Investors are always looking for potential growth in stocks, and Franklin Industries is one such company that attracts attention. Whether you are a new investor or an experienced one, understanding the company’s future share price targets can help in making informed decisions. Franklin Industries Share Price on 28 March 2025 is 2.08 INR. This article will provide more details on Franklin Industries Share Price Target 2025, 2026 to 2030.

Franklin Industries Company Info

- Founded: 1983

- Headquarters: India

- Subsidiary: Aphrodite Industries Limited.

Franklin Industries Share Price Chart

Franklin Industries Share Price Details

- Today Open: 2.08

- Today High: 2.12

- Today Low: 2.06

- Mkt cap: 60.15Cr

- P/E ratio: 1.37

- Div yield: N/A

- 52-wk high: 4.13

- 52-wk low: 1.32

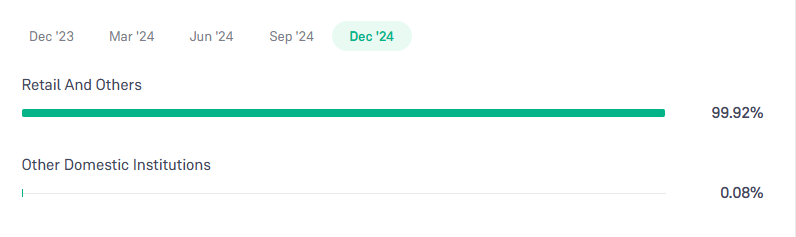

Franklin Industries Shareholding Pattern

- Promoters: 0%

- Foreign Institutions: 0%

- Mutual Funds: 0%

- Retails and others: 99.92%

- Domestic Institutions: 0.08%

Franklin Industries Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹5

- 2026 – ₹7

- 2027 – ₹9

- 2028 – ₹11

- 2029 – ₹13

- 2030 – ₹15

Franklin Industries Share Price Target 2025

Franklin Industries share price target 2025 Expected target could be ₹5. Here are 5 Key Factors Affecting Growth for Franklin Industries Share Price Target 2025:

-

Market Demand & Industry Trends – The performance of Franklin Industries depends on demand in its sector. If the industry sees strong growth, the company’s share price may rise accordingly.

-

Financial Performance – Revenue, profit margins, and debt levels will play a key role in determining investor confidence and future stock performance.

-

Government Policies & Regulations – Changes in policies, taxation, and regulatory norms affecting the industry could impact Franklin Industries’ growth prospects.

-

Competition & Market Position – The company’s ability to compete with peers and maintain a strong market presence will influence its stock price.

-

Global Economic Conditions – Economic trends, inflation, and foreign investments can directly impact Franklin Industries’ stock performance, affecting investor sentiment.

Franklin Industries Share Price Target 2030

Franklin Industries share price target 2030 Expected target could be ₹15. Here are 5 Key Factors Affecting Growth for Franklin Industries Share Price Target 2030:

-

Long-Term Industry Growth – The company’s share price will depend on its ability to adapt to future industry trends, technological advancements, and market demands.

-

Expansion & Diversification – Entering new markets, expanding product lines, or diversifying operations can contribute to sustained growth and a higher valuation.

-

Innovation & Technological Advancements – Investment in new technology, automation, or sustainable practices will determine Franklin Industries’ competitive edge over the long term.

-

Macroeconomic & Global Factors – Economic stability, inflation rates, and international trade policies will impact the company’s long-term performance and stock price.

-

Investor Sentiment & Institutional Interest – Increased interest from large investors, mutual funds, or foreign institutional investors (FIIs) can drive the stock price upward over time.

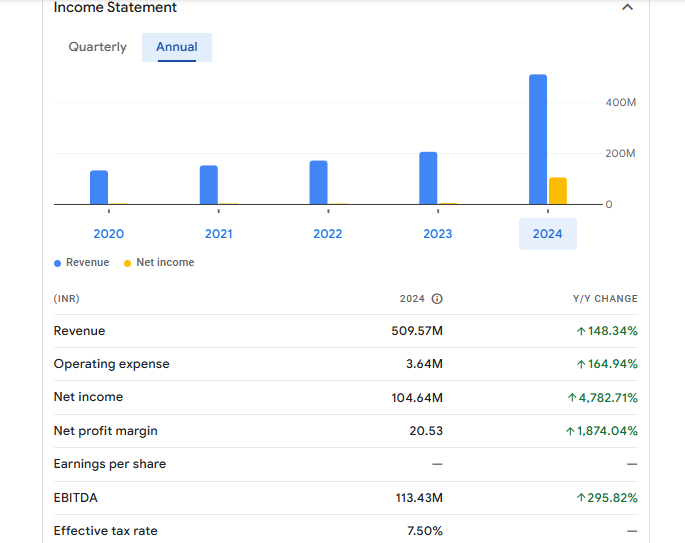

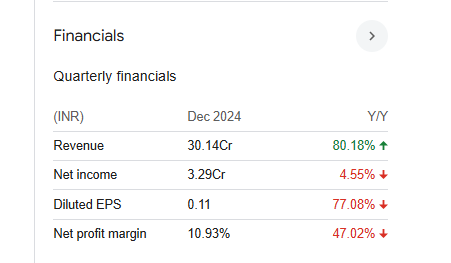

Financials Statement Of Franklin Industries

| (INR) | 2024 | Y/Y change |

| Revenue | 509.57M | 148.34% |

| Operating expense | 3.64M | 164.94% |

| Net income | 104.64M | 4,782.71% |

| Net profit margin | 20.53 | 1,874.04% |

| Earnings per share | — | — |

| EBITDA | 113.43M | 295.82% |

| Effective tax rate | 7.50% | — |

Read Also:- Sri Adhikari Brothers Share Price Target Tomorrow 2025, 2026 To 2030