Investors looking for potential growth in the infrastructure sector often consider ITD Cementation (ITDCEM) as a strong choice. The company has a solid track record in construction and engineering, playing a key role in major projects across India. With a focus on innovation and expansion, ITDCEM’s share price performance depends on multiple factors like government policies, project execution, and financial stability. ITDCEM Share Price on 26 March 2025 is 556.60 INR. This article will provide more details on ITDCEM Share Price Target 2025, 2026 to 2030.

ITDCEM Company Info

- Headquarters: India

- Number of employees: 2,632 (2024)

- Subsidiaries: Itd Cemindia JV, CEC-ITD Cem-TPL JV, ITD-ITDCEM Joint Venture

ITDCEM Share Price Chart

ITDCEM Share Price Details

- Today Open: 563.00

- Today High: 563.95

- Today Low: 554.25

- Mkt cap: 9.54KCr

- P/E ratio: 27.41

- Div yield: 0.31%

- 52-wk high: 694.30

- 52-wk low: 311.10

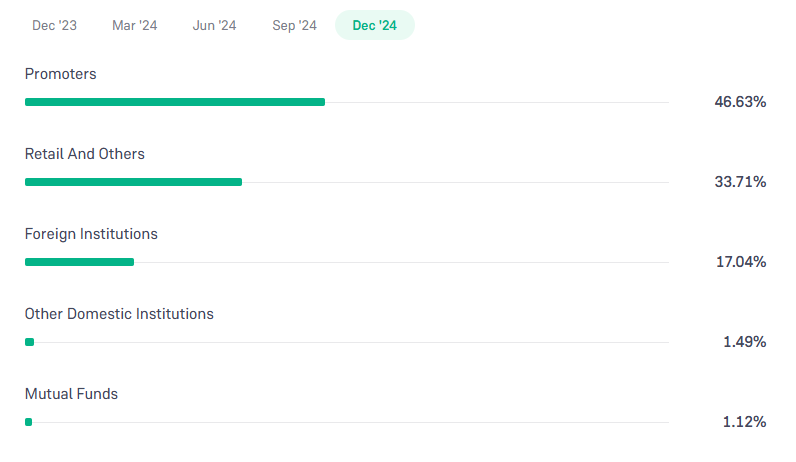

ITDCEM Shareholding Pattern

- Promoters: 46.63%

- Foreign Institutions: 17.04%

- Mutual Funds: 1.12%

- Retails and others: 33.71

- Domestic Institutions: 1.49%

ITDCEM Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹700

- 2026 – ₹950

- 2027 – ₹1200

- 2028 – ₹1450

- 2029 – ₹1700

- 2030 – ₹1950

ITDCEM Share Price Target 2025

ITDCEM share price target 2025 Expected target could be ₹700. Here are 5 Key Factors Affecting Growth for ITD Cementation (ITDCEM) Share Price Target 2025:

-

Government Infrastructure Projects – ITDCEM benefits from large-scale government investments in roads, bridges, metro rail, and urban infrastructure, which drive revenue growth.

-

Order Book & Project Execution – A strong order book and timely execution of projects will be crucial in maintaining profitability and investor confidence.

-

Raw Material Costs & Supply Chain Efficiency – Fluctuations in the prices of cement, steel, and other raw materials can impact profit margins, making cost management a key factor.

-

Technological Advancements & Innovation – Adoption of modern construction techniques and automation can improve efficiency, reduce costs, and enhance competitiveness.

-

Economic & Regulatory Environment – Favorable government policies, ease of doing business, and infrastructure spending will significantly influence ITDCEM’s growth and stock performance.

ITDCEM Share Price Target 2030

ITDCEM share price target 2030 Expected target could be ₹1950. Here are 5 Key Factors Affecting Growth for ITD Cementation (ITDCEM) Share Price Target 2030:

-

Long-Term Infrastructure Development Plans – The company’s growth will depend on India’s long-term infrastructure vision, including smart cities, high-speed rail, and urban expansion projects.

-

International Expansion & New Markets – Diversifying into global markets or securing large-scale international contracts could drive revenue and enhance ITDCEM’s global presence.

-

Adoption of Sustainable & Green Construction – The increasing focus on eco-friendly construction practices and sustainable materials may create new opportunities for ITDCEM.

-

Technological Innovations & Automation – Investments in AI, automation, and digital construction technologies will be key in improving efficiency, reducing costs, and maintaining a competitive edge.

-

Financial Stability & Debt Management – Strong financial performance, controlled debt levels, and a healthy cash flow will be crucial for sustained growth and investor confidence by 2030.

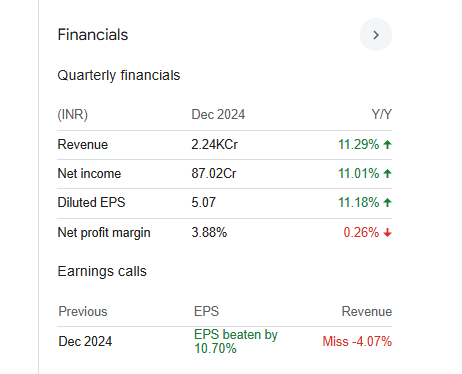

Financials Statement Of ITDCEM

| (INR) | 2024 | Y/Y change |

| Revenue | 77.18B | 51.60% |

| Operating expense | 21.53B | 38.63% |

| Net income | 2.74B | 120.32% |

| Net profit margin | 3.55 | 45.49% |

| Earnings per share | 15.93 | 120.33% |

| EBITDA | 7.25B | 89.99% |

| Effective tax rate | 28.42% | — |

Read Also:- UTI AMC Share Price Target Tomorrow 2025, 2026 To 2030