Mazagon Dock Shipbuilders is a well-known name in India’s defense and shipbuilding sector. Investors are keen to know its future share price potential, given its strong government backing and growing demand for warships and submarines. With continuous modernization, strategic partnerships, and increasing defense budgets, Mazagon Dock holds promising growth prospects. Mazagin Dock Share Price on 15 March 2025 is 2,310.25 INR. This article will provide more details on Mazagin Dock Share Price Target 2025, 2026 to 2030.

Mazagin Dock Company Info

- Founded: 1934

- Headquarters: India

- Number of employees: 2,814 (2024)

- Revenue: 7,827.18 crores INR (US$980 million, 2023)

Mazagin Dock Share Price Chart

Mazagin Dock Share Price Details

- Today Open: 2,267.05

- Today High: 2,340.00

- Today Low: 2,235.90

- Mkt cap: 93.40KCr

- P/E ratio: 33.87

- Div yield: 0.76%

- 52-wk high: 2,930.00

- 52-wk low: 897.70

Mazagin Dock Shareholding Pattern

- Promoters: 84.83%

- Foreign Institutions: 1.55%

- Mutual Funds: 1.23%

- Retails and others: 12.16%

- Domestic Institutions: 0.23%

Mazagin Dock Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹2930

- 2026 – ₹4350

- 2027 – ₹5643

- 2028 – ₹6720

- 2029 – ₹7573

- 2030 – ₹8860

Mazagin Dock Share Price Target 2025

Mazagin Dock share price target 2025 Expected target could be ₹2930. Here are 5 Key Factors Affecting Growth for Mazagon Dock Share Price Target 2025:

-

Strong Order Book & Defense Contracts – Mazagon Dock is a key player in India’s defense sector, securing large contracts for naval ships and submarines. A growing order book from the Indian Navy and Coast Guard will support revenue growth.

-

Government’s Focus on Defense & Make in India – The Indian government’s push for self-reliance in defense manufacturing under the “Atmanirbhar Bharat” initiative is expected to benefit Mazagon Dock through increased local production and partnerships.

-

Technological Advancements & Modernization – Investing in advanced shipbuilding technology and automation can improve efficiency and enhance the company’s production capacity, driving future growth.

-

Export Opportunities – With rising global demand for warships and defense vessels, Mazagon Dock has the potential to expand internationally by exporting to friendly nations, increasing revenue streams.

-

Financial Performance & Profit Margins – Consistent growth in revenue, profitability, and efficient cost management will play a crucial role in sustaining investor confidence and boosting share price performance.

Mazagin Dock Share Price Target 2030

Mazagin Dock share price target 2030 Expected target could be ₹8860. Here are 5 Key Factors Affecting Growth for Mazagon Dock Share Price Target 2030:

-

Long-Term Defense Contracts & Naval Expansion – Continued collaborations with the Indian Navy and potential foreign defense contracts will drive Mazagon Dock’s revenue and market expansion.

-

Technological Advancements in Shipbuilding – Adoption of cutting-edge shipbuilding techniques, automation, and AI-driven design processes will enhance efficiency and production capacity, boosting growth.

-

Diversification into Commercial Shipbuilding – Expanding beyond defense projects into commercial shipbuilding and repair services could create additional revenue streams and reduce dependency on government contracts.

-

Strategic Global Partnerships & Exports – Collaborations with international defense manufacturers and increased exports of submarines and warships to allied nations can significantly contribute to the company’s long-term growth.

-

Government Policies & Budget Allocation – Consistent financial backing from the government, increased defense budgets, and favorable policies supporting indigenous manufacturing will be key in shaping the company’s future share price trajectory.

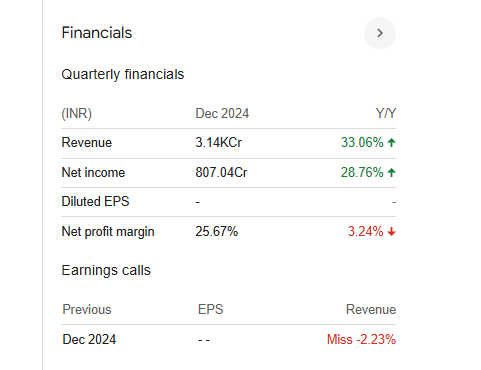

Financials Statement Of Mazagin Dock

| (INR) | 2024 | Y/Y change |

| Revenue | 94.67B | 20.94% |

| Operating expense | 14.80B | 0.14% |

| Net income | 19.37B | 73.09% |

| Net profit margin | 20.46 | 43.08% |

| Earnings per share | 48.02 | 73.11% |

| EBITDA | 14.01B | 74.80% |

| Effective tax rate | 24.13% | — |

Read Also:- Dr Agarwal’s Health Care Share Price Target Tomorrow 2025, 2026 To 2030