Indo Farm Equipment is a growing name in the tractor and construction equipment industry, known for its quality and innovation. Investors are interested in how its share price will perform in the coming years. With increasing demand for farm machinery, expansion plans, and government support for agriculture, the company has strong growth potential. Indo Farm Equipment Share Price on 3 April 2025 is 163.75 INR. This article will provide more details on Indo Farm Equipment Share Price Target 2025, 2026 to 2030.

Indo Farm Equipment Company Info

- Founded: 1994

- Headquarters: India

- Number of employees: 886 (2023).

Indo Farm Equipment Share Price Chart

Indo Farm Equipment Share Price Details

- Today Open: 163.05

- Today High: 165.00

- Today Low: 159.11

- Mkt cap: 788.43Cr

- P/E ratio: N/A

- Div yield: N/A

- 52-wk high: 293.20

- 52-wk low: 150.11

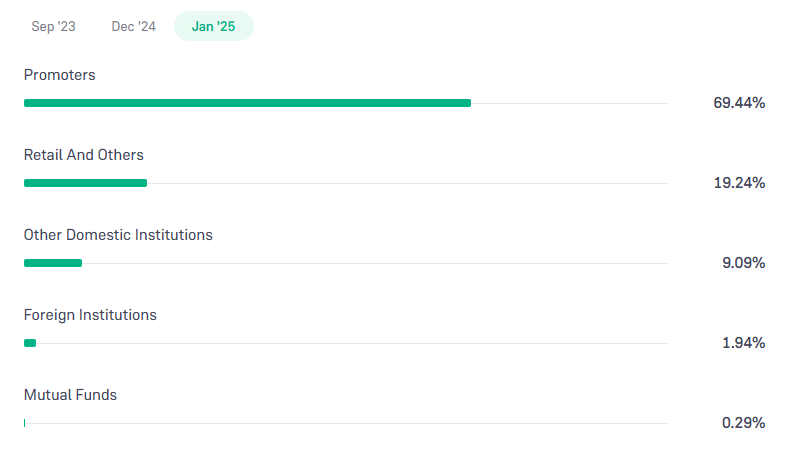

Indo Farm Equipment Shareholding Pattern

- Promoters: 69.44%

- Foreign Institutions: 1.94%

- Mutual Funds: 0.29%

- Retails and others: 19.24%

- Domestic Institutions: 9.09%

Indo Farm Equipment Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹300

- 2026 – ₹400

- 2027 – ₹500

- 2028 – ₹600

- 2029 – ₹700

- 2030 – ₹800

Indo Farm Equipment Share Price Target 2025

Indo Farm Equipment share price target 2025 Expected target could be ₹300. Here are five key factors that could influence Indo Farm Equipment Limited’s share price target for 2025:

-

Financial Performance: In Fiscal Year 2024, the company reported revenue from operations of ₹375.2 crore and a Profit After Tax (PAT) of ₹15.5 crore. Consistent growth in revenue and profitability will be crucial for enhancing investor confidence and positively impacting the share price.

-

Utilization of IPO Proceeds: Following its Initial Public Offering (IPO) in January 2025, Indo Farm Equipment plans to allocate funds towards expanding its pick-and-carry crane manufacturing capacity and strengthening its dealer network. Effective execution of these plans is expected to drive future growth and influence the company’s market valuation.

-

Product Innovation and Technological Advancements: The company’s focus on modernizing its product line, including the development of advanced 4WD tractors, positions it to meet evolving agricultural demands. Successful innovation can enhance market share and contribute to revenue growth.

-

Market Expansion and Dealer Network Strengthening: Efforts to expand into new markets and bolster the dealer network are pivotal for increasing sales volume and revenue. The company’s strategic initiatives in this direction will play a significant role in its growth trajectory.

-

Macroeconomic and Industry Trends: Factors such as government policies promoting agricultural mechanization, economic conditions, and industry competition will impact the company’s performance. Staying attuned to these trends and adapting strategies accordingly will be essential for sustained growth.

Indo Farm Equipment Share Price Target 2030

Indo Farm Equipment share price target 2030 Expected target could be ₹800. Here are five key factors that could influence the Indo Farm Equipment share price target for 2030:

-

Business Expansion & Market Penetration – Indo Farm Equipment’s ability to expand into new domestic and international markets, especially in Africa, Southeast Asia, and Latin America, will play a crucial role in its long-term growth.

-

Technology & Innovation in Farm Machinery – Investing in advanced tractors, automation, and precision farming equipment will help Indo Farm stay competitive and meet future agricultural demands.

-

Government Policies & Agricultural Reforms – Supportive government policies, such as subsidies for mechanized farming, low-interest loans, and infrastructure investments, can significantly boost demand for farm equipment.

-

Financial Performance & Profitability – Maintaining strong revenue growth, reducing production costs, and improving profit margins will be key to attracting long-term investors and ensuring share price appreciation.

-

Industry Competition & Global Economic Conditions – Indo Farm will need to compete with established brands while adapting to global economic changes, raw material price fluctuations, and supply chain disruptions to sustain its growth.

Financial Statement Of Indo Farm Equipment

| (INR) | 2024 | Y/Y change |

| Revenue | 3.75B | 1.21% |

| Operating expense | 1.02B | 6.49% |

| Net income | 155.95M | 1.45% |

| Net profit margin | 4.16 | 0.24% |

| Earnings per share | — | — |

| EBITDA | 626.69M | 7.80% |

| Effective tax rate | 34.73% | — |

Read Also:- Lupin Share Price Target Tomorrow 2025, 2026 To 2030