Maruti Suzuki is one of India’s most trusted and leading automobile companies, known for its quality, innovation, and strong market presence. Investors are always curious about its future growth and share price trends. If you are looking for insights into Maruti Suzuki’s share price target, you are in the right place. Maruti Suzuki Share Price on 22 March 2025 is 11,769.20 INR. This article will provide more details on Maruti Suzuki Share Price Target 2025, 2026 to 2030.

Maruti Suzuki Company Info

- Founded: 24 February 1981, Gurugram

- Founder: Government of India

- Headquarters: New Delhi

- Number of employees: 18,228 (2024)

- Parent organization: Suzuki

- Revenue: 1.46 lakh crores INR (US$18 billion, 2024)

- Subsidiaries: True Value Solutions Ltd

Maruti Suzuki Share Price Chart

Maruti Suzuki Share Price Details

- Today Open: 11,780.00

- Today High: 11,921.70

- Today Low: 11,705.80

- Mkt cap: 3.69LCr

- P/E ratio: 25.45

- Div yield: 1.06%

- 52-wk high: 13,680.00

- 52-wk low: 10,725.00

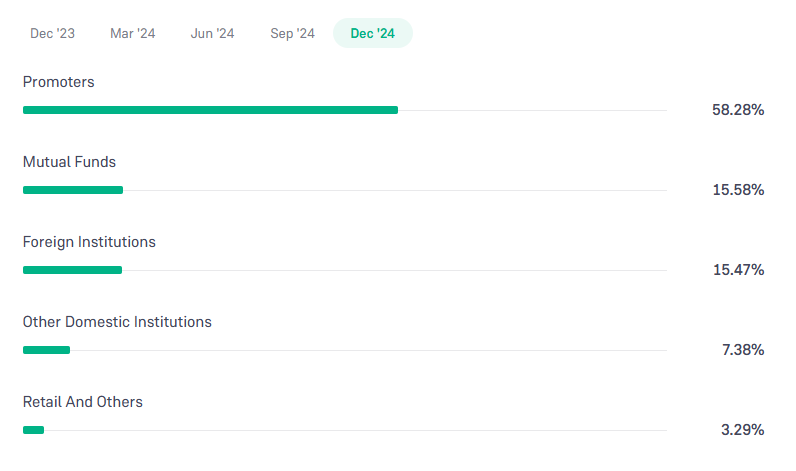

Maruti Suzuki Shareholding Pattern

- Promoters: 58.28%

- Foreign Institutions: 15.47%

- Mutual Funds: 15.58%

- Retails and others: 3.29%

- Domestic Institutions: 7.38%

Maruti Suzuki Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹13,680

- 2026 – ₹14,840

- 2027 – ₹16,020

- 2028 – ₹17,140

- 2029 – ₹18,260

- 2030 – ₹19,155

Maruti Suzuki Share Price Target 2025

Maruti Suzuki share price target 2025 Expected target could be ₹13,680. Here are 5 Key Factors Affecting Growth for Maruti Suzuki Share Price Target 2025:

-

Demand for Passenger Vehicles – The increasing demand for affordable and fuel-efficient cars in India will play a crucial role in Maruti Suzuki’s growth. A rise in disposable income and urbanization will further drive sales.

-

Electric Vehicle (EV) Expansion – Maruti Suzuki’s entry into the EV segment and its plans to launch new electric and hybrid vehicles will impact its market share and stock performance.

-

Raw Material Costs & Supply Chain Stability – The availability and pricing of essential raw materials like steel and semiconductor chips can affect production costs and profit margins.

-

Government Policies & Regulations – Favorable government policies, incentives for electric vehicles, and changes in emission norms will influence Maruti Suzuki’s growth and operational strategies.

-

Competition from Other Brands – Rising competition from domestic and international car manufacturers, including Tata Motors, Hyundai, and global EV brands, will determine Maruti Suzuki’s market dominance.

Maruti Suzuki Share Price Target 2030

Maruti Suzuki share price target 2030 Expected target could be ₹19,155. Here are 5 Key Factors Affecting Growth for Maruti Suzuki Share Price Target 2030:

-

Adoption of Electric Vehicles (EVs) – Maruti Suzuki’s long-term growth will depend on its ability to compete in the EV market. Investments in EV technology, charging infrastructure, and battery innovation will be key factors.

-

Expansion in Global Markets – Increasing exports and entry into new international markets will play a significant role in boosting revenue and stock value by 2030.

-

Technological Advancements & Smart Mobility – The integration of AI, autonomous driving, and connected car technology will shape Maruti Suzuki’s competitiveness in the auto industry.

-

Sustainability & Government Regulations – Stricter emission norms, environmental policies, and the push for greener transportation solutions will impact production strategies and vehicle design.

-

Economic & Consumer Trends – Long-term growth will be influenced by India’s economic development, infrastructure expansion, and changing consumer preferences for premium, feature-rich, and eco-friendly vehicles.

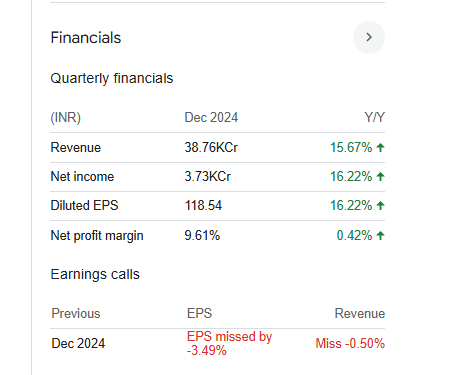

Financials Statement Of Maruti Suzuki

| (INR) | 2024 | Y/Y change |

| Revenue | 1.42T | 19.80% |

| Operating expense | 274.43B | 16.47% |

| Net income | 134.88B | 63.22% |

| Net profit margin | 9.51 | 36.25% |

| Earnings per share | 431.08 | 61.78% |

| EBITDA | 185.85B | 41.93% |

| Effective tax rate | 22.59% | — |

Read Also:- IRB Infrastructure Share Price Target Tomorrow 2025, 2026 To 2030