Piramal Pharma is a well-known name in the pharmaceutical industry, recognized for its strong presence in drug manufacturing, research, and healthcare solutions. Investors are keen to know the future share price target of Piramal Pharma as the company continues to expand its business and explore new opportunities. Various factors like innovation, market demand, and government policies will play a key role in shaping its stock performance. Piramal Pharma Share Price on 17 March 2025 is 204.70 INR. This article will provide more details on Piramal Pharma Share Price Target 2025, 2026 to 2030.

Piramal Pharma Company Info

- Founded: 2020

- Headquarters: India

- Number of employees: 6,719 (2024)

- Subsidiaries: Piramal Critical Care, Piramal Critical Care Limited

Piramal Pharma Share Price Chart

Piramal Pharma Share Price Details

- Today Open: 202.93

- Today High: 207.55

- Today Low: 202.35

- Mkt cap: 27.01KCr

- P/E ratio: 703.63

- Div yield: 0.054%

- 52-wk high: 307.90

- 52-wk low: 115.00

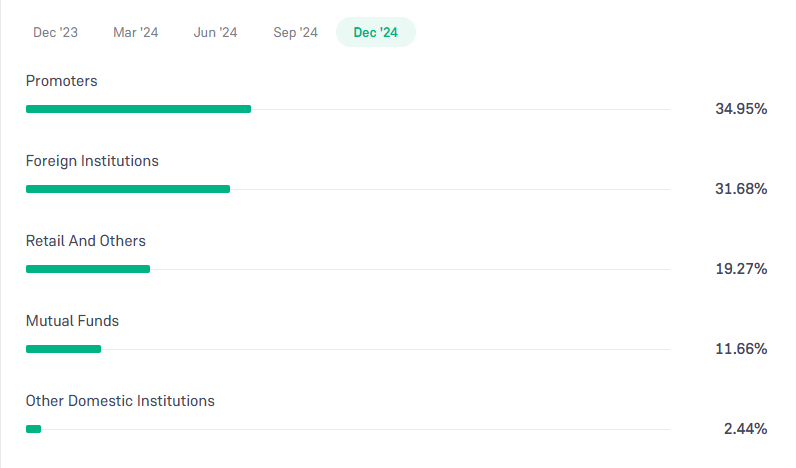

Piramal Pharma Shareholding Pattern

- Promoters: 34.95%

- Foreign Institutions: 31.68%

- Mutual Funds: 11.66%

- Retails and others: 19.27%

- Domestic Institutions: 2.44%

Piramal Pharma Share Price Target Tomorrow 2025, 2026 To 2030

- 2025 – ₹310

- 2026 – ₹425

- 2027 – ₹515

- 2028 – ₹620

- 2029 – ₹710

- 2030 – ₹830

Piramal Pharma Share Price Target 2025

Piramal Pharma share price target 2025 Expected target could be ₹310. Here are 5 Key Factors Affecting Growth for Piramal Pharma Share Price Target 2025:

-

Expansion in Domestic and Global Markets – Piramal Pharma’s focus on expanding its presence in both Indian and international markets can drive revenue growth and improve its share price.

-

Rising Demand for Pharmaceuticals – Increased demand for pharmaceutical products, including generics and specialty medicines, can boost the company’s sales and profitability.

-

Research & Development Initiatives – Continuous investment in R&D for new drug discoveries and innovations in healthcare solutions can enhance the company’s long-term growth prospects.

-

Regulatory Approvals & Compliance – Timely approvals from regulatory authorities for new drugs and manufacturing processes can strengthen the company’s position in the pharma industry.

-

Strategic Partnerships & Acquisitions – Collaborations with global pharma companies and acquisitions of complementary businesses can help Piramal Pharma expand its product portfolio and market reach.

Piramal Pharma Share Price Target 2030

Piramal Pharma share price target 2030 Expected target could be ₹830. Here are 5 Key Factors Affecting Growth for Piramal Pharma Share Price Target 2030:

-

Long-Term Expansion in Global Markets – Piramal Pharma’s ability to strengthen its international presence through exports and partnerships will be crucial for sustained growth by 2030.

-

Innovation in Drug Development – Investment in research and development (R&D) for innovative medicines, biosimilars, and specialty drugs can significantly boost the company’s future prospects.

-

Government Policies & Healthcare Regulations – Favorable policies, including incentives for pharmaceutical companies and faster regulatory approvals, can positively impact Piramal Pharma’s growth trajectory.

-

Growth in Contract Development & Manufacturing (CDMO) – Increased demand for contract manufacturing services from global pharma companies can drive revenue growth and market expansion.

-

Technology & Digital Transformation – Adoption of advanced technologies like AI-driven drug discovery, automation in manufacturing, and digital healthcare solutions can enhance efficiency and profitability.

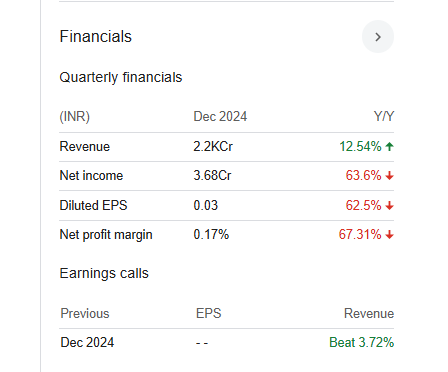

Financials Statement Of Piramal Pharma

| (INR) | 2024 | Y/Y change |

| Revenue | 81.71B | 15.39% |

| Operating expense | 44.49B | 7.09% |

| Net income | 178.20M | 109.56% |

| Net profit margin | 0.22 | 108.37% |

| Earnings per share | 0.19 | 112.57% |

| EBITDA | 11.39B | 97.62% |

| Effective tax rate | 90.06% | — |

Read Also:- HCC Share Price Target Tomorrow 2025, 2026 To 2030