Investors looking at IGL (Indraprastha Gas Limited) are often curious about its future growth and share price potential. As a leading player in the city gas distribution sector, IGL benefits from India’s rising demand for clean energy. With strong fundamentals, government support, and expansion plans, the company holds promising prospects for long-term investors. IGL Share Price on 31 March 2025 is 203.78 INR. This article will provide more details on IGL Share Price Target 2025, 2026 to 2030.

IGL Company Info

- Founded: 1998

- Headquarters: New Delhi

- Number of employees: 719 (2024)

- Revenue: 15,805 crores INR (US$2.0 billion, FY23)

- Subsidiaries: Maharashtra Natural Gas Limited, Central U.P. Gas Limited

IGL Share Price Chart

IGL Share Price Details

- Today Open: 197.99

- Today High: 204.36

- Today Low: 193.85

- Mkt cap: 28.36KCr

- P/E ratio: 23.71

- Div yield: 2.58%

- 52-wk high: 285.18

- 52-wk low: 153.05

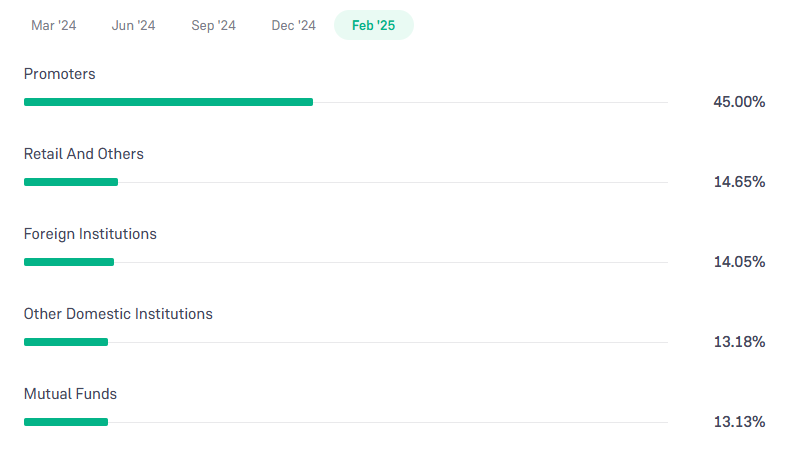

IGL Shareholding Pattern

- Promoters: 45%

- Foreign Institutions: 14.05%

- Mutual Funds: 13.13%

- Retails and others: 14.65%

- Domestic Institutions: 13.18%

IGL Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹290

- 2026 – ₹340

- 2027 – ₹390

- 2028 – ₹440

- 2029 – ₹490

- 2030 – ₹540

IGL Share Price Target 2025

IGL share price target 2025 Expected target could be ₹290. Here are 5 Key Factors Affecting Growth for IGL Share Price Target 2025:

-

Rising Demand for Natural Gas – As India moves towards cleaner energy solutions, the demand for CNG and PNG is expected to grow, benefiting Indraprastha Gas Limited (IGL).

-

Government Policies & Support – Favorable policies promoting the use of natural gas, subsidies, and expansion plans in new cities can drive IGL’s growth.

-

Expansion of Gas Distribution Network – IGL’s plans to expand its pipeline infrastructure and reach more customers will play a key role in increasing revenue.

-

Crude Oil & Gas Price Volatility – Fluctuations in global crude oil and natural gas prices can impact margins and influence IGL’s profitability.

-

Competition & Market Share – The entry of new players in the city gas distribution (CGD) sector and pricing strategies will affect IGL’s market position and share price movement.

IGL Share Price Target 2030

IGL share price target 2030 Expected target could be ₹540. Here are 5 Key Factors Affecting Growth for IGL Share Price Target 2030:

-

Long-Term Demand for Clean Energy – With India’s push towards a greener future, the demand for CNG and PNG is expected to rise significantly, benefiting IGL in the long run.

-

Infrastructure & Network Expansion – IGL’s plans to expand its city gas distribution (CGD) network across new regions will be crucial in sustaining growth and increasing revenue.

-

Technological Advancements – Innovations in gas distribution, smart metering, and efficient energy management can improve operational efficiency and profitability for IGL.

-

Government Regulations & Policies – Supportive policies, tax benefits, and subsidies for the natural gas sector will have a direct impact on IGL’s business growth and stock performance.

-

Global Energy Market Trends – Changes in global natural gas prices, crude oil market conditions, and geopolitical factors will influence IGL’s profitability and share price movement by 2030.

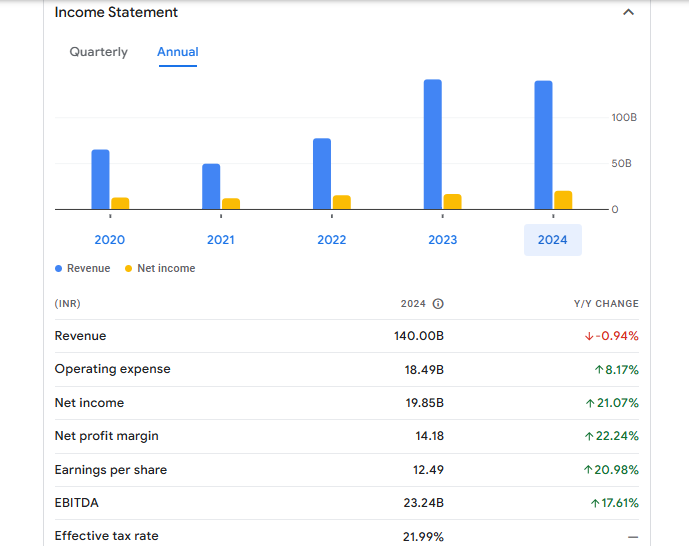

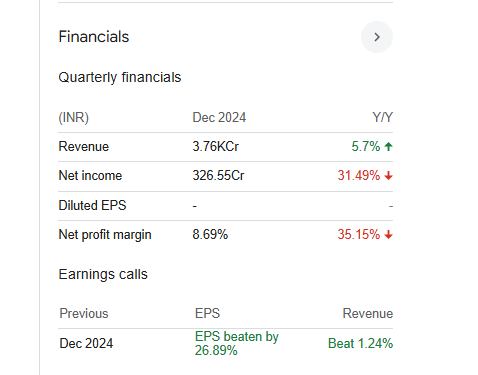

Financial Statement Of IGL

| (INR) | 2024 | Y/Y change |

| Revenue | 140.00B | -0.94% |

| Operating expense | 18.49B | 8.17% |

| Net income | 19.85B | 21.07% |

| Net profit margin | 14.18 | 22.24% |

| Earnings per share | 12.49 | 20.98% |

| EBITDA | 23.24B | 17.61% |

| Effective tax rate | 21.99% | — |

Read Also:- JM Financial Share Price Target Tomorrow 2025, 2026 To 2030