Igarashi Motors India Ltd. is a trusted name in the world of automotive micro motors, especially known for its work in power window and seat adjustment motors. Whether you’re a new investor or someone closely watching the stock market, understanding the future of Igarashi Motors can help guide smart decisions. Igarashi Motors Share Price on 7 April 2025 is 438.10 INR. This article will provide more details on Igarashi Motors Share Price Target 2025, 2026 to 2030.

Igarashi Motors Company Info

- Founded: 1992

- Headquarters: Nova Scotia, Canada

- Number of employees: 675 (2024)

- Parent organization: Agile Electric Sub Assembly Private Limited

- Subsidiary: Igarashi Motors Sales Pvt Ltd.

Igarashi Motors Share Price Chart

Igarashi Motors Share Price Details

- Today Open: 493.85

- Today High: 493.85

- Today Low: 429.05

- Mkt cap: 1.38KCr

- P/E ratio: 52.52

- Div yield: 0.23%

- 52-wk high: 848.95

- 52-wk low: 410.00

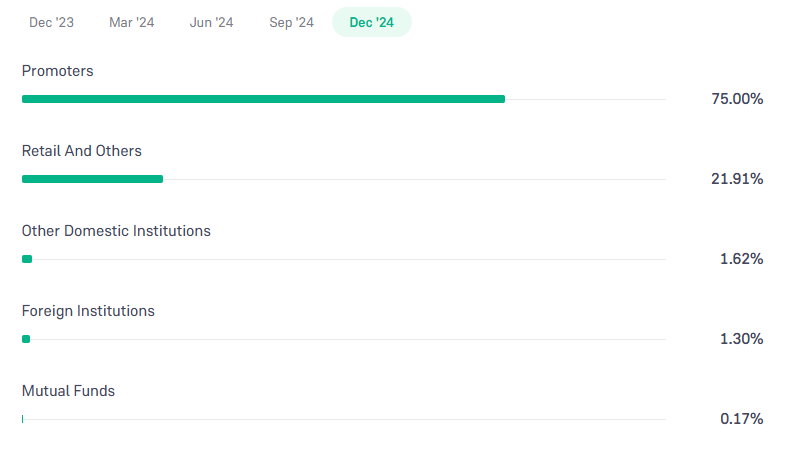

Igarashi Motors Shareholding Pattern

- Promoters: 75%

- Foreign Institutions: 1.30%

- Mutual Funds: 0.17%

- Retails and others: 21.91%

- Domestic Institutions: 1.62%

Igarashi Motors Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹850

- 2026 – ₹900

- 2027 – ₹950

- 2028 – ₹1000

- 2029 – ₹1050

- 2030 – ₹1100

Igarashi Motors Share Price Target 2025

Igarashi Motors share price target 2025 Expected target could be ₹850. As of April 2025, Igarashi Motors India Ltd. is a notable player in the automotive components sector, specializing in micro motors. Several key factors are influencing the company’s share price target for 2025:

-

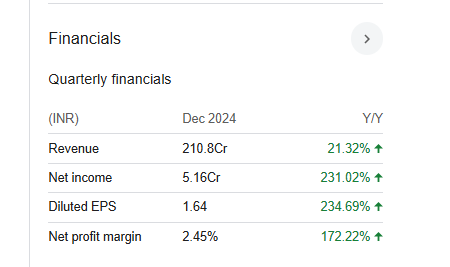

Financial Performance: In Q3 FY2025, Igarashi Motors reported a net profit of ₹5.16 crore, marking a 230.77% year-over-year increase, with revenue reaching ₹210.8 crore.

-

Earnings Per Share (EPS) Growth: The company achieved an EPS of ₹1.64 in Q3 FY2025, up from ₹0.49 in the same quarter of the previous year, indicating enhanced profitability.

-

Return on Equity (ROE): Igarashi Motors has a relatively low ROE compared to the industry average of 12%, which may impact investor perceptions and valuation.

-

Market Position and Competition: The company’s performance is influenced by its competitive standing in the automotive components industry, where factors such as product innovation and market share play crucial roles.

-

Regulatory Compliance: Adherence to regulations set by the Securities and Exchange Board of India (SEBI) and other governing bodies is essential for maintaining operational legitimacy and investor confidence.

Igarashi Motors Share Price Target 2030

Igarashi Motors share price target 2030 Expected target could be ₹1100. As of April 2025, Igarashi Motors India Ltd. is a significant player in the automotive micro motor industry. Several key factors are projected to influence the company’s share price trajectory leading up to 2030:

-

Expansion in the Automotive Micro Motor Market

The global automotive micro motor market is projected to grow from USD 16,180 million in 2023 to USD 19,880 million by 2030, at a compound annual growth rate (CAGR) of 3.1%. This growth is driven by increasing demand for comfort and convenience features in modern vehicles, such as power windows and automatic seat adjustments, which rely on micro motors. -

Growth in the Indian Automotive Sector

Indian passenger vehicle sales are expected to increase from 4.1 million units in 2023 to 6.0 million units by 2030, reflecting a CAGR of 5.6%. This expansion presents opportunities for Igarashi Motors to enhance its market presence and revenue streams. -

Financial Performance and Return on Equity (ROE)

Igarashi Motors India has experienced a decline in earnings, with an average annual decrease of 15.8%, while the auto components industry saw earnings growth of 28%. Additionally, the company’s ROE is relatively low compared to the industry average of 12%, indicating potential challenges in generating shareholder value. -

Technological Innovation and Product Development

To maintain a competitive edge, Igarashi Motors must invest in research and development to introduce innovative micro motor solutions that cater to evolving automotive technologies, such as electric and autonomous vehicles. -

Regulatory Compliance and Sustainability Initiatives

Adhering to environmental regulations and adopting sustainable manufacturing practices are becoming increasingly important in the automotive industry. Igarashi Motors’ commitment to these areas can enhance its reputation and mitigate risks associated with regulatory compliance.

Financial Statement Of Igarashi Motors

| (INR) | 2024 | Y/Y change |

| Revenue | 7.25B | 10.48% |

| Operating expense | 2.00B | 6.77% |

| Net income | 95.73M | 82.77% |

| Net profit margin | 1.32 | 65.00% |

| Earnings per share | — | — |

| EBITDA | 653.36M | 18.36% |

| Effective tax rate | 31.02% | — |

Read Also:- GSFC Share Price Target Tomorrow 2025, 2026 To 2030