If you’re looking to invest in MMTC shares or just want to understand its future growth potential, you’re in the right place. MMTC Limited is one of India’s largest trading companies, known for its role in exports and imports of commodities like metals, minerals, and agro products. Over the years, it has shown resilience and adaptability in a fast-changing market. MMTC Share Price on 12 April 2025 is 50.31 INR. This article will provide more details on MMTC Share Price Target 2025, 2026 to 2030.

MMTC Company Info

- Founded: 26 September 1963

- Headquarters: New Delhi

- Number of employees: 361 (2024)

- Revenue: 28,997.23 crores INR (US$3.6 billion, 2019)

- Subsidiaries: MMTC-PAMP India Private.

MMTC Share Price Chart

MMTC Share Price Details

- Today Open: 50.47

- Today High: 50.90

- Today Low: 49.76

- Mkt cap: 7.56KCr

- P/E ratio: 49.40

- Div yield: N/A

- 52-wk high: 131.80

- 52-wk low: 44.50

MMTC Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹135

- 2026 – ₹160

- 2027 – ₹180

- 2028 – ₹200

- 2029 – ₹220

- 2030 – ₹240

MMTC Share Price Target 2025

MMTC share price target 2025 Expected target could be ₹135. Here are five key factors influencing MMTC Ltd.’s share price target for 2025:

-

Commodity Price Fluctuations

As a major trading company dealing in metals, minerals, and agricultural products, MMTC’s revenue is significantly influenced by global commodity prices. Volatility in these markets can directly impact the company’s profitability and, consequently, its stock performance.

-

Government Policies and Regulations

Being a public sector enterprise, MMTC’s operations are closely tied to government trade policies, import-export regulations, and international trade agreements. Any changes in these areas can affect the company’s trading activities and financial outcomes.

-

Global Economic Conditions

MMTC’s performance is linked to the global economic environment. Factors such as international demand for commodities, currency exchange rates, and geopolitical developments can influence the company’s trade volumes and margins.

-

Operational Efficiency and Diversification

Efforts to improve operational efficiency, diversify product offerings, and expand into new markets can enhance MMTC’s competitiveness. Strategic initiatives aimed at reducing costs and increasing revenue streams are crucial for sustaining growth.

-

Financial Performance Metrics

Investors closely monitor MMTC’s financial indicators, including sales growth, profit margins, and return on equity. Consistent improvement in these metrics can boost investor confidence and positively influence the share price.

MMTC Share Price Target 2030

MMTC share price target 2030 Expected target could be ₹240. Here are several key factors are expected to influence MMTC Ltd.’s growth trajectory:

-

Business Diversification and Technological Advancements

MMTC is actively working on transforming its business operations by investing in new technologies and diversifying its offerings. These initiatives are aimed at enhancing operational efficiency and tapping into new revenue streams, which could significantly boost the company’s growth by 2030.

-

Expansion into High-Growth Sectors

The company’s strategic focus on expanding its presence in high-growth sectors, such as agro-products and coal, is expected to contribute positively to its overall business performance. By tapping into these sectors, MMTC aims to reduce its reliance on traditional trading activities and explore new avenues for revenue generation.

-

Impact of Government Policies and Infrastructure Initiatives

Government policies, including the National Infrastructure Pipeline, which anticipates ₹100 trillion in investments by 2025, are likely to increase demand for MMTC’s traded commodities. Such infrastructure initiatives can provide a favorable environment for the company’s growth.

-

Financial Performance and Restructuring Efforts

MMTC’s financial performance has shown signs of improvement, with net profits reported in recent quarters. The company’s ongoing restructuring efforts and focus on operational efficiency are expected to enhance its profitability and investor confidence over the long term.

-

Global Commodity Market Dynamics

As a major trading company dealing in metals, minerals, and agricultural products, MMTC’s revenue is significantly influenced by global commodity prices. Fluctuations in these markets can directly impact the company’s profitability and, consequently, its stock performance.

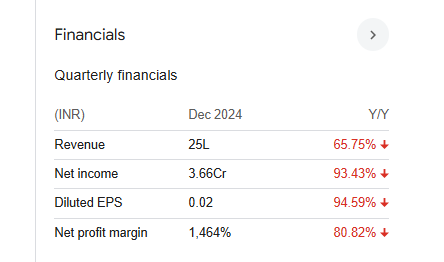

Financial Statement Of MMTC

| (INR) | 2024 | Y/Y change |

| Revenue | 53.40M | -99.85% |

| Operating expense | 1.65B | -28.85% |

| Net income | 1.92B | -87.70% |

| Net profit margin | 3.60K | 8,027.55% |

| Earnings per share | — | — |

| EBITDA | -1.63B | -49.41% |

| Effective tax rate | 3.91% | — |

Read Also:- Tips Industries Share Price Target 2025, 2026 To 2030