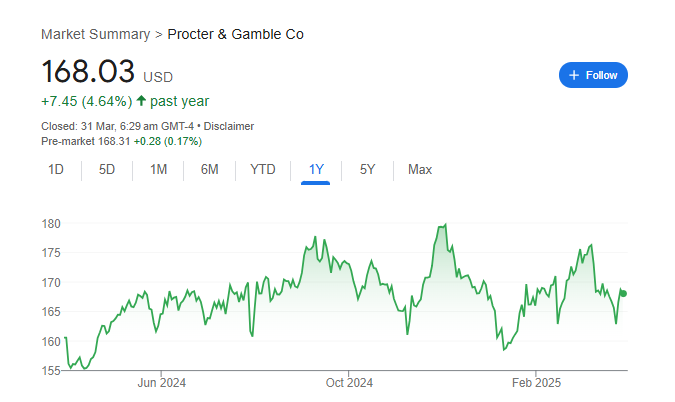

Procter & Gamble (PG) is a well-known global brand that provides everyday consumer products in categories like health, beauty, and home care. Investors looking for stable and long-term growth often consider PG as a strong option. The company’s solid financial performance, innovation, and global reach make it a reliable choice in the stock market. PG Share Price on 31 March 2025 is 168.03 USD. This article will provide more details on PG Share Price Target 2025, 2026 to 2030.

PG Company Info

- CEO: Jon R. Moeller (Nov 2021–)

- Founded: 31 October 1837, Cincinnati, Ohio, United States

- Founders: William Procter, James Gamble

- Headquarters: Cincinnati, Ohio, United States

- Number of employees: 1,08,000 (2024)

- Subsidiaries: Procter & Gamble Inc, TULA, Braun.

PG Share Price Chart

PG Share Price Details

- Today Open: 169.38

- Today High: 169.71

- Today Low: 167.62

- Mkt cap: 39.40KCr

- P/E ratio: 26.77

- Div yield: 2.40%

- 52-wk high: 180.43

- 52-wk low: 153.52

PG Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – $190

- 2026 – $210

- 2027 – $230

- 2028 – $250

- 2029 – $270

- 2030 – $290

PG Share Price Target 2025

PG share price target 2025 Expected target could be $190. Here are 5 Key Factors Affecting Growth for PG Share Price Target 2025:

-

Brand Strength and Market Position – Procter & Gamble (PG) has a strong global presence with well-established brands. Continued customer trust and market dominance will impact its stock performance.

-

Consumer Demand and Economic Trends – Changes in consumer spending, inflation, and economic conditions can affect the sales and profitability of PG’s products, influencing its share price.

-

Innovation and Product Expansion – PG’s ability to introduce new products and improve existing ones plays a crucial role in sustaining growth and staying competitive in the FMCG sector.

-

Cost Management and Profit Margins – Efficient cost control, supply chain management, and raw material pricing will determine PG’s profitability, impacting investor confidence and share price movement.

-

Dividend Policy and Share Buybacks – PG’s history of strong dividend payouts and potential stock buybacks can attract long-term investors, supporting stock price growth in 2025.

PG Share Price Target 2030

PG share price target 2030 Expected target could be $290. Here are 5 Key Factors Affecting Growth for PG Share Price Target 2030:

-

Long-Term Consumer Demand – The demand for essential consumer goods is expected to remain strong, ensuring steady revenue growth for Procter & Gamble (PG) over the years.

-

Sustainability and ESG Initiatives – PG’s focus on sustainable products, eco-friendly packaging, and ethical business practices can enhance brand reputation and attract responsible investors, impacting long-term growth.

-

Global Expansion and Emerging Markets – Growth in developing economies, particularly in Asia and Africa, can provide new revenue streams, supporting share price appreciation by 2030.

-

Technological Advancements in Operations – Investments in AI, automation, and supply chain efficiency will improve cost management and profit margins, boosting investor confidence.

-

Economic and Regulatory Environment – Global trade policies, taxation changes, and regulatory factors will influence PG’s profitability and overall market valuation in the coming years.

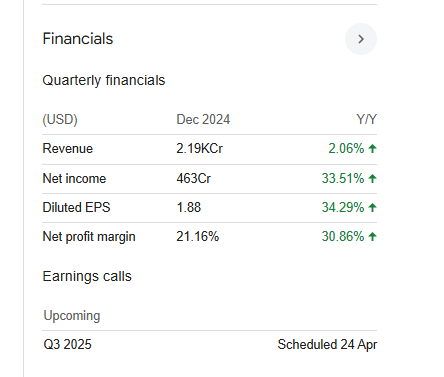

Financial Statement Of PG

| (INR) | 2024 | Y/Y change |

| Revenue | 84.04B | 2.48% |

| Operating expense | 22.49B | 10.53% |

| Net income | 14.88B | 1.54% |

| Net profit margin | 17.70 | -0.95% |

| Earnings per share | 6.59 | 11.69% |

| EBITDA | 23.84B | 9.52% |

| Effective tax rate | 20.19% | — |

Read Also:- GMR Power Share Price Target Tomorrow 2025, 2026 To 2030