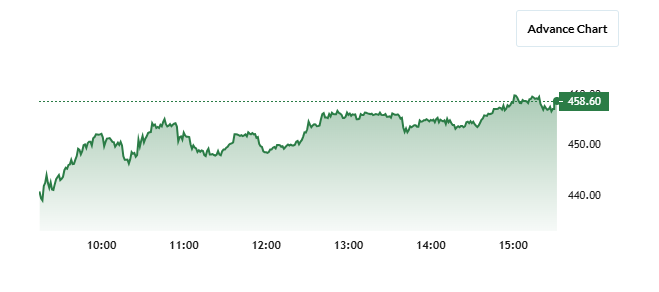

HBL Power Systems is a well-known company in the battery and power solutions industry, serving sectors like defense, aerospace, and industrial applications. Investors are keen to know the future potential of HBL’s share price, as the company continues to expand in energy storage and technology-driven solutions. HBL Share Price on 5 March 2025 is 458.60 INR. This article will provide more details on HBL Share Price Target 2025, 2026 to 2030.

HBL Share Price Chart

HBL Share Price Details

- Today Open: 440.00

- Today High: 459.90

- Today Low: 437.30

- Mkt cap: 18.99KCr

- P/E ratio: 26.73

- Div yield: 0.11%

- 52-wk high: 739.65

- 52-wk low: 378.20

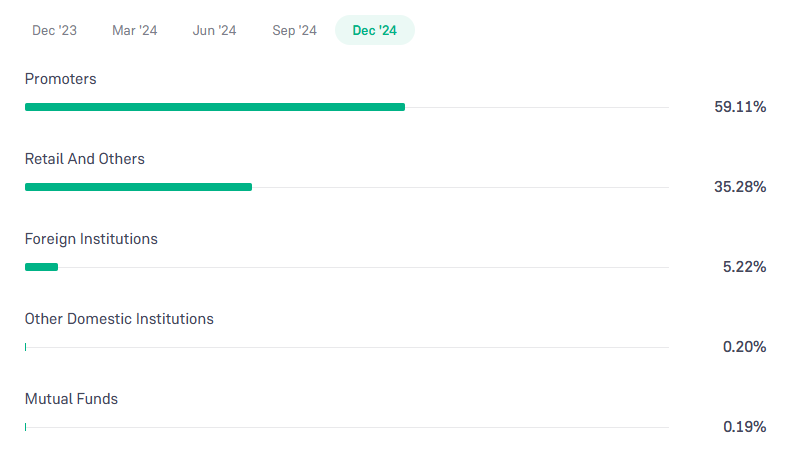

HBL Shareholding Pattern

- Promoters: 59.11%

- Foreign Institutions: 5.22%

- Mutual Funds: .19%

- Retails and others: 35.28%

- Domestic Institutions: 0.20%

HBL Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹740

- 2026 – ₹890

- 2027 – ₹1014

- 2028 – ₹1145

- 2029 – ₹1276

- 2030 – ₹1400

HBL Share Price Target 2025

HBL share price target 2025 Expected target could be ₹740. HBL Power Systems is a leading company in the battery and power solutions industry. Several factors can influence its share price growth by 2025. Here are five key drivers:

1. Rising Demand for Energy Storage Solutions

With the increasing use of renewable energy and electric vehicles (EVs), the demand for advanced battery solutions is growing. HBL’s expertise in battery technology positions it well for expansion in this sector.

2. Government Policies and Initiatives

Supportive policies for clean energy, defense manufacturing, and infrastructure development can boost HBL’s growth. Government contracts and incentives for local production could further strengthen its financial performance.

3. Expansion in Defense and Aerospace Sectors

HBL has a strong presence in the defense and aerospace battery market. Growth in defense spending and technological advancements in aviation can create new business opportunities for the company.

4. Technological Advancements and Innovation

Investment in research and development (R&D) can help HBL stay ahead of competitors. Innovations in battery efficiency, durability, and new product development can drive revenue growth.

5. Financial Performance and Investor Confidence

Consistent revenue growth, profitability, and a strong balance sheet can positively influence investor sentiment. If HBL continues to deliver strong financial results, its share price is likely to reflect this upward momentum.

HBL Share Price Target 2030

HBL share price target 2030 Expected target could be ₹1400. While HBL Power Systems has strong growth potential, certain risks and challenges could impact its share price by 2030. Here are five key concerns:

1. Market Competition and Technological Disruptions

The battery and energy storage industry is rapidly evolving, with new technologies emerging. Competition from global players and innovative startups could impact HBL’s market position if it fails to keep up with technological advancements.

2. Dependence on Government Contracts

A significant portion of HBL’s revenue comes from defense and government projects. Any changes in government policies, budget cuts, or delays in contracts could negatively affect its financial performance.

3. Raw Material Price Fluctuations

The cost of key raw materials like lithium, lead, and other metals can fluctuate due to supply chain disruptions, inflation, or geopolitical issues. Rising input costs could pressure profit margins if not managed efficiently.

4. Global Economic Slowdown

A global or domestic economic downturn can impact industrial and defense spending, reducing demand for HBL’s products. Uncertainty in financial markets may also affect investor sentiment toward the stock.

5. Regulatory and Environmental Challenges

Battery manufacturing and disposal are subject to strict environmental regulations. Stricter policies on emissions, waste management, or hazardous materials could increase compliance costs and pose operational challenges.

Read Also:- Sun Pharma Share Price Target Tomorrow 2025, 2026 To 2030