IRB Infrastructure is one of the leading players in India’s road and highway construction sector. Investors are keen to know its future growth potential and share price targets. With strong government support for infrastructure development and ongoing highway projects, the company has a promising outlook. IRB Infrastructure Share Price on 22 March 2025 is 46.85 INR. This article will provide more details on IRB Infrastructure Share Price Target 2025, 2026 to 2030.

IRB Infrastructure Company Info

- Founded: 27 July 1998, Mumbai

- Headquarters: Mumbai

- Number of employees: 3,180 (2024)

- Revenue: 2,750.27 crores INR (US$340 million, 2021)

- Subsidiaries: Irb Infrastructure Private Limited

IRB Infrastructure Share Price Chart

IRB Infrastructure Share Price Details

- Today Open: 45.85

- Today High: 47.13

- Today Low: 45.61

- Mkt cap: 28.34KCr

- P/E ratio: 4.38

- Div yield: 0.80%

- 52-wk high: 78.15

- 52-wk low: 41.04

IRB Infrastructure Shareholding Pattern

- Promoters: 30.42%

- Foreign Institutions: 45.07%

- Mutual Funds: 4.61%

- Retails and others: 15.93%

- Domestic Institutions: 3.96%

IRB Infrastructure Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹80

- 2026 – ₹100

- 2027 – ₹120

- 2028 – ₹140

- 2029 – ₹160

- 2030 – ₹180

IRB Infrastructure Share Price Target 2025

IRB Infrastructure share price target 2025 Expected target could be ₹80. Here are 5 Key Factors Affecting Growth for IRB Infrastructure Share Price Target 2025:

-

Government Infrastructure Projects – IRB Infrastructure heavily benefits from government initiatives like road construction, highway expansion, and smart city projects, boosting revenue and share price potential.

-

Toll Revenue Growth – The company’s toll collection on highways and expressways plays a crucial role in revenue generation. Increasing traffic and new toll projects can enhance profitability.

-

Debt Management & Funding – Efficient handling of debt and securing new funding sources for projects will determine financial stability and future growth.

-

Private Investment & FDI – Rising interest from private investors and foreign direct investment (FDI) in infrastructure can support IRB’s expansion and share price appreciation.

-

Economic Growth & Demand – A strong economy increases demand for better roads and infrastructure, leading to more projects and revenue growth for IRB Infrastructure.

IRB Infrastructure Share Price Target 2030

IRB Infrastructure share price target 2030 Expected target could be ₹180. Here are 5 Key Factors Affecting Growth for IRB Infrastructure Share Price Target 2030:

-

Long-Term Government Policies & Budget Allocation – Continuous investment in infrastructure projects under government policies like Bharatmala and Smart Cities will drive IRB’s growth over the next decade.

-

Expansion of Road & Highway Projects – IRB Infrastructure’s involvement in new expressways, highways, and public-private partnerships will significantly impact its revenue and market valuation.

-

Adoption of Technology in Toll Collection – The shift towards digital toll collection methods like FASTag and automated systems can improve efficiency, reducing operational costs and boosting profitability.

-

Sustainable & Green Infrastructure Development – With increasing focus on environmental sustainability, IRB’s involvement in eco-friendly road projects and carbon footprint reduction can attract investors and enhance growth.

-

Global & Domestic Economic Stability – The overall economic environment, including GDP growth, inflation control, and interest rates, will determine investment flows into the infrastructure sector and impact IRB’s stock performance.

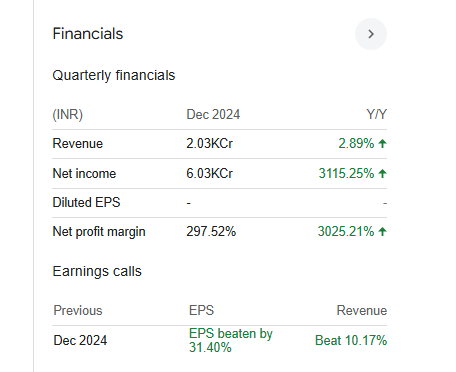

Financials Statement Of IRB Infrastructure

| (INR) | 2024 | Y/Y change |

| Revenue | 20.25B | 2.89% |

| Operating expense | 4.97B | 9.99% |

| Net income | 60.26B | 3,115.25% |

| Net profit margin | 297.52 | 3,025.21% |

| Earnings per share | 0.53 | 69.55% |

| EBITDA | 9.67B | 17.17% |

| Effective tax rate | 1.64% | — |

Read Also:- Asian Paints Share Price Target Tomorrow 2025, 2026 To 2030