HUDCO (Housing and Urban Development Corporation Limited) is a trusted government-backed company that helps build homes and develop cities across India. With its strong presence in affordable housing and urban infrastructure, HUDCO plays an important role in the country’s development journey. Hudco Share Price on 9 April 2025 is 207.73 INR. This article will provide more details on Hudco Share Price Target 2025, 2026 to 2030.

Hudco Company Info

- Founded: 25 April 1970

- Headquarters: New Delhi

- Number of employees: 621 (2024)

- Revenue: 7,571.64 crores INR (US$950 million, 2020)

- Subsidiaries: HUDLAND Real Estate Investment and Development Joint Stock Company.

Hudco Share Price Chart

Hudco Share Price Details

- Today Open: 200.69

- Today High: 207.80

- Today Low: 198.38

- Mkt cap: 41.45KCr

- P/E ratio: 15.51

- Div yield: 2.13%

- 52-wk high: 353.70

- 52-wk low: 158.85

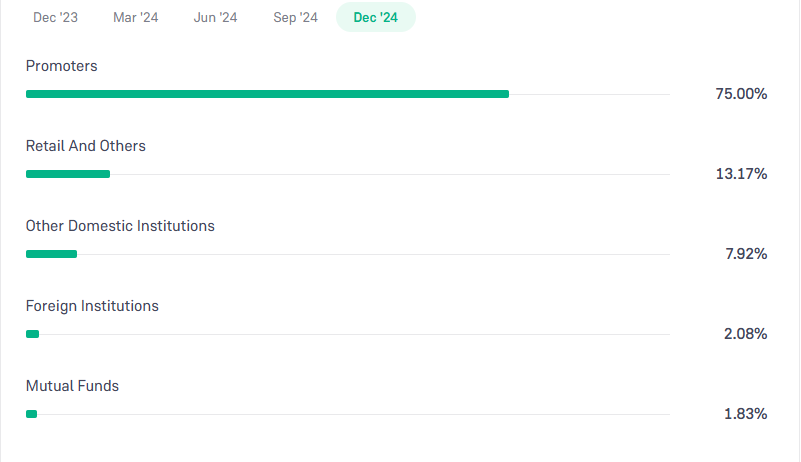

Hudco Shareholding Pattern

- Promoters: 75%

- Foreign Institutions: 2.08%

- Mutual Funds: 1.83%

- Retails and others: 13.17%

- Domestic Institutions: 7.92%

Hudco Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹360

- 2026 – ₹380

- 2027 – ₹400

- 2028 – ₹420

- 2029 – ₹440

- 2030 – ₹460

Hudco Share Price Target 2025

Hudco share price target 2025 Expected target could be ₹360. Housing and Urban Development Corporation Ltd. (HUDCO) is a prominent public sector enterprise in India, specializing in financing housing and urban infrastructure projects. Several key factors are influencing HUDCO’s growth and share price target for 2025:

-

Government Initiatives in Urban Development

HUDCO stands to benefit from India’s emphasis on urban development and affordable housing. The government’s initiatives, such as the Pradhan Mantri Awas Yojana (PMAY) and Smart Cities Mission, are likely to create substantial opportunities for HUDCO in financing housing and infrastructure projects.

-

Financial Performance and Loan Growth

Analysts project a robust loan book compound annual growth rate (CAGR) of approximately 31% for HUDCO over FY2024-FY2027, driven by increased disbursements in housing and infrastructure sectors. This anticipated growth is expected to enhance the company’s earnings and, consequently, its share price.

-

Strategic Partnerships and Memorandums of Understanding (MoUs)

HUDCO has entered into significant MoUs, such as the agreement with the Mumbai Metropolitan Region Development Authority (MMRDA) to fund infrastructure projects worth ₹1.5 lakh crore. These collaborations are set to expand HUDCO’s project portfolio and revenue streams.

-

Capital Raising and Borrowing Capacity

The company’s board has approved a fundraising plan of up to ₹65,000 crore for the financial year 2025-26 and increased the overall borrowing limit to ₹2,50,000 crore. While this enhances HUDCO’s capacity to finance large-scale projects, it also raises considerations regarding debt management and interest obligations.

-

Market Sentiment and Analyst Recommendations

Market analysts have shown optimism toward HUDCO’s stock. For instance, Bajaj Broking has set a target price of ₹314, indicating a potential upside of 29% from current levels. Such positive sentiment can influence investor confidence and share price performance.

