Godrej Consumer Products is a well-known name in the FMCG sector, offering a wide range of household and personal care products. Investors looking for steady growth often keep an eye on its stock performance. Understanding the share price target of Godrej Consumer can help in making informed investment decisions. Godrej Consumer Share Price on 25 March 2025 is 1,128.45 INR. This article will provide more details on Godrej Consumer Share Price Target 2025, 2026 to 2030.

Godrej Consumer Company Info

- CEO: Sudhir Sitapati (18 Oct 2021–)

- Founded: 2001

- Headquarters: Mumbai

- Number of employees: 8,600 (2024)

- Parent organizations: Godrej Group, Godrej Industries

- Revenue: 14,365 crores INR (US$1.8 billion, 2024)

- Subsidiaries: Lorna Nigeria Limited

Godrej Consumer Share Price Chart

Godrej Consumer Share Price Details

- Today Open: 1,111.85

- Today High: 1,134.90

- Today Low: 1,097.60

- Mkt cap: 1.15LCr

- P/E ratio: N/A

- Div yield: 1.77%

- 52-wk high: 1,541.85

- 52-wk low: 979.50

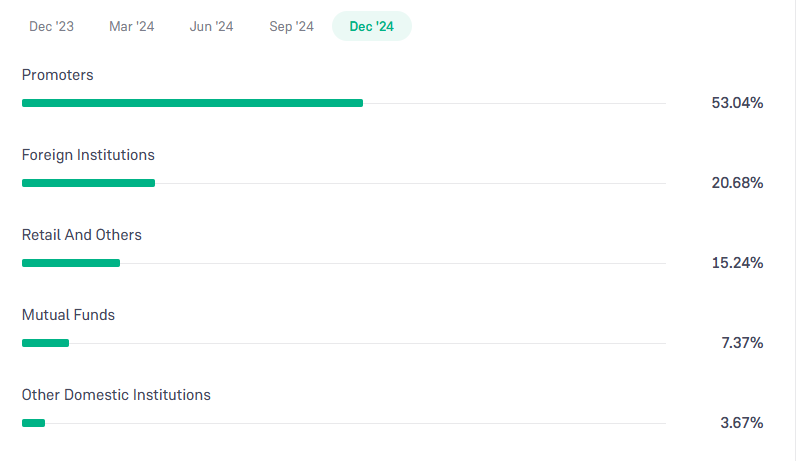

Godrej Consumer Shareholding Pattern

- Promoters: 53.04%

- Foreign Institutions: 20.68%

- Mutual Funds: 7.37%

- Retails and others: 15.24%

- Domestic Institutions: 3.67%

Godrej Consumer Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹1545

- 2026 – ₹1600

- 2027 – ₹1650

- 2028 – ₹1700

- 2029 – ₹1750

- 2030 – ₹1800

Godrej Consumer Share Price Target 2025

Godrej Consumer share price target 2025 Expected target could be ₹1545. Here are 5 Key Factors Affecting Growth for Godrej Consumer Share Price Target 2025:

-

Strong Brand Presence – Godrej Consumer has a well-established brand in the FMCG sector, which helps maintain customer trust and drive consistent sales growth.

-

Expansion in Emerging Markets – The company’s focus on expanding in high-growth markets like Africa, Indonesia, and Latin America can boost revenue and profitability.

-

Innovation & Product Portfolio – Continuous innovation in personal care, home care, and hygiene products ensures market competitiveness and customer retention.

-

Rural Market Penetration – Increased demand from rural areas, along with strategic pricing and distribution networks, can contribute to steady revenue growth.

-

Raw Material Costs & Supply Chain Efficiency – Efficient cost management and stable raw material prices will impact the company’s profit margins and overall financial performance.

Godrej Consumer Share Price Target 2030

Godrej Consumer share price target 2030 Expected target could be ₹1800. Here are 5 Key Factors Affecting Growth for Godrej Consumer Share Price Target 2030:

-

Global Expansion & Market Share – Godrej Consumer’s ability to strengthen its presence in international markets, especially in emerging economies, will play a key role in long-term growth.

-

Sustainability & ESG Initiatives – The company’s commitment to sustainability, eco-friendly packaging, and ethical sourcing will enhance brand reputation and attract conscious consumers.

-

Technological Advancements & Digital Transformation – Investments in digital marketing, e-commerce, and AI-driven consumer insights can drive higher sales and customer engagement.

-

Diversification & Product Innovation – Expanding product lines in categories like natural and organic personal care, home hygiene, and premium segments can open new revenue streams.

-

Economic & Regulatory Environment – Factors like inflation, government policies, taxation, and global economic conditions will influence business operations and stock performance in the long run.

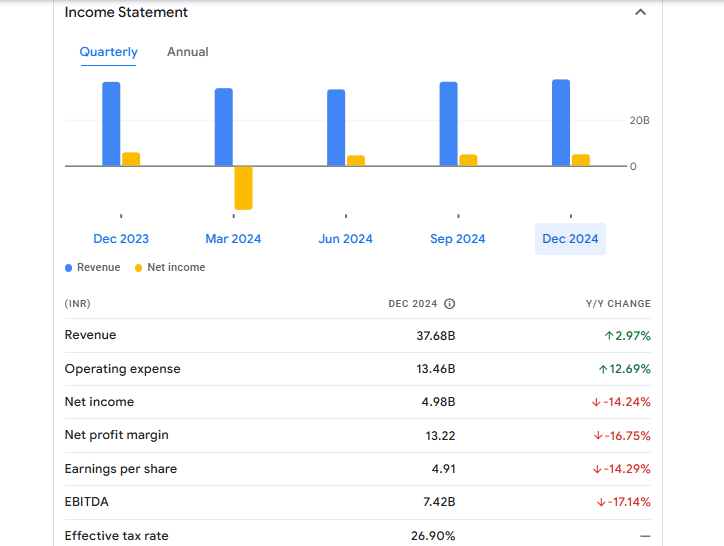

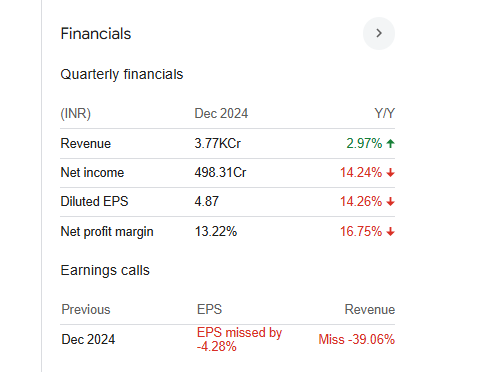

Financials Statement Of Godrej Consumer

| (INR) | 2024 | Y/Y change |

| Revenue | 37.68B | 2.97% |

| Operating expense | 13.46B | 12.69% |

| Net income | 4.98B | -14.24% |

| Net profit margin | 13.22 | -16.75% |

| Earnings per share | 4.91 | -14.29% |

| EBITDA | 7.42B | -17.14% |

| Effective tax rate | 26.90% | — |

Read Also:- EPL Share Price Target Tomorrow 2025, 2026 To 2030