Hindustan Construction Company (HCC) is a well-known name in India’s infrastructure and construction sector. With its involvement in large-scale projects like highways, bridges, and metro systems, the company has strong growth potential. Investors looking at HCC’s share price target often consider factors like government contracts, financial stability, and market trends. HCC Share Price on 15 March 2025 is 22.59 INR. This article will provide more details on HCC Share Price Target 2025, 2026 to 2030.

HCC Company Info

- CEO: Arjun Dhawan (1 Apr 2017–)

- Founded: 27 January 1926

- Founder: Walchand Hirachand

- Headquarters: Mumbai

- Number of employees: 1,013 (2024)

- Revenue: 11,152 crores INR (US$1.4 billion, 2022)

- Subsidiaries: HCC Infrastructure Company Limited

HCC Share Price Chart

HCC Share Price Details

- Today Open: 23.25

- Today High: 23.55

- Today Low: 22.50

- Mkt cap: 4.12KCr

- P/E ratio: 11.19

- Div yield: N/A

- 52-wk high: 57.50

- 52-wk low: 21.97

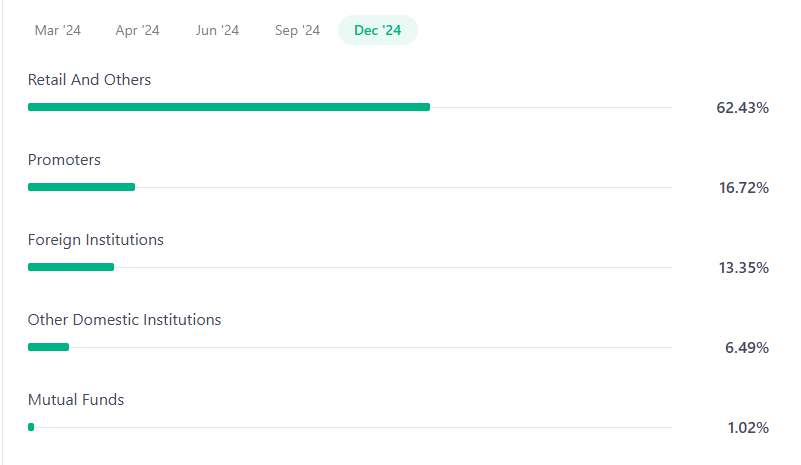

HCC Shareholding Pattern

- Promoters: 16.72%

- Foreign Institutions: 13.35%

- Mutual Funds: 1.02%

- Retails and others: 62.43%

- Domestic Institutions: 6.49%

HCC Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹60

- 2026 – ₹70

- 2027 – ₹80

- 2028 – ₹90

- 2029 – ₹100

- 2030 – ₹110

HCC Share Price Target 2025

HCC share price target 2025 Expected target could be ₹60. Here are five key factors affecting the growth of Hindustan Construction Company (HCC) Share Price Target 2025:

-

Infrastructure Development Projects – Government initiatives in highways, bridges, and metro rail projects can boost HCC’s revenue and profitability.

-

Order Book Strength – A strong and growing order book with large-scale projects can improve the company’s financial stability and future earnings potential.

-

Debt Management & Financial Health – Effective debt restructuring and better financial management can enhance investor confidence and support stock growth.

-

Government Policies & Investments – Policies related to infrastructure spending, ease of business, and foreign investments in the construction sector can positively impact HCC’s share price.

-

Raw Material Costs & Supply Chain – The cost and availability of key materials like cement, steel, and labor can affect project profitability and overall financial performance.

HCC Share Price Target 2030

HCC share price target 2030 Expected target could be ₹110. Here are five key factors affecting the growth of Hindustan Construction Company (HCC) Share Price Target 2030:

-

Long-Term Infrastructure Development – Government spending on mega projects like highways, tunnels, smart cities, and water management will drive HCC’s growth in the coming years.

-

Technological Advancements – Adoption of modern construction technologies, automation, and digital solutions can improve efficiency and profitability, impacting stock performance positively.

-

Debt Reduction & Financial Stability – A lower debt burden and improved cash flow management will enhance investor confidence and support long-term share price growth.

-

Public-Private Partnerships (PPP) & Foreign Investments – Increased collaboration with private firms and foreign investors in large-scale projects can provide funding and growth opportunities.

-

Sustainable & Green Construction Trends – With a growing focus on eco-friendly infrastructure, HCC’s participation in sustainable construction can open new business avenues and boost its long-term prospects.

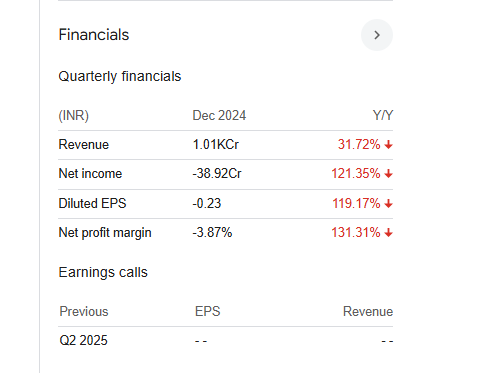

Financials Statement Of HCC

| (INR) | 2024 | Y/Y change |

| Revenue | 70.31B | -14.99% |

| Operating expense | 13.07B | -10.20% |

| Net income | 4.78B | 1,817.53% |

| Net profit margin | 6.80 | 2,100.00% |

| Earnings per share | — | — |

| EBITDA | 6.64B | 31.49% |

| Effective tax rate | 31.92% | — |

Read Also:- Denta Water and Infra Solutions Share Price Target Tomorrow 2025, 2026 To 2030