Orient Green Power is a well-known company in the renewable energy sector, focusing on wind and solar power. Investors looking for sustainable and long-term growth often consider this stock. The company’s share price is influenced by various factors, including government policies, energy demand, and industry competition. Orient Green Power Share Price on 6 March 2025 is 12.60 INR. This article will provide more details on Orient Green Power Share Price Target 2025, 2026 to 2030.

Orient Green Power Company Info

- Headquarters: India

- Number of employees: 129 (2024)

- Subsidiaries: Beta Wind Farm Private Limited

Orient Green Power Share Price Chart

Orient Green Power Share Price Details

- Today Open: 12.62

- Today High: 12.99

- Today Low: 12.48

- Mkt cap: 1.48KCr

- P/E ratio: 52.43

- Div yield: N/A

- 52-wk high: 23.43

- 52-wk low: 11.20

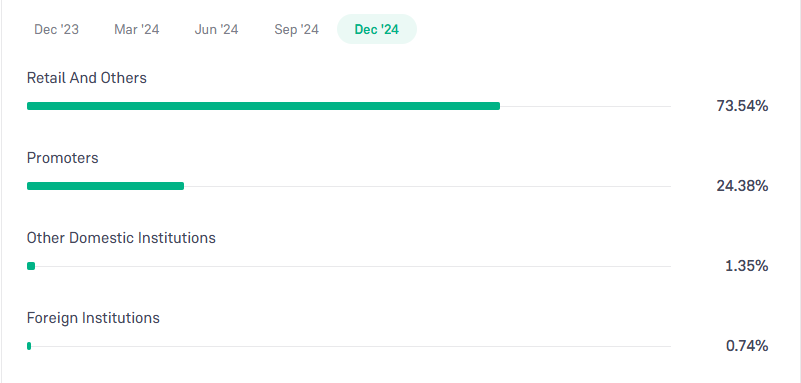

Orient Green Power Shareholding Pattern

- Promoters: 24.38%

- Foreign Institutions: 0.74%

- Mutual Funds: 0%

- Retails and others: 73.54%

- Domestic Institutions: 1.35%

Orient Green Power Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹25

- 2026 – ₹50

- 2027 – ₹75

- 2028 – ₹100

- 2029 – ₹125

- 2030 – ₹150

Orient Green Power Share Price Target 2025

Orient Green Power share price target 2025 Expected target could be ₹25. Here are 5 Key Factors Affecting Growth for Orient Green Power Share Price Target 2025:

-

Government Support for Renewable Energy

The Indian government is actively promoting renewable energy through subsidies, incentives, and favorable policies. Increased support for wind and solar energy projects could drive the growth of Orient Green Power, positively impacting its share price. -

Expansion of Power Generation Capacity

If the company successfully expands its power generation capacity and commissions new projects, it could boost revenue and investor confidence, leading to a rise in share price. -

Rising Demand for Green Energy

With growing environmental awareness and the shift towards sustainable energy solutions, the demand for wind power is expected to increase. This could create new growth opportunities for Orient Green Power. -

Strategic Partnerships and Investments

Collaborations with government bodies, private firms, or foreign investors could help the company scale operations and improve efficiency, contributing to long-term growth. -

Financial Performance and Debt Management

Strong financial performance, efficient debt management, and improved profitability will be key to attracting investors. A well-managed balance sheet can enhance confidence in the stock, supporting its upward movement.

Orient Green Power Share Price Target 2030

Orient Green Power share price target 2030 Expected target could be ₹150. Here are 5 Risks and Challenges for Orient Green Power Share Price Target 2030″

-

Regulatory and Policy Changes

Renewable energy policies and government incentives play a crucial role in the company’s growth. Any unfavorable changes in regulations, subsidies, or tariff structures could negatively impact revenue and profitability. -

Dependence on Weather Conditions

Since Orient Green Power relies on wind and solar energy, unpredictable weather patterns, such as low wind speeds or reduced sunlight, could affect power generation and revenue streams. -

High Capital Investment and Debt Levels

Expanding renewable energy projects requires significant investment. If the company takes on excessive debt or struggles to secure funding, it may face financial stress, impacting its share price. -

Competition in the Renewable Energy Sector

The renewable energy industry is becoming increasingly competitive with new players entering the market. If Orient Green Power fails to keep up with technological advancements and cost efficiencies, it could lose market share. -

Fluctuating Power Tariffs and Demand

Changes in electricity tariffs and fluctuations in demand for renewable energy could impact revenue generation. If power purchase agreements (PPAs) are not renewed at favorable rates, profitability could be affected in the long run.

Financials Statement Of Orient Green Power

| (INR) | 2024 | Y/Y change |

| Revenue | 2.71B | 4.90% |

| Operating expense | 1.16B | -3.23% |

| Net income | 365.30M | 12.09% |

| Net profit margin | 13.48 | 6.81% |

| Earnings per share | — | — |

| EBITDA | 1.83B | 10.02% |

| Effective tax rate | 0.70% | — |

Read Also:- Urja Global Share Price Target Tomorrow 2025, 2026 To 2030