Happiest Minds is a well-known IT company that focuses on digital transformation and emerging technologies. Investors are keen to know its share price target as the company continues to grow in areas like AI, cloud computing, and cybersecurity. Happiest Minds Share Price on 7 March 2025 is 695.00 INR. This article will provide more details on Happiest Minds Share Price Target 2025, 2026 to 2030.

Happiest Minds Company Info

- Founded: 30 March 2011

- Founder: Ashok Soota

- Headquarters: India

- Number of employees: 6,630 (2024)

- Subsidiaries: PureSoftware Technologies Private Limited

Happiest Minds Share Price Chart

Happiest Minds Share Price Details

- Today Open: 695.55

- Today High: 709.85

- Today Low: 693.05

- Mkt cap: 10.42KCr

- P/E ratio: 46.93

- Div yield: 0.83%

- 52-wk high: 956.00

- 52-wk low: 654.85

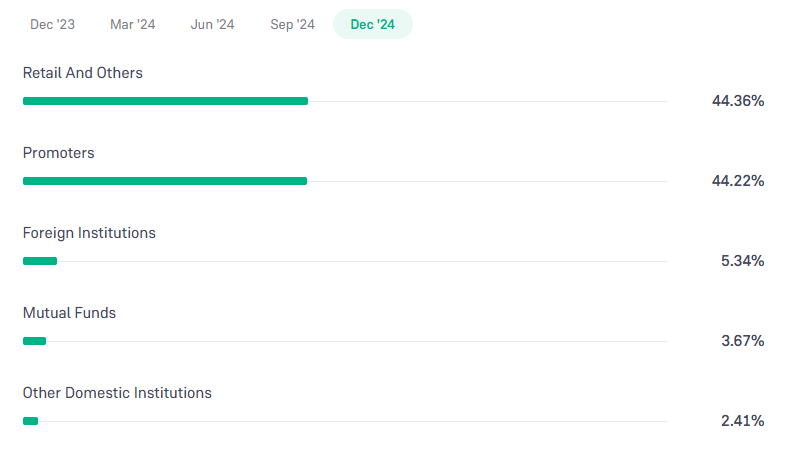

Happiest Minds Shareholding Pattern

- Promoters: 44.22%

- Foreign Institutions: 5.34%

- Mutual Funds: 3.67%

- Retails and others: 44.36%

- Domestic Institutions: 2.41%

Happiest Minds Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹960

- 2026 – ₹1035

- 2027 – ₹1110

- 2028 – ₹1243

- 2029 – ₹1350

- 2030 – ₹1500

Happiest Minds Share Price Target 2025

Happiest Minds share price target 2025 Expected target could be ₹960. Here are 5 Key Factors Affecting Growth for Happiest Minds Share Price Target 2025:

-

Strong Demand for Digital Services

Happiest Minds focuses on digital transformation, cloud computing, and cybersecurity, which are in high demand. As businesses continue to adopt digital solutions, the company’s revenue and growth potential are expected to rise. -

Expanding Client Base

The company has been consistently adding new clients across industries, leading to higher recurring revenues. Strong client relationships and long-term contracts contribute to financial stability and growth. -

Global Expansion and Market Reach

Happiest Minds is expanding its presence in international markets, especially in the US and Europe. This diversification helps reduce dependency on a single region and increases revenue opportunities. -

Consistent Financial Performance

The company has reported steady revenue and profit growth in recent quarters. Investors closely track financial performance, and strong earnings can positively impact the share price. -

Technology Innovations and Investments

Happiest Minds continues to invest in artificial intelligence, automation, and other emerging technologies. Staying ahead of industry trends helps the company maintain a competitive edge and attract more business.

Happiest Minds Share Price Target 2030

Happiest Minds share price target 2030 Expected target could be ₹1500. Here are 5 Risks and Challenges for Happiest Minds Share Price Target 2030:

-

Intense Competition in IT Sector

The IT industry is highly competitive, with major players like TCS, Infosys, and Wipro offering similar services. Increased competition may impact market share and profit margins. -

Global Economic Uncertainty

Economic downturns, inflation, or geopolitical issues can reduce IT spending by businesses. This could slow down revenue growth and affect the company’s long-term performance. -

Rapid Technological Changes

The IT industry evolves quickly, and companies must continuously invest in innovation. Failing to keep up with emerging technologies like AI, blockchain, and cloud computing could affect growth. -

Dependence on Key Markets

A significant portion of Happiest Minds’ revenue comes from the US and Europe. Any slowdown in these markets due to economic or regulatory issues could impact earnings and stock performance. -

Workforce and Talent Challenges

The IT sector faces challenges in hiring and retaining skilled professionals. Rising salary costs and employee attrition can put pressure on profitability and operational efficiency.

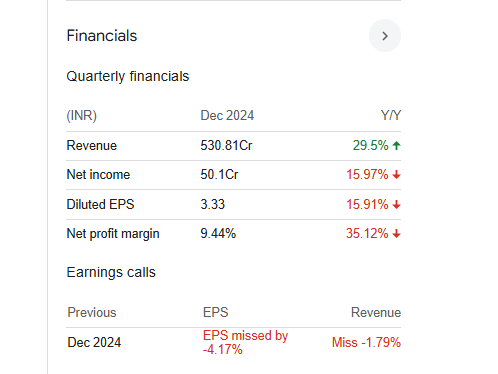

Financials Statement Of Happiest Minds

| (INR) | 2024 | Y/Y change |

| Revenue | 16.25B | 13.67% |

| Operating expense | 3.24B | 8.00% |

| Net income | 2.48B | 7.53% |

| Net profit margin | 15.29 | -5.38% |

| Earnings per share | 16.03 | -1.89% |

| EBITDA | 3.03B | -8.03% |

| Effective tax rate | 25.78% | — |

Read Also:- NBCC Share Price Target Tomorrow 2025, 2026 To 2030