Hudco Share Price Target 2030

Hudco share price target 2030 Expected target could be ₹460. Housing and Urban Development Corporation Ltd. (HUDCO) plays a pivotal role in financing housing and urban infrastructure projects in India. Looking ahead to 2030, several key factors are anticipated to influence HUDCO’s growth trajectory and share price:

-

Government Initiatives in Affordable Housing and Urban Development

HUDCO is expected to benefit significantly from ongoing and future government programs aimed at affordable housing and urban infrastructure. Initiatives like Pradhan Mantri Awas Yojana (PMAY) 2.0 and the Smart Cities Mission are likely to generate substantial opportunities for HUDCO to finance and support large-scale projects, thereby driving growth.

-

Expansion and Diversification of Loan Portfolio

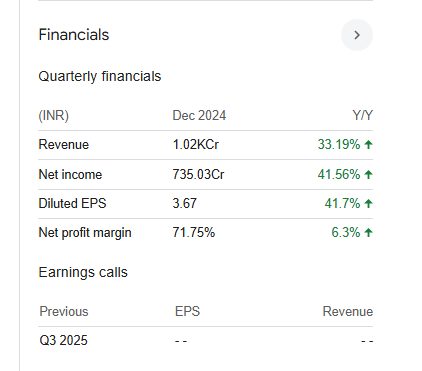

The company’s strategic focus on expanding its loan book, particularly in sectors like affordable housing and urban infrastructure, is crucial. As of December 2024, HUDCO’s loan book expanded by approximately 41% year-over-year, reaching ₹1,18,931 crore, with around 40.17% exposure to affordable housing. Continued diversification and growth in the loan portfolio are essential for sustaining long-term profitability.

-

Financial Performance and Profitability

HUDCO has demonstrated robust financial performance, with a 39.87% increase in Profit After Tax (PAT) year-over-year and a 30.55% growth in revenue from operations for the third quarter ending December 2024. Maintaining such profitability and revenue growth is vital for enhancing investor confidence and supporting share price appreciation.

-

Strategic Partnerships and Collaborations

Entering into significant partnerships, such as the Memorandum of Understanding (MoU) with the Mumbai Metropolitan Region Development Authority (MMRDA) to fund infrastructure projects worth ₹1.5 lakh crore, positions HUDCO to play a central role in major urban development projects. Such collaborations can substantially boost the company’s project pipeline and revenue streams.

-

Credit Ratings and Borrowing Capacity

HUDCO’s creditworthiness, as reflected in its credit ratings, influences its ability to raise funds at favorable terms. The company’s close ties with the government and its policy mission to support affordable housing contribute to its stable credit outlook. Maintaining or improving these ratings is essential for financing future growth initiatives effectively.

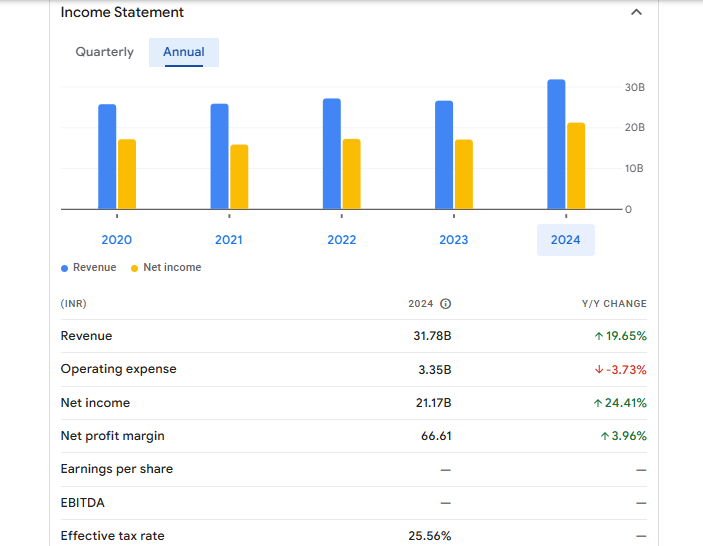

Financial Statement Of Hudco

| (INR) | 2024 | Y/Y change |

| Revenue | 31.78B | 19.65% |

| Operating expense | 3.35B | -3.73% |

| Net income | 21.17B | 24.41% |

| Net profit margin | 66.61 | 3.96% |

| Earnings per share | — | — |

| EBITDA | — | — |

| Effective tax rate | 25.56% | — |

Read Also:- PCBL Share Price Target Tomorrow 2025, 2026 To 2030