | 2024 | Y/Y change |

| Revenue | 15.29B | 0.49% |

| Operating expense | 4.29B | 11.72% |

| Net income | 10.59B | 61.24% |

| Net profit margin | 69.26 | 60.47% |

| Earnings per share | 5.50 | 107.64% |

| EBITDA | 3.94B | -22.68% |

| Effective tax rate | -33.67% | — |

Read Also:- Deepak Nitrite Share Price Target Tomorrow 2025, 2026 To 2030