Indian Infotech & Software Ltd. is a small but growing company working in the finance and IT services sector. Over the years, it has attracted attention from investors looking for affordable stocks with long-term potential. As the company continues to improve its services and expand its reach, many people are curious about where its share price could be heading. Indian Infotech Share Price on 4 April 2025 is 1.13 INR. This article will provide more details on Indian Infotech Share Price Target 2025, 2026 to 2030.

Indian Infotech Company Info

- Headquarters: India, Mumbai

- Number of employees: 10 (2024)

- Subsidiary: Indian Infotech and Software Limited, Asset Management Arm.

Indian Infotech Share Price Chart

Indian Infotech Share Price Details

- Today Open: 1.12

- Today High: 1.14

- Today Low: 1.11

- Mkt cap: 143.18Cr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 1.78

- 52-wk low: 1.07

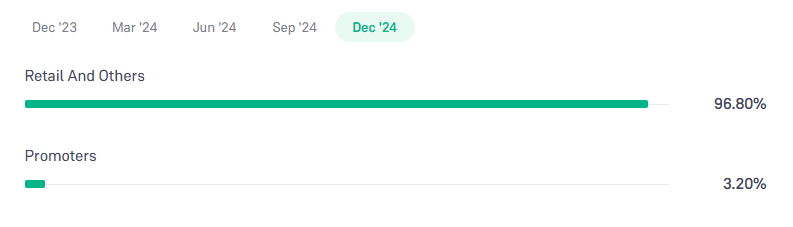

Indian Infotech Shareholding Pattern

- Promoters: 3.20%

- Foreign Institutions: 0%

- Mutual Funds: 0%

- Retails and others: 96.80%

- Domestic Institutions: 0%

Indian Infotech Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹2

- 2026 – ₹4

- 2027 – ₹6

- 2028 – ₹8

- 2029 – ₹10

- 2030 – ₹12

Indian Infotech Share Price Target 2025

Indian Infotech share price target 2025 Expected target could be ₹2. As of April 2025, Indian Infotech and Software Ltd. operates as a non-banking financial company (NBFC) in India, primarily engaged in providing loans to retail and corporate borrowers. The company’s share price target for 2025 is influenced by several key factors:

-

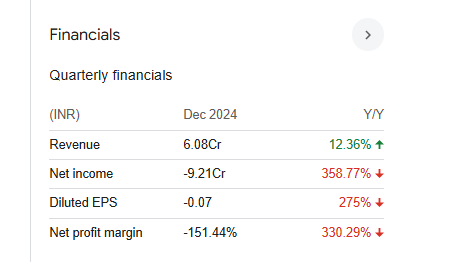

Financial Performance: The company’s financial results have shown variability. For instance, in the quarter ending December 2024, Indian Infotech reported net sales of ₹17.71 crore, reflecting a 54.54% year-over-year growth. However, the same period saw a net loss of ₹9.21 crore, indicating profitability challenges.

-

Debt Management: Indian Infotech has made strides in reducing its debt, positioning itself as an almost debt-free company. This financial prudence can enhance investor confidence and positively impact the share price.

-

Market Sentiment and Analyst Forecasts: Analyst projections suggest potential growth in the company’s stock value. For example, forecasts indicate that the share price could reach ₹2.513 by March 2030, representing a 120.47% increase over five years. While this pertains to a longer-term outlook, such projections can influence current investor sentiment and share price targets for 2025.

-

Regulatory Environment and Compliance: As an NBFC, Indian Infotech’s operations are subject to regulatory oversight. Compliance with financial regulations and timely disclosures, such as board meeting announcements and financial results, play a crucial role in maintaining transparency and investor trust.

-

Operational Efficiency and Revenue Streams: The company’s ability to diversify its revenue streams and manage operational costs effectively will be pivotal. Initiatives aimed at enhancing operational efficiency and exploring new business opportunities can contribute to improved financial performance and, consequently, a favorable share price trajectory.

Indian Infotech Share Price Target 2030

Indian Infotech share price target 2030 Expected target could be ₹12. Here are 5 key factors that could influence the Indian Infotech & Software Ltd. share price target by 2030:

-

Digital Finance and NBFC Sector Growth

As India continues its digital transformation, the demand for tech-driven financial services is expected to rise. Indian Infotech, operating as an NBFC, could benefit if it adapts and scales with the growing fintech ecosystem by offering digital lending and financial products. -

Business Diversification and Strategic Expansion

By 2030, companies that diversify their revenue streams—such as venturing into software services, digital platforms, or tech consulting—will likely perform better. Indian Infotech’s future growth will depend on its ability to expand beyond traditional NBFC services. -

Technological Adoption

Staying competitive in the financial and tech sectors will require investment in AI, data analytics, and automation. If Indian Infotech embraces these trends and improves efficiency and customer experience, it could see long-term stock appreciation. -

Regulatory Compliance and Stability

With increased regulatory scrutiny in both tech and finance sectors, maintaining a strong compliance record and transparent governance will be key to investor trust and sustainable growth. -

Financial Health and Consistent Profitability

By 2030, investors will likely favor companies with stable revenue, low debt, and improving net profits. Indian Infotech’s ability to manage expenses and grow profitably will have a direct impact on its share price target in the long run.

Financial Statement Of Indian Infotech

| (INR) | 2024 | Y/Y change |

| Revenue | 211.21M | -55.12% |

| Operating expense | 180.70M | 1,112.31% |

| Net income | 17.16M | 183.22% |

| Net profit margin | 8.12 | 529.46% |

| Earnings per share | — | — |

| EBITDA | — | — |

| Effective tax rate | 26.12% | — |

Read Also:- Va Tech Wabag Share Price Target Tomorrow 2025, 2026 To 2